Introduction and Overview

The Employees’ Compensation Act, 1923, is a foundational social security law in India, aimed at providing financial compensation to workers or their dependents in cases of injury, disability, or death arising from employment-related accidents or occupational diseases.

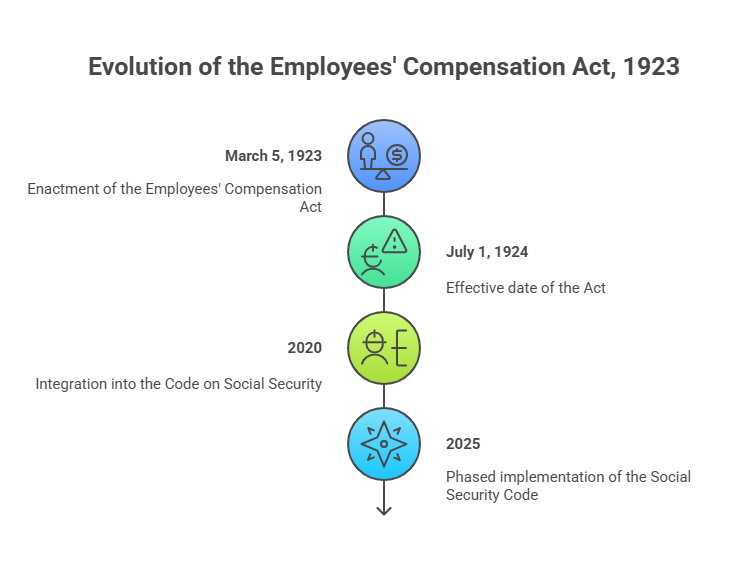

Enacted on March 5, 1923, and effective from July 1, 1924, it replaced the earlier Workmen’s Compensation Act to ensure employers’ liability for workplace hazards, promoting worker welfare without the need for proving negligence. The Act applies to employees in specified industries, including factories, mines, railways, plantations, and construction, covering both manual and clerical workers earning up to Rs. 15,000 per month (as amended). It mandates compensation through a no-fault system, where employers pay lump-sum or periodic amounts based on injury severity, age, and wages

Historical Background and Evolution

The Employees’ Compensation Act, 1923, emerged during British colonial rule to address rising industrial accidents in sectors like mining, railways, and textiles, where workers faced hazardous conditions without adequate protection.

Influenced by the UK Workmen’s Compensation Act, 1897, and early ILO conventions, it was introduced following reports on labor exploitation and high fatality rates in Indian industries during the early 20th century.

The Act shifted from common law negligence requirements to a no-fault system, making employers liable for compensation regardless of fault, a progressive step for worker rights. Post-independence, it aligned with India’s welfare state vision under Directive Principles (Articles 39(e), 42), ensuring just work conditions.

