Detailed Study Material for UPSC EPFO and UPSC ALC Exams

Introduction to the Employees’ State Insurance Act, 1948

The Employees’ State Insurance Act, 1948 (ESI Act), is a comprehensive social security legislation in India, designed to provide medical, financial, and other benefits to workers and their families in cases of sickness, maternity, disablement, and death due to employment injury.

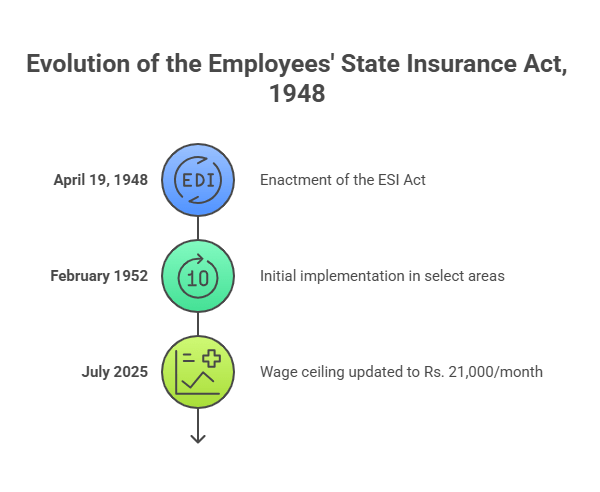

Enacted on April 19, 1948, and initially effective from February 1952 in select areas, it has been progressively extended to cover the entire country. Administered by the Employees’ State Insurance Corporation (ESIC), a statutory body under the Ministry of Labour and Employment, the Act operates through a contributory scheme funded by employers, employees, and the government.

It applies to factories and establishments with 10 or more employees (5 in some states for shops/hotels), where wages do not exceed Rs. 21,000 per month (as of July 2025).

The Act’s primary objectives include ensuring healthcare access, cash benefits during contingencies, and promoting worker welfare to enhance productivity and reduce poverty.

