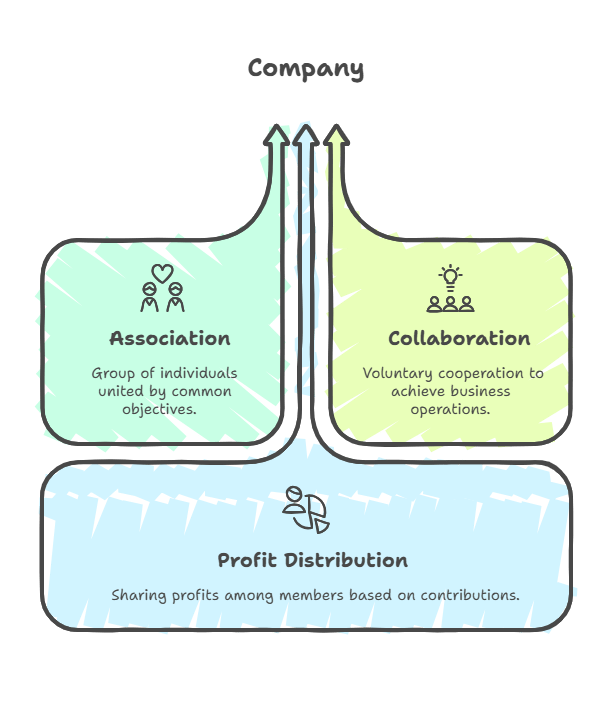

Introduction to a Company

A company represents an association of individuals united for a common purpose, which may encompass economic or non-economic objectives. In a business context, it is a voluntary group of persons collaborating to conduct operations and distribute resulting profits.

Definition of a Company

Under Section 2(20) of the Companies Act, 2013, a company is defined as an entity incorporated under this Act or any prior company law.

- Chief Justice Marshall: Describes a corporation as an artificial, invisible, intangible entity existing solely under legal contemplation, possessing only attributes granted by its charter.

- Prof. Haney: Views a company as a legally created artificial person with a separate entity, perpetual succession, and a common seal.

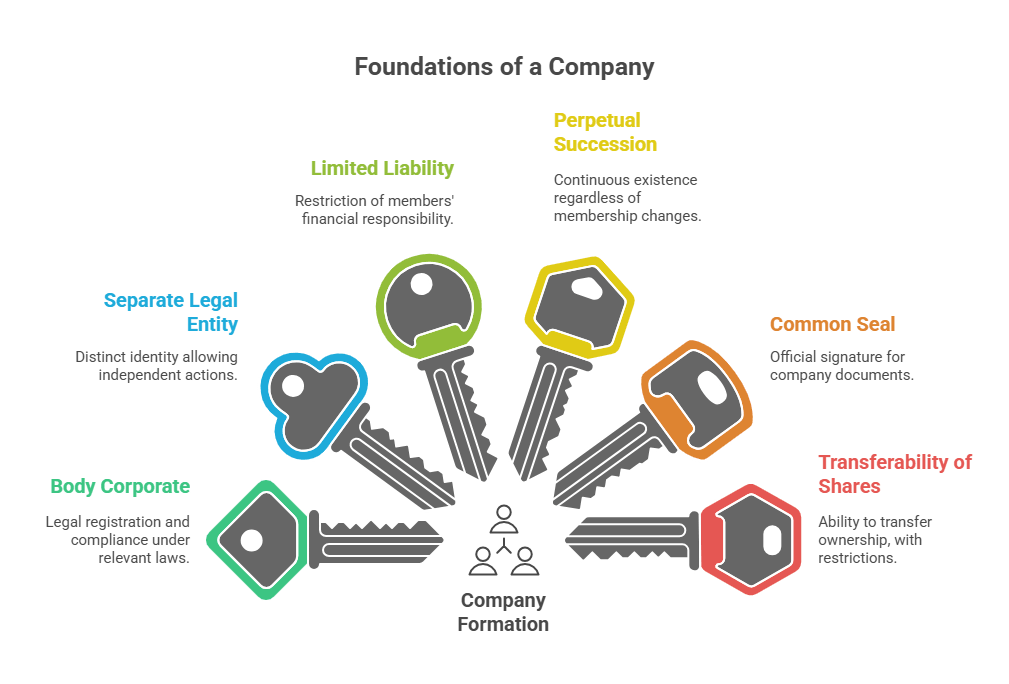

Features of a Company

A company is formed by individuals contributing capital to a shared pool for a mutual goal. Key characteristics include:

- Body Corporate: Established and registered under prevailing laws (e.g., Companies Act in India; separate laws for banking and insurance).