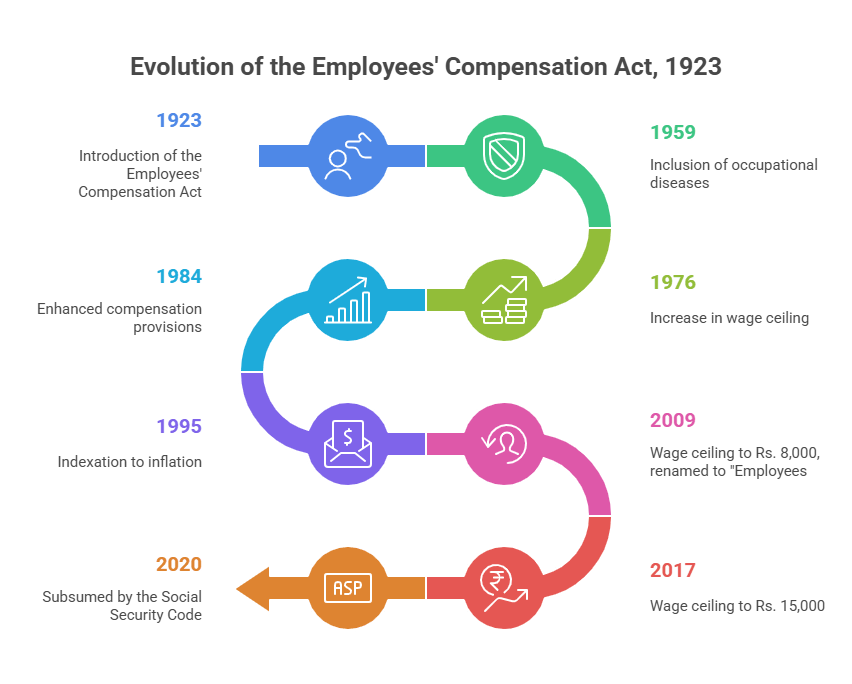

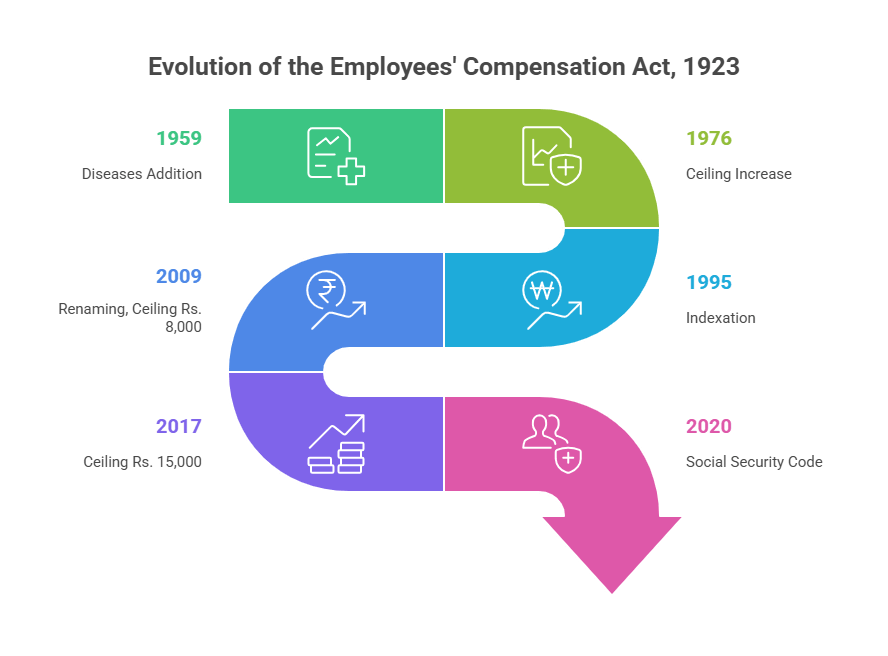

Key amendments include 1959 (occupational diseases added), 1976 (wage ceiling increase),

1984 (enhanced compensation),

1995 (indexation to inflation),

2009 (wage ceiling to Rs. 8,000,

renamed from “Workmen” to “Employees”),

and 2017 (ceiling to Rs. 15,000).

The Social Security Code, 2020, subsumes the Act, introducing universal coverage, higher compensation (50-60% of wages for disability), and digital claims by 2025.

Evolution reflects adaptation to industrialization, with over 2 lakh claims processed annually, reducing court burdens.