Historical Background and Evolution

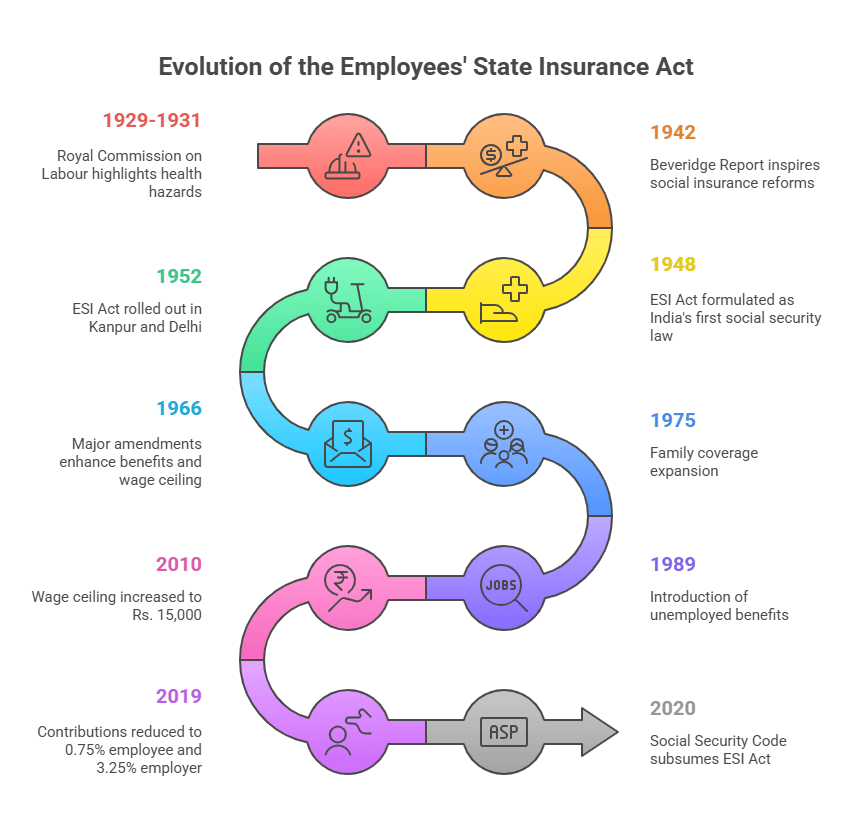

The ESI Act originated from the need to provide social insurance to industrial workers during British colonial rule, inspired by the Beveridge Report (1942) in the UK and ILO conventions on social security. The Royal Commission on Labour (1929-1931) highlighted health hazards in factories and mines, leading to the Act’s formulation as India’s first comprehensive social security law post-independence. It was rolled out in phases, starting in Kanpur and Delhi in 1952, and extended nationwide by the 1970s. Major amendments include 1966 (enhanced benefits, wage ceiling increase), 1975 (family coverage expansion), 1989 (unemployed benefits), 2010 (wage ceiling to Rs. 15,000, IT-enabled services), and 2019 (reduced contributions to 0.75% employee and 3.25% employer effective July 2019). The Social Security Code, 2020, subsumes the ESI Act, introducing universal coverage for gig/platform workers and a national database (e-Shram portal), with full implementation targeted for 2025-2026. As of July 2025, ESIC covers over 3.4 crore insured persons and 12 crore beneficiaries through 159 hospitals and 1,500 dispensaries. The evolution reflects India’s transition from colonial exploitation to a welfare state, adapting to globalization, digitalization, and the gig economy.