- Separate Legal Entity: Distinct from its members; can own property, enter contracts, sue/be sued, and maintain a bank account independently.

- Limited Liability: Members’ liability is restricted to the unpaid value of their shares.

- Perpetual Succession: Continues indefinitely, unaffected by changes in membership.

- Common Seal: Acts as the company’s signature for official documents.

- Transferability of Shares: Shares can generally be transferred, subject to restrictions in private companies.

Kinds of Companies

Companies are classified based on liability and number of members.

Based on Liability

| Type | Description |

|---|---|

| Limited by Shares | Members’ liability limited to the nominal value of shares held. |

| Limited by Guarantee | Members’ liability limited to a guaranteed amount, payable only on winding up. |

| Unlimited Company | No limit on members’ liability; personal assets can be used to settle debts. |

Based on Number of Members

| Type | Description |

|---|---|

| Public Company | Minimum 7 members; no upper limit; shares freely transferable; must invite public subscriptions. |

| Private Company | Minimum 2, maximum 200 members; restricts share transfers; no public invitations for capital. |

| One Person Company (OPC) | Single member (natural person); nominee required; limited liability; suitable for sole proprietors. |

Share Capital of a Company

Share capital is funds raised from shareholders, as a company cannot generate its own capital.

Categories of Share Capital

- Authorised Capital: Maximum capital a company can issue per its Memorandum of Association (also called Nominal or Registered Capital).

- Issued Capital: Portion of authorised capital offered to the public for subscription, including vendor allotments.

- Subscribed Capital: Issued capital actually subscribed by the public; equals issued if fully subscribed.

- Called-up Capital: Subscribed capital amount called for payment by the company.

- Paid-up Capital: Called-up capital actually received from shareholders.

- Uncalled Capital: Subscribed capital not yet called.

- Reserve Capital: Uncalled capital reserved for use only during winding up, available to creditors.

Nature and Classes of Shares

Per Section 43 of the Companies Act, 2013,

companies issue two share types:

- Preference Shares: Carry preferential rights to:

- Fixed dividend (or rate-based) before equity dividends.

- Capital repayment on winding up before equity shareholders.

- Equity Shares: No preferential rights; dividends and capital repayment after preferences; also called ordinary shares.

Accounting Treatment for Issue of Shares

Shares are issued via application, allotment, and calls.

Journal entries assume double-entry system.

- On Receipt of Application Money:

- Bank A/c Dr.

- To Share Application A/c (Application money received for X shares @ ₹Y per share).

- Transfer of Application Money:

- Share Application A/c Dr.

- To Share Capital A/c (Application money transferred for allotted shares).

- Allotment Due:

- Share Allotment A/c Dr.

- To Share Capital A/c (Allotment due on X shares @ ₹Y per share).

- Receipt of Allotment Money:

- Bank A/c Dr.

- To Share Allotment A/c (Allotment money received).

- Call Due (e.g., First Call):

- Share First Call A/c Dr.

- To Share Capital A/c (Call due on X shares @ ₹Y per share).

- Receipt of Call Money:

- Bank A/c Dr.

- To Share First Call A/c (Call money received).

- Refund on Rejected Applications:

- Share Application A/c Dr.

- To Bank A/c (Application money refunded).

- Adjustment of Excess Application Money:

- Share Application A/c Dr.

- To Share Allotment A/c (Excess adjusted towards allotment).

Calls in Arrears

Unpaid calls; debited to Calls in Arrears A/c.

- Calls in Arrears A/c Dr.

- To Relevant Call A/c(s) (Arrears recorded).

On receipt (with interest):

- Bank A/c Dr.

- To Calls in Arrears A/c

- To Interest A/c.

Calls in Advance

Advance payments on future calls; liability until adjusted. Interest up to 12% p.a. per Table F.