Definitions and Scope

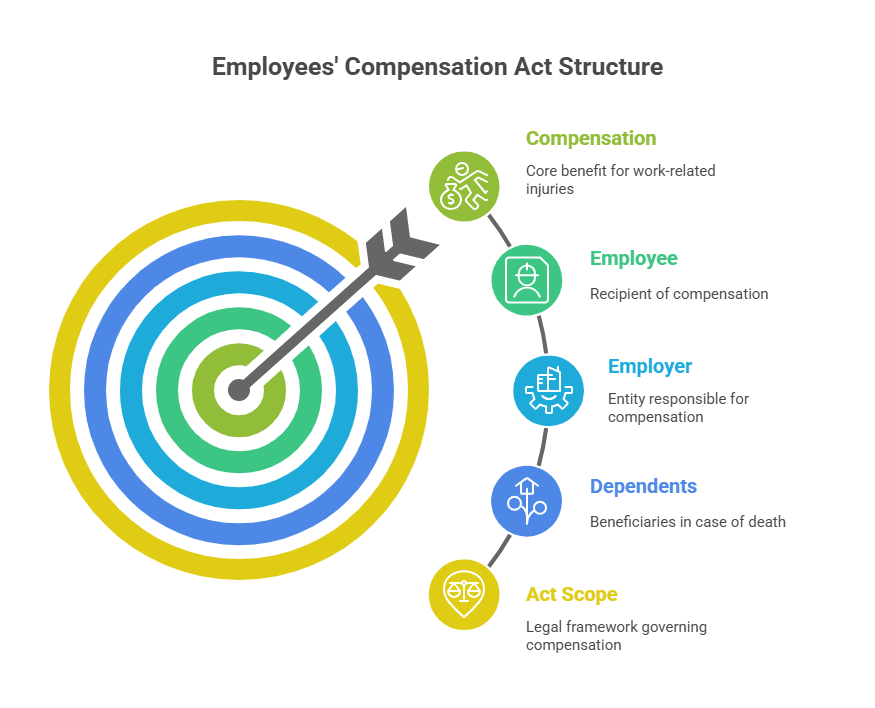

Section 2 of the Act defines terms to ensure clear application.

An “employee” includes any person employed in scheduled employments (Schedule II),

covering manual, clerical, or supervisory roles with wages ≤ Rs. 15,000/month,

including contract labor but excluding armed forces and casual workers not connected to the trade.

A “dependent” (Section 2(d)) encompasses widows, minor children, parents, and other relatives eligible for compensation on death.

“Employer” (Section 2(e)) is the person or entity liable, including contractors and legal representatives.

“Compensation” refers to payments for personal injury or death arising “out of and in the course of employment,” excluding war injuries.

“Disablement” is partial (reducing earning capacity) or total (incapacitating work).

The Act’s scope covers employments in Schedule II (e.g., factories, mines, construction, transport), applicable across India.

It mandates employer liability without fault, with claims filed before Commissioners.

Exclusions include injuries from willful disobedience or intoxication. As of 2025,

the Social Security Code extends scope to all establishments with 10+ workers.

Scope Details

- Applicability: Scheduled employments; no minimum employee threshold.

- Coverage: Accidents/occupational diseases arising from employment.

- Exclusions: Self-inflicted injuries, contractual exclusions for certain risks.

| Definition | Explanation | Inclusions/Exclusions |

|---|---|---|

| Employee | Employed in Schedule II; wages ≤ Rs. 15,000 | Includes contract; excludes casual unrelated |

| Dependent | Family members eligible on death | Widows, children, parents; excludes non-relatives |

| Employer | Liable person/entity | Includes contractors, heirs |

| Compensation | Payment for injury/death | Employment-related only; excludes negligence proof |

| Disablement | Loss of earning capacity | Partial/total; occupational diseases included |

Employer Liability and Compensation

Section 3 establishes employer liability for compensation in cases of personal injury or death from accidents “arising out of and in the course of employment,” without requiring proof of negligence.

Liability extends to occupational diseases in Schedule III (e.g., asbestosis, silicosis).

Employers must pay within 1 month of due date, with Commissioners determining amounts if disputed.

Compensation for death is 50% of monthly wages x relevant factor (based on age), minimum Rs. 1,20,000.

For permanent total disablement, it’s 60% x factor, minimum Rs. 1,40,000.

Partial disablement uses percentage loss of earning capacity. Temporary disablement offers half-monthly payments (25% of wages).

Employers can commute payments to lump-sum with agreement.

Defenses include intoxication or willful disobedience, but not if injury results in death.

The Act ensures quick relief, with over 1.5 lakh compensations awarded annually.

Liability Conditions

- Arising Out of Employment: Causal link to work duties.

- Course of Employment: During work hours or premises.

- No-Fault: Strict liability on employer.