Phases of Evolution

Key Provisions and Definitions

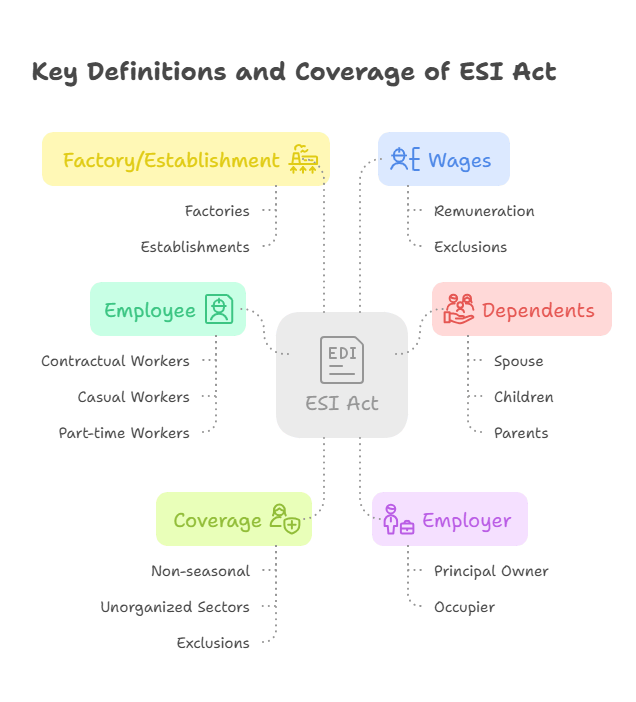

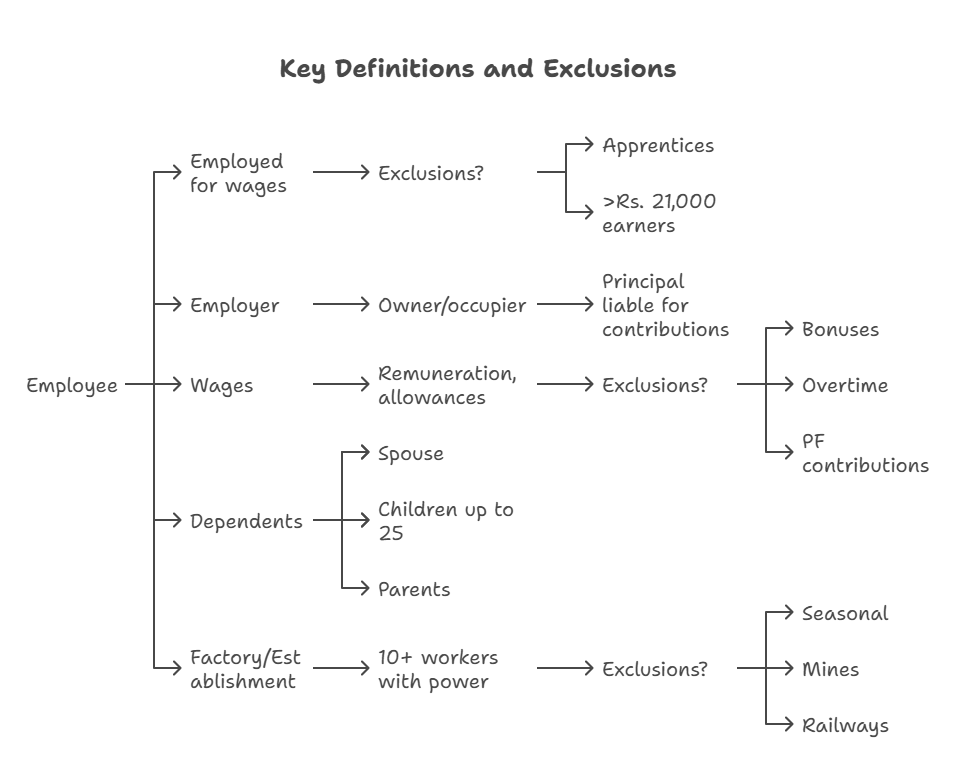

Section 2 of the ESI Act defines essential terms for precise application. An “employee” includes any person employed for wages in connection with the establishment’s work, covering contractual, casual, and part-time workers, but excluding apprentices under the Apprentices Act, 1961, and those earning above Rs. 21,000/month. An “employer” is the principal owner or occupier responsible for contributions. “Factory” means premises with 10+ workers using power (20+ without), while “establishment” includes shops, hotels, and notified entities. “Wages” encompass all remuneration but exclude overtime, bonuses, and gratuity. “Dependents” include spouse, children, parents, and widowed relatives for benefits. The Act applies to non-seasonal factories/establishments with the threshold employee count, extended to unorganized sectors via notifications. Exclusions include mines, railways, and defense forces. As of 2025, coverage has been broadened to gig workers under the Social Security Code, with voluntary options for higher-wage earners.

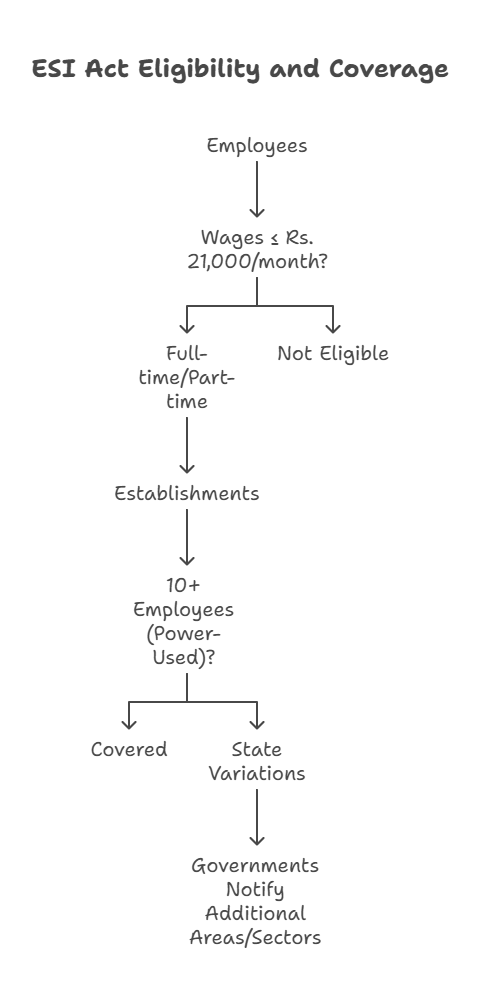

Eligibility and Coverage

- Employees: Wages ≤ Rs. 21,000/month; full-time/part-time included.

- Establishments: 10+ employees (power-used); state variations for non-factories.