- Bank A/c Dr.

- To Calls in Advance A/c (Advance received).

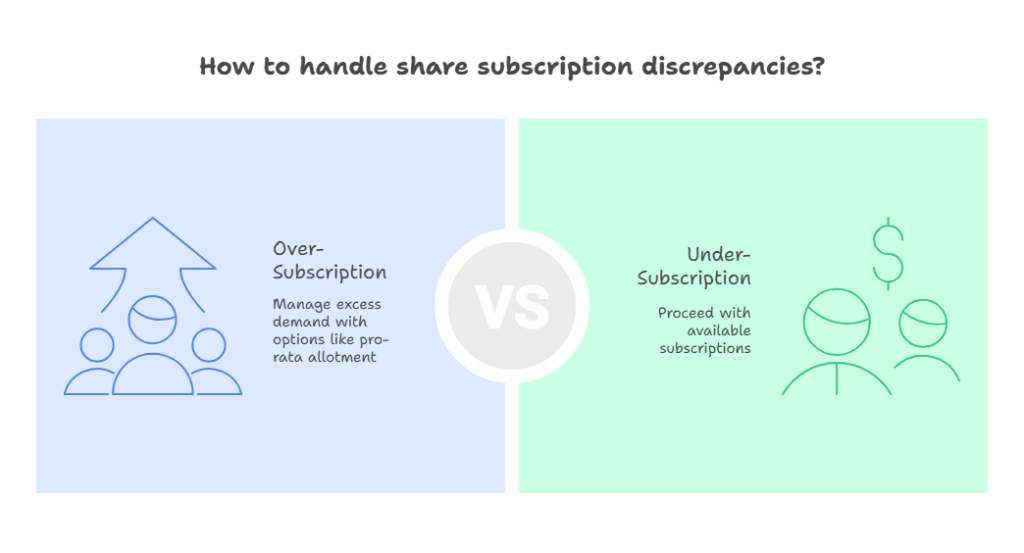

Over-Subscription and Under-Subscription

- Over-Subscription: More applications than shares offered. Options: Full acceptance/rejection, pro-rata allotment, or combination. Excess money refunded or adjusted.

- Share Application A/c Dr.

- To Bank A/c (Refund).

- Under-Subscription: Fewer applications; company proceeds with available subscriptions.

Issue of Shares at Premium or Discount

- At Premium: Issued above par value; premium to Securities Premium Reserve (capital profit, used for specific purposes like bonus issues, writing off expenses).

- Entries include crediting premium separately.

- At Discount: Issued below par; discount debited as loss.

Forfeiture and Re-issue of Shares

Forfeiture for non-payment; shares canceled, amounts retained.

- At Par:

- Share Capital A/c Dr.

- To Share Forfeiture A/c

- To Unpaid Calls A/c(s).

- At Premium (Premium Received): No debit to premium.

- At Premium (Premium Unreceived): Debit premium.

Re-issue:

- Bank A/c Dr.

- Share Forfeiture A/c Dr. (if discount).

- To Share Capital A/c.

Profit to Capital Reserve:

- Share Forfeiture A/c Dr.

- To Capital Reserve A/c.

Buy-back of Shares

Company repurchases own shares per Section 68; sources: Free reserves, securities premium, proceeds of new issues. Limits: ≤25% paid-up capital + reserves; debt-equity ≤2:1; completed in 12 months.

Procedures: Articles authorization, special resolution, solvency declaration.

Issue of Debentures

Debentures: Long-term borrowings; certificate acknowledging debt under company seal. Per Section 2(30): Includes bonds/securities, with/without asset charge.