| Injury Type | Compensation Formula | Minimum Amount |

|---|---|---|

| Death | 50% wages x age factor | Rs. 1,20,000 |

| Permanent Total Disablement | 60% wages x age factor | Rs. 1,40,000 |

| Permanent Partial | Proportionate to loss % | Based on schedule |

| Temporary | 25% wages half-monthly | Up to 5 years |

Occupational Diseases and Schedules

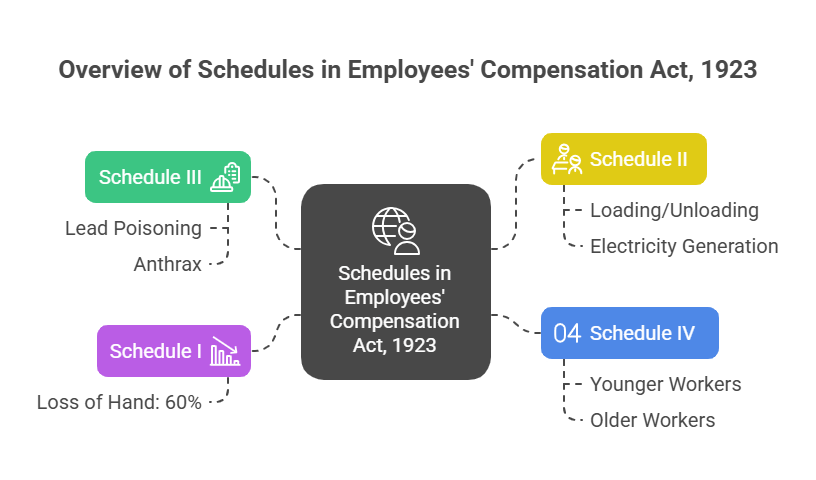

Schedule III lists occupational diseases (e.g., lead poisoning, anthrax) deemed to arise from employment if contracted in specified occupations, shifting burden to employer to disprove. Compensation mirrors accident provisions, with deemed contraction if employed for required period (e.g., 6 months for silicosis).

Schedule I details percentage loss for partial disablement (e.g., loss of hand: 60%).

Schedule II lists covered employments (e.g., loading/unloading, electricity generation).

Schedule IV provides age-based factors for calculations (higher for younger workers).

These schedules ensure standardized compensation, reducing disputes. Amendments have expanded Schedule III to include new diseases like COVID-19 for essential workers (2020 notification).

The Social Security Code, 2020, updates schedules for modern hazards like stress-related illnesses.

Schedules Overview

- Schedule I: Disablement percentages.

- Schedule II: Covered employments.

- Schedule III: Occupational diseases.

- Schedule IV: Compensation factors.

Commissioners and Procedure

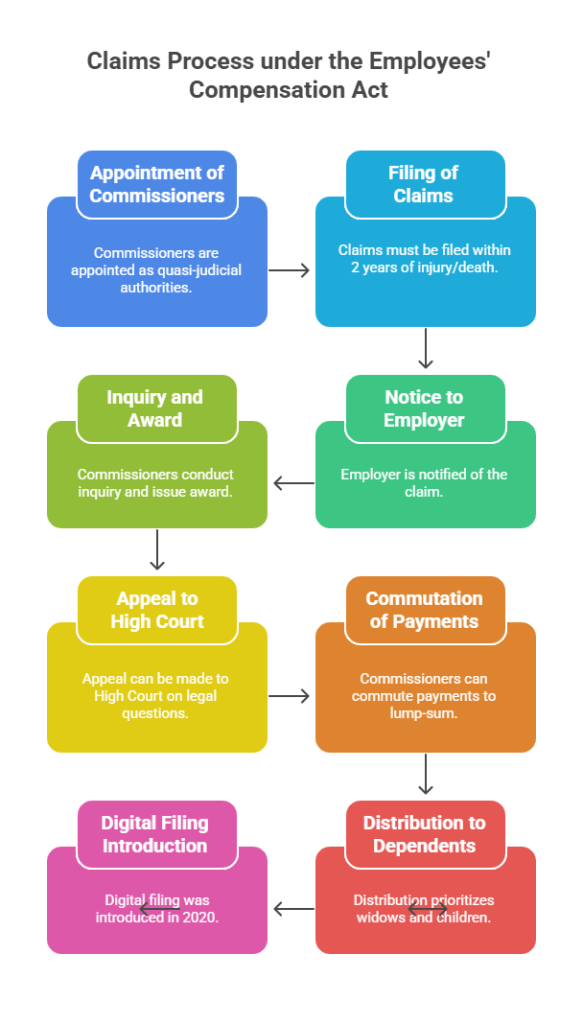

Section 19 appoints Commissioners as quasi-judicial authorities to determine liability, compensation amounts, and distribution to dependents.