- Extension: Governments can notify additional areas/sectors.

| Definition | Explanation | Inclusion/Exclusion |

|---|---|---|

| Employee | Employed for wages; contractual included | Excludes apprentices, >Rs. 21,000 earners |

| Employer | Owner/occupier | Principal liable for contributions |

| Wages | Remuneration, allowances | Excludes bonuses, overtime, PF contributions |

| Dependents | Family members | Spouse, children up to 25, parents |

| Factory/Establishment | 10+ workers with power | Excludes seasonal, mines, railways |

Benefits Under the ESI Act

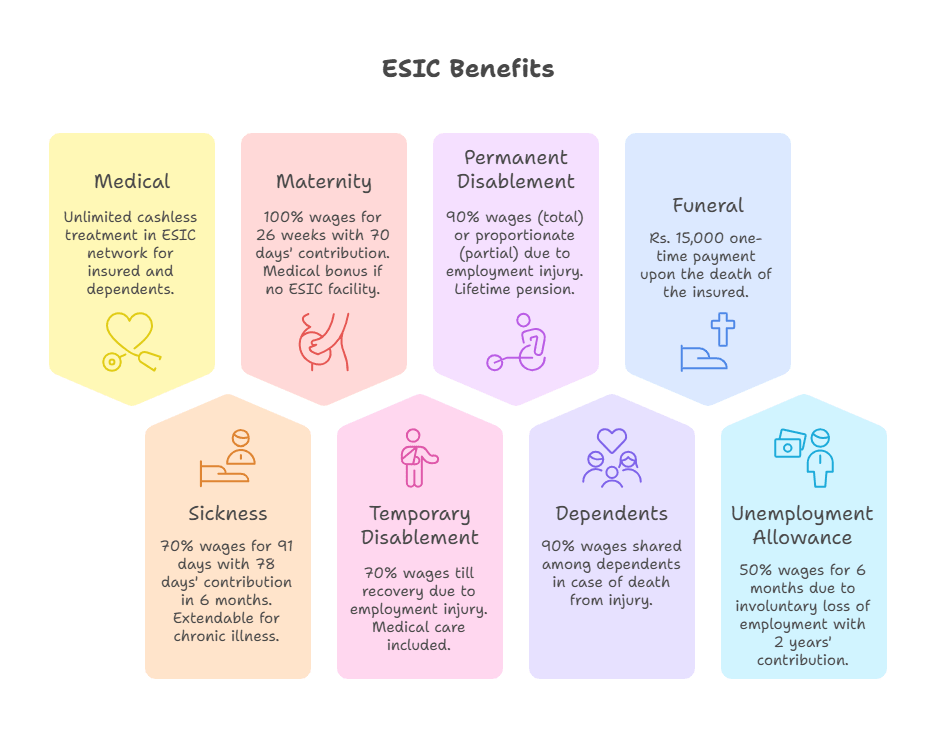

The Act provides a range of benefits funded by contributions, ensuring comprehensive protection. Medical benefits (Section 56) include full healthcare for insured persons and dependents through ESIC hospitals/dispensaries or tie-up facilities, covering outpatient, inpatient, and super-specialty treatment. Sickness benefits (Section 46) offer 70% of average daily wages for up to 91 days in two benefit periods. Maternity benefits (Section 50) provide 100% wages for 26 weeks (extendable), plus medical care. Disablement benefits (Section 51) grant temporary (70% wages) or permanent (90% for total, proportionate for partial) cash support. Dependents’ benefits (Section 52) pay 90% of wages to family on death due to employment injury. Funeral expenses (Section 46) are Rs. 15,000. Unemployment allowance (Atal Beemit Vyakti Kalyan Yojana, extended to 2025) offers 50% wages for 6 months to involuntarily unemployed. As of July 2025, benefits have been enhanced for gig workers, with digital claim processing reducing time to 7 days.

Types of Benefits

- Medical: Unlimited care, cashless treatment.

- Cash: Sickness (91 days), maternity (26 weeks), disablement (lifetime for permanent).