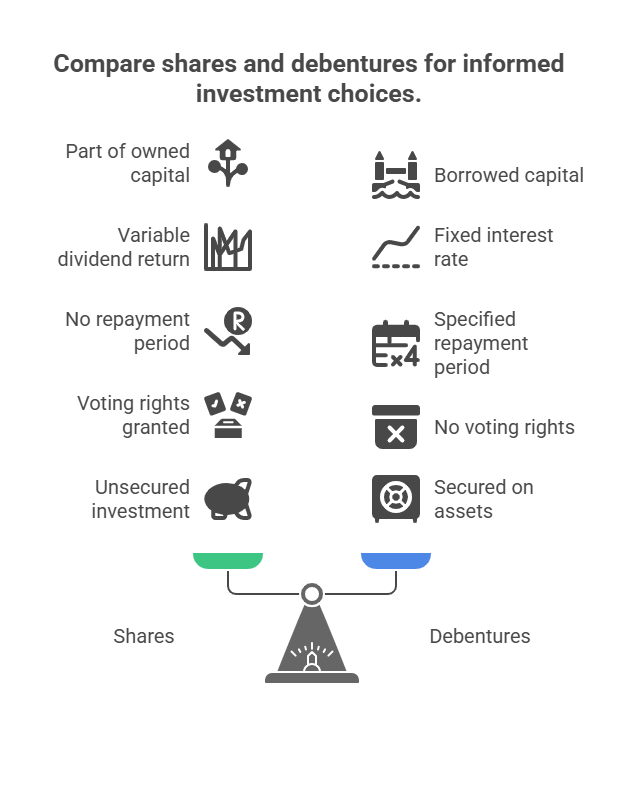

Distinction: Shares vs. Debentures

| Aspect | Shares | Debentures |

|---|---|---|

| Ownership | Part of owned capital; owners. | Borrowed capital; creditors. |

| Return | Dividend (variable). | Interest (fixed rate). |

| Repayment | Not during lifetime. | Specified period. |

| Voting | Rights granted. | No rights. |

| Security | Unsecured. | Often secured on assets. |

Features of Debentures

- Written debt acknowledgment under seal.

- Repayment at specified date.

- Maturity ≤10 years (≤30 for infrastructure).

- Interest payable regardless of profits.

Types of Debentures

- Secured/Mortgage: Backed by fixed/floating charge on assets.

- Unsecured/Naked: No security.

- Registered: Holder details recorded; transfer via deed.

- Bearer: Transfer by delivery.

- Redeemable: Repaid at end or installments.

- Irredeemable/Perpetual: Repaid on liquidation.

- Convertible: Convertible to shares (fully/partly).

Accounting for Issue of Debentures

Similar to shares; at par/premium/discount.

- Application Receipt:

- Bank A/c Dr.

- To Debenture Application A/c.

- Transfer:

- Debenture Application A/c Dr.

- To Debentures A/c.

Adjust for refunds, allotments, calls similarly.

- At Premium: Credit Securities Premium Reserve.

- At Discount: Debit Discount on Issue (amortized over period).

- For Non-Cash Consideration (e.g., assets):

- Assets A/c Dr.

- To Vendor A/c.

- Vendor A/c Dr.

- To Debentures A/c (adjust for premium/discount).

Interest on Debentures

Charge against profits; paid half-yearly; TDS deducted.

- Due (with TDS):

- Interest on Debentures A/c Dr.

- To Debentureholders A/c

- To TDS A/c.

- Payment:

- Debentureholders A/c Dr.

- To Bank A/c.

- TDS Deposit:

- TDS A/c Dr.

- To Bank A/c.

- Transfer to P&L:

- Statement of Profit & Loss A/c Dr.

- To Interest on Debentures A/c.

Accrued interest (due/not due) shown as current liabilities.

Redemption of Debentures

Repayment to holders; sources: Fresh issues, capital, profits.

- SEBI Guidelines: DRR (25% for non-convertible) before redemption; exemptions for certain institutions.

- DRR to General Reserve post-redemption.

Methods

- Lump-Sum: At maturity.

- Invest 15% in specified securities by April 30.

- Entries: DRR creation, redemption payments.

- Installments (Drawing Lots): Annual portions.

- Open Market Purchase: Buy own debentures at discount; cancel.

- No new DRR/investment if sufficient.

- Conversion to Shares: Optional after 18-36 months; no cash outflow, no DRR.

- Debentures A/c Dr.

- To Debentureholders A/c.

- Debentureholders A/c Dr.

- To Share Capital A/c (premium if applicable).

Accounting Considering Redemption Terms

- Par Issue, Par Redemption: Standard entries.

- Discount Issue, Par Redemption: Debit discount on issue.

- Premium Issue, Par Redemption: Credit premium.