Claims must be filed within 2 years of injury/death (extendable for cause), with Commissioners having civil court powers for evidence and summons (Section 23).

Procedure includes notice to employer, inquiry, and award (Section 20),

appealable to High Court on substantial legal questions (Section 30).

Commissioners can commute payments to lump-sum (Section 4A) and impose 12% interest plus up to 50% penalty for delays (Section 4A).

Distribution to dependents prioritizes widows and children (Section 8). Over 90% claims are settled within 6 months, with digital filing introduced in 2020.

Claims Process

- File claim within 2 years.

- Commissioner inquiry with parties.

- Award calculation and distribution.

- Appeal to High Court (60 days).

| Role | Powers | Procedure |

|---|---|---|

| Commissioner | Determine liability, awards | Inquiry, evidence |

| Appeals | High Court | Legal questions only |

| Penalties | 12% interest + 50% | For unjustified delays |

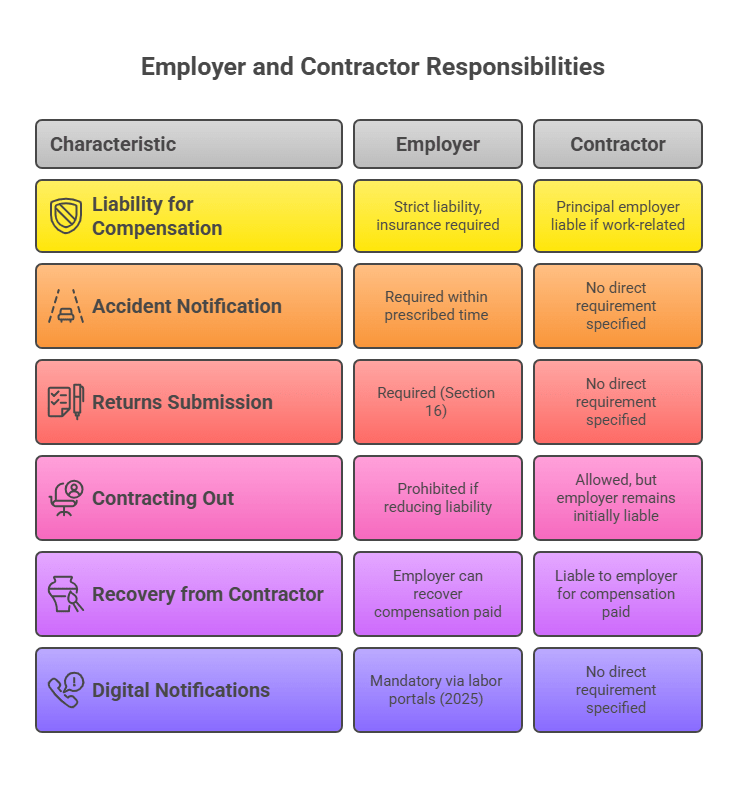

Employer Obligations and Insurance

Section 3 imposes strict liability on employers for compensation, requiring insurance or self-funding.

Employers must notify accidents within prescribed time (Section 10B) and submit returns (Section 16).

Contracting out is prohibited if reducing liability (Section 12). For contractors, principal employer is liable if work is part of trade (Section 12).

Employers can recover from contractors but must pay first. The Act encourages ESI integration for comprehensive coverage.

Non-compliance attracts fines up to Rs. 5,000 (Section 18A).

As of 2025, digital notifications via labor portals are mandatory.

Obligations

- Notify Accidents: Immediate reporting.

- Pay Compensation: Within 1 month.

- Insurance: Compulsory in hazardous industries.

Penalties and Offences

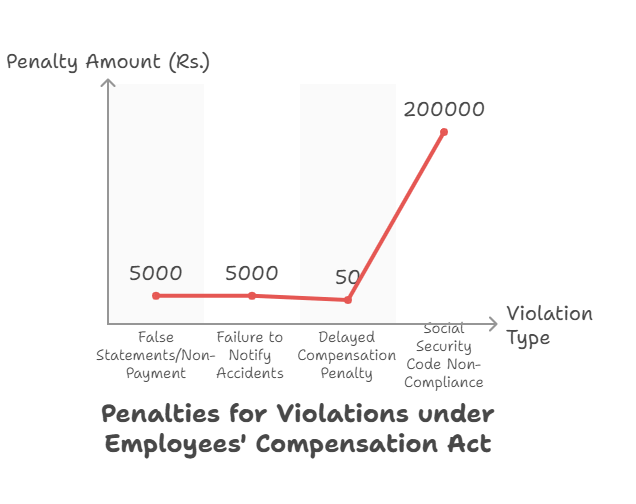

Section 18A prescribes penalties for violations:

fines up to Rs. 5,000 for false statements or non-payment.