- Other: Rehabilitation, vocational training for disabled.

| Benefit Type | Eligibility | Amount/Duration | Key Feature |

|---|---|---|---|

| Medical | Insured + dependents | Unlimited | Cashless in ESIC network |

| Sickness | 78 days’ contribution in 6 months | 70% wages, 91 days | Extendable to 2 years for chronic illness |

| Maternity | 70 days’ contribution | 100% wages, 26 weeks | Medical bonus Rs. 7,500 if no ESIC facility |

| Disablement (Temporary) | Employment injury | 70% wages, till recovery | Medical care included |

| Disablement (Permanent) | Employment injury | 90% wages (total), proportionate (partial) | Lifetime pension |

| Dependents | Death from injury | 90% wages shared | Till remarriage/age limit |

| Funeral | Insured’s death | Rs. 15,000 | One-time payment |

| Unemployment Allowance | Involuntary loss, 2 years’ contribution | 50% wages, 6 months | Atal Yojana, extended 2025 |

Contributions and Funding

Contributions are mandatory for covered employees and employers. Employees contribute 0.75% of wages, employers 3.25% (reduced from 1.75% and 4.75% in 2019), with no ceiling for medical benefits but applicability up to Rs. 21,000. Contributions are deposited monthly by the 15th, with ESIC managing the fund for benefits and administration (0.18% cess on employers). Government subsidizes for low-coverage areas. Defaults attract 12% interest and damages up to 100% (Section 85B). As of 2025, digital ECR filing is mandatory, with auto-debit options. The fund invests in secure assets, generating surplus for infrastructure (e.g., new hospitals). Gig workers contribute 1-5% under the Social Security Code.

Contribution Structure

- Employee: 0.75% (wages ≤ Rs. 21,000).

- Employer: 3.25% + 0.18% admin cess.

- Payment Mode: Bank transfer/ECR; monthly.