- Par Issue, Premium Redemption: Debit loss on issue; credit premium on redemption.

- Discount Issue, Premium Redemption: Combine discount/loss.

UPSC style MCQs For detailed Explanation

(Even for Non-commerce Background Students )

Question 1:

Which of the following best defines a company under Section 2(20) of the Companies Act, 2013?

A) A voluntary association of persons for non-economic purposes only.

B) An entity incorporated under the Act or previous company law, treated as an artificial person.

C) A partnership firm with unlimited liability for all members.

D) A sole proprietorship with perpetual succession.

Correct Answer: B

Detailed Explanation:

For non-commerce students, think of a company like a “legal robot” created by law—it isn’t a real person but acts like one in business. Section 2(20) of the Companies Act, 2013, defines a company as an organization formally registered under this law or earlier ones, making it a separate “entity” (like a standalone unit) from its owners. This allows it to own property, sign contracts, and continue existing even if owners change. Option A is incorrect because companies can have economic goals. Option C refers to partnerships, which differ as they don’t have separate legal status. Option D describes sole proprietorships, which end with the owner’s death and lack perpetual succession (ongoing existence).

Question 2:

What is the primary feature of a company’s separate legal entity?

A) It shares the same identity as its shareholders.

B) It can enter contracts and own property independently of its members.

C) Its liability extends to the personal assets of directors without limits.

D) It must dissolve if a single member leaves.

Correct Answer: B

Detailed Explanation:

Imagine a company as a “fictional person” created by law—separate from the real people who own it (shareholders). This “separate legal entity” means the company can buy/sell property, borrow money, or sue someone in its own name, not in the owners’ names. For example, if a company buys land, the land belongs to the company, not the shareholders personally. This protects owners’ personal assets. Option A is wrong because the company is distinct. Option C confuses it with unlimited liability (which applies to some partnerships). Option D ignores perpetual succession, where the company continues despite member changes.

Question 3:

In a company limited by shares, the liability of members is restricted to:

A) The full value of the company’s assets.

B) The unpaid amount on the shares they hold.

C) An unlimited amount including personal property.

D) Only the initial investment without further obligations.

Correct Answer: B

Detailed Explanation:

Limited liability is like buying a ticket to a game—you only lose what you paid for the ticket, not your entire savings if the team loses. In a company limited by shares, owners (shareholders) are only responsible for the remaining unpaid value of their shares if the company faces debts. For instance, if you buy a ₹100 share and pay ₹80, your maximum extra liability is ₹20. This encourages investment without risking personal bankruptcy. Option A is incorrect as liability isn’t tied to all assets. Option C describes unlimited companies. Option D overlooks potential unpaid calls on shares.

Question 4:

Which type of company requires a minimum of 7 members and allows free transfer of shares?

A) Private Company.

B) One Person Company (OPC).

C) Public Company.

D) Unlimited Company.

Correct Answer: C

Detailed Explanation:

A public company is like a large club open to anyone—it needs at least 7 members (no maximum) and invites the public to buy shares, which can be easily sold or transferred (like trading stocks on a market). This helps raise large capital. A private company (Option A) limits members to 200 and restricts transfers. OPC (Option B) is for one person only. Unlimited company (Option D) focuses on liability, not membership numbers.

Question 5:

Authorised capital of a company refers to:

A) The capital actually paid by shareholders.

B) The maximum capital it can issue as per its Memorandum of Association.

C) The portion of capital called up but not yet received.

D) The reserve capital used only during winding up.

Correct Answer: B

Detailed Explanation:

Think of authorised capital as the “maximum limit” set in the company’s rulebook (Memorandum of Association)—it’s the highest amount of shares the company is allowed to sell, like a budget cap. It ensures controlled growth. Issued capital is what’s actually offered (less than or equal to authorised). Paid-up (Option A) is money received. Called-up (Option C) is demanded but unpaid. Reserve (Option D) is a subset for emergencies.

Question 6:

Equity shares differ from preference shares primarily in:

A) Having fixed dividends before equity dividends.

B) Not enjoying preferential rights in dividends or capital repayment.

C) Being convertible into debentures.

D) Carrying unlimited liability.