Failure to notify accidents attracts Rs. 1,000-5,000 fines. Commissioners can impose 50% penalty on delayed compensation (Section 4A).

Offenses are cognizable only on complaint by inspectors or authorized persons.

The Social Security Code, 2020, increases penalties to Rs. 50,000-2 lakh for non-compliance, with imprisonment up to 3 months for repeats.

Over 5,000 prosecutions annually enforce accountability.

Offence Types

- Non-Payment: Fines, penalties.

- False Statements: Fines up to Rs. 5,000.

- Notification Failure: Fines Rs. 1,000-5,000.

Case Laws and Judicial Interpretations

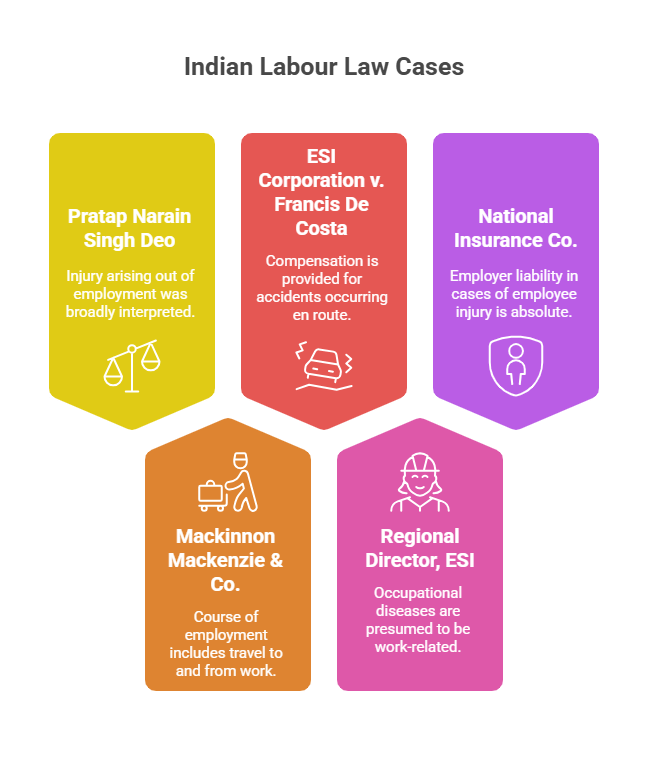

Key cases clarify provisions:

- Pratap Narain Singh Deo v. Srinivas Sabata (1976): Injury “arising out of employment” broadly interpreted.

- Mackinnon Mackenzie & Co. v. Ibrahim Mahmmod Issak (1969): “Course of employment” includes travel to/from work.

- ESI Corporation v. Francis De Costa (1993): Compensation for accidents en route.

- Regional Director, ESI v. High Land Coffee Works (1991): Occupational diseases presumption.

- National Insurance Co. v. Balakrishnan (2012): Employer liability absolute.

These interpretations expand coverage and ensure fair compensation.

Amendments, Conclusion, and Importance

Amendments include 1959 (diseases), 1976 (ceiling increase), 1995 (indexation), 2009 (renaming, ceiling Rs. 8,000), 2017 (ceiling Rs. 15,000). The Social Security Code, 2020, enhances compensation (50% wages for death, 60% for disablement), extends to gig workers, and introduces self-assessment. In conclusion, the Employees’ Compensation Act, 1923, remains vital for worker protection, awarding over Rs. 500 crore annually. Challenges like delays and under-reporting are addressed by digital portals and code reforms. Its importance lies in providing no-fault relief, reducing litigation, and promoting safety, aligning with constitutional welfare goals. For UPSC exams, it tests liability, compensation calculations, and integration with codes.

Leave a comment