| Contributor | Rate | Ceiling | Due Date |

|---|---|---|---|

| Employee | 0.75% | Rs. 21,000 | 15th of next month |

| Employer | 3.25% + 0.18% cess | Same | Same |

| Government | Subsidy as needed | N/A | N/A |

Authorities and Administration

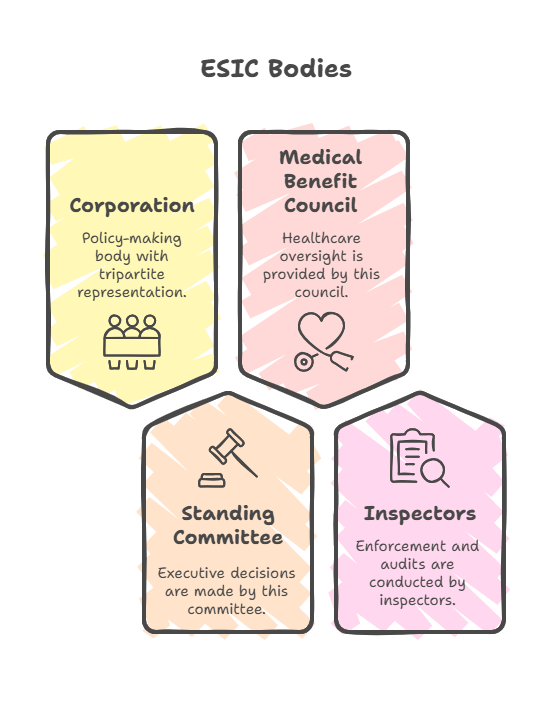

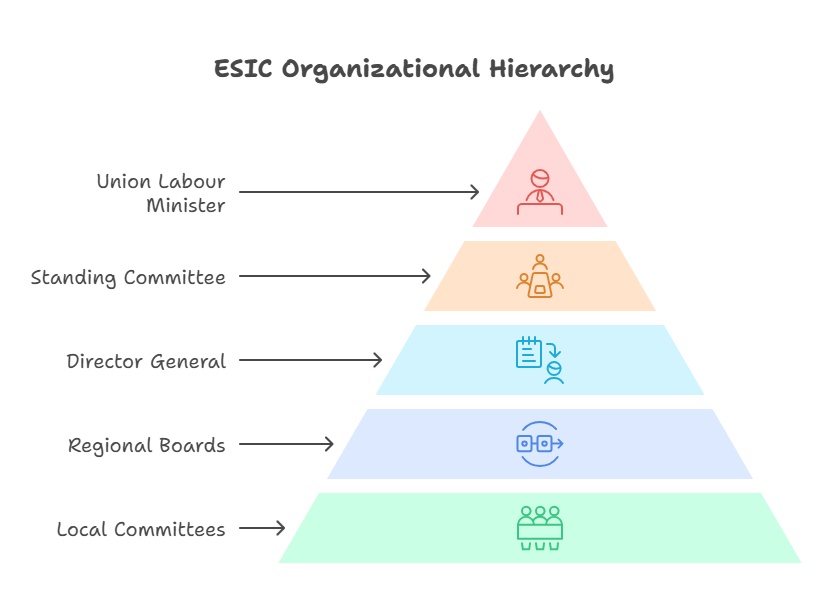

The ESIC, established under Section 3, is a corporate body headed by the Union Labour Minister as Chairperson, with a tripartite Standing Committee and Medical Benefit Council. Regional Boards manage state-level operations. The Director General oversees day-to-day administration, with powers to appoint inspectors (Section 45) for compliance checks, entry, and record examination. Local Committees advise on benefits delivery. Disputes are resolved by Employees’ Insurance Courts (Section 74), with appeals to High Courts. As of 2025, ESIC operates 159 hospitals, 1,500 dispensaries, and 620 branch offices, serving 3.4 crore insured persons. Digital initiatives like e-Pehchan cards and mobile apps enable online registration and claims, reducing processing time.

Organizational Structure

- Corporation: Policy-making body.

- Standing Committee: Executive decisions.

- Medical Benefit Council: Healthcare oversight.

- Inspectors: Enforcement and audits.

| Authority | Role | Composition |

|---|---|---|

| ESIC Corporation | Overall policy | Tripartite (govt, employer, employee) |

| Standing Committee | Administration | Subset of Corporation |

| Insurance Court | Dispute resolution | Judicial officers |

| Inspectors | Compliance | Appointed officers with entry powers |

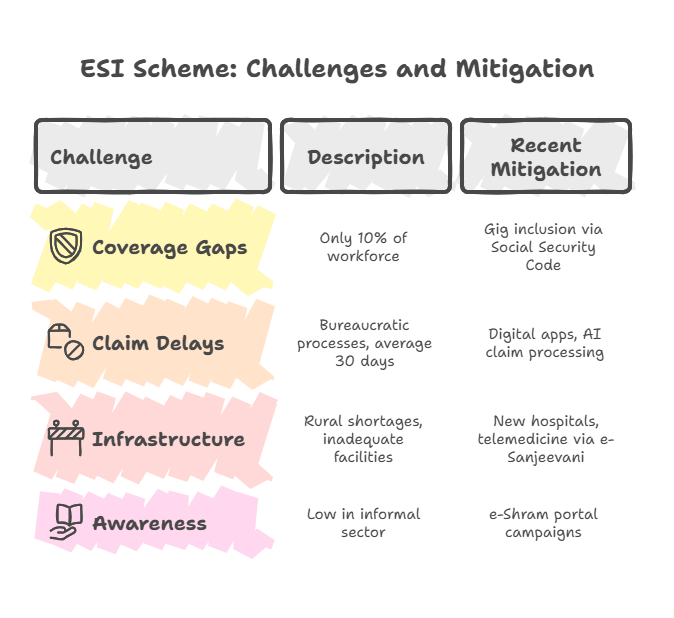

Challenges and Recent Developments

Challenges include limited coverage (only 10% workforce), delays in claims (average 30 days pre-digital), inadequate facilities in rural areas, and low awareness among gig workers. Recent developments as of July 2025: Social Security Code implementation extends ESI to gig/platform workers (1-2% contribution), wage ceiling remains Rs. 21,000, but benefits enhanced (e.g., unemployment allowance extended). ESIC launched AI-based claim processing and telemedicine via e-Sanjeevani, covering 12 crore beneficiaries. New hospitals (20 added in 2024-25) and Atal Beemit Yojana continuation support post-COVID recovery. Amendments under the Code aim for universalization by 2026.