Correct Answer: B

Detailed Explanation:

Preference shares are like “VIP tickets”—they get fixed dividends first and priority in getting money back if the company closes. Equity shares (ordinary shares) are standard tickets: dividends vary based on profits (after preferences), and repayment comes last. No preferential rights make equity riskier but potentially more rewarding. Option A describes preferences. Option C isn’t standard. Option D is unrelated to share types.

Question 7:

When shares are issued at a premium, the premium amount is credited to:

A) Share Capital Account.

B) Securities Premium Reserve.

C) Calls in Arrears Account.

D) General Reserve.

Correct Answer: B

Detailed Explanation:

Issuing at premium means selling shares above face value (e.g., ₹100 share at ₹110; ₹10 premium). This extra is a “capital gain” (not regular profit), so it’s stored in Securities Premium Reserve for special uses like bonus shares or writing off expenses. It’s like saving a bonus for big purchases. Option A is for face value only. Option C is for unpaid amounts. Option D is for profits transferred.

Question 8:

Calls in advance refer to:

A) Money demanded but not paid by shareholders.

B) Payments made by shareholders before they are due.

C) Forfeited amounts from non-payment.

D) Refunds on over-subscribed applications.

Correct Answer: B

Detailed Explanation:

Calls are like installments on shares. If a shareholder pays early (before the company asks), it’s “calls in advance”—a liability for the company until adjusted, with possible interest (up to 12%). Like paying rent ahead. Option A is calls in arrears (unpaid). Option C is forfeiture. Option D is excess application money.

Question 9:

In case of over-subscription of shares, the company may:

A) Always reject all applications.

B) Make pro-rata allotment or refund excess.

C) Issue more shares than authorised capital.

D) Convert excess to debentures automatically.

Correct Answer: B

Detailed Explanation:

Over-subscription is like more people wanting tickets than available. The company can allot proportionally (pro-rata, e.g., 2 shares for every 3 applied) or refund extras. It can’t exceed authorised capital (Option C). Rejection (Option A) or conversion (Option D) aren’t mandatory.

Question 10:

Forfeiture of shares occurs when:

A) Shares are issued at discount.

B) Shareholders fail to pay calls, leading to cancellation.

C) Company buys back its shares.

D) Shares are re-issued at premium.

Correct Answer: B

Detailed Explanation:

Forfeiture is like revoking a membership for non-payment—company cancels shares for unpaid calls, keeping paid amounts. It follows Articles of Association. Buy-back (Option C) is voluntary repurchase. Discount/issue (Options A, D) are separate.

Question 11:

Debentures are distinguished from shares as:

A) Part of owned capital with voting rights.

B) Borrowed capital with fixed interest, no ownership.

C) Convertible to preference shares only.

D) Always unsecured.

Correct Answer: B

Detailed Explanation:

Debentures are loans to the company (borrowed capital), paying fixed interest (like loan EMI), not dividends. Holders are creditors, not owners—no voting. Shares (Option A) are ownership. Conversion (Option C) is optional. Security (Option D) varies.

Question 12:

Secured debentures are backed by:

A) No assets, treated as unsecured creditors.

B) Fixed or floating charge on company assets.

C) Only government guarantees.

D) Shareholder contributions.

Correct Answer: B

Detailed Explanation:

Secured debentures are like mortgaged loans—backed by assets (fixed: specific; floating: general). If unpaid, assets can be sold. Unsecured (Option A) lack this. Options C, D are incorrect.

Question 13:

Interest on debentures is:

A) Paid only if profits are made.

B) A fixed charge against profits, deductible with TDS.

C) Variable like dividends.

D) Not taxable.

Correct Answer: B

Detailed Explanation:

Interest is like rent on borrowed money—fixed rate, paid regardless of profits, with tax deducted at source (TDS) for government. Dividends (Option C) vary. Always paid (unlike Option A), and taxable (Option D wrong).

Question 14:

Debenture Redemption Reserve (DRR) is created for:

A) Issuing new shares.

B) Redeeming non-convertible debentures, at least 25% of amount.

C) Paying dividends.

D) All companies without exemption.

Correct Answer: B

Detailed Explanation:

DRR is a “savings fund” from profits for repaying debentures (loans), mandatory