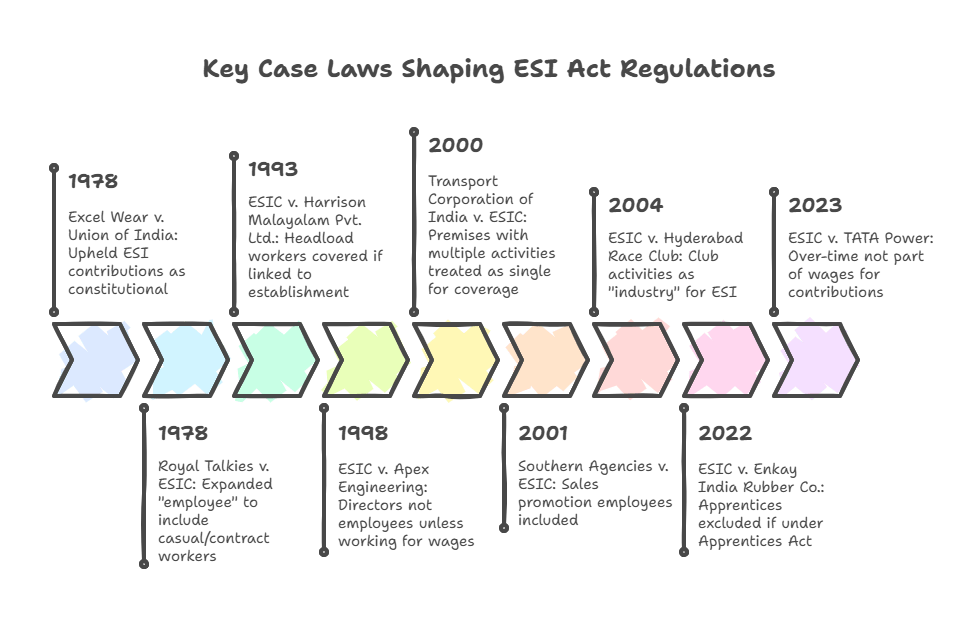

Major Case Laws

- Excel Wear v. Union of India (1978): Upheld ESI contributions as constitutional, not violative of Article 19(1)(g).

- Royal Talkies v. ESIC (1978): Expanded “employee” to include casual/contract workers.

- ESIC v. Harrison Malayalam Pvt. Ltd. (1993): Headload workers covered if linked to establishment.

- Transport Corporation of India v. ESIC (2000): Premises with multiple activities treated as single for coverage.

- ESIC v. Hyderabad Race Club (2004): Club activities as “industry” for ESI.

- Southern Agencies v. ESIC (2001): Sales promotion employees included.

- ESIC v. Enkay India Rubber Co. (2022): Apprentices excluded if under Apprentices Act.

- ESIC v. TATA Power (2023): Over-time not part of wages for contributions.

- Bombay Labour Union v. International Franchises (1985): ESI applicability to small units.

- ESIC v. Apex Engineering (1998): Directors not employees unless working for wages.

Practice MCQs for Self-Assessment (50 Questions)

- When was the ESI Act enacted?

A) 1947

B) 1948

C) 1952

D) 1961

Ans: B. - What is the wage ceiling for ESI coverage as of July 2025?

A) Rs. 15,000

B) Rs. 21,000

C) Rs. 25,000

D) Rs. 30,000

Ans: B. - Employee contribution rate under ESI is?

A) 0.75%

B) 1.75%

C) 3.25%

D) 4.75%

Ans: A. - Employer contribution rate under ESI is?

A) 0.75%

B) 1.75%

C) 3.25%

D) 4.75%

Ans: C. - ESI applies to factories with minimum how many employees?

A) 5

B) 10

C) 20

D) 50

Ans: B. - Sickness benefit is what percentage of wages?

A) 50%

B) 70%

C) 90%

D) 100%

Ans: B. - Maternity benefit duration under ESI?

A) 12 weeks

B) 26 weeks

C) 52 weeks

D) 91 days

Ans: B. - Funeral expenses under ESI?

A) Rs. 10,000

B) Rs. 15,000

C) Rs. 20,000

D) Rs. 25,000

Ans: B. - Which case expanded “employee” to casual workers?

A) Royal Talkies v. ESIC (1978)

B) Excel Wear (1978)

C) ESIC v. Harrison (1993)

D) Transport Corp (2000)

Ans: A. - ESIC v. Hyderabad Race Club (2004) held?

A) Clubs as industry

B) Apprentices excluded

C) Overtime not wages

D) Directors not employees

Ans: A.

Leave a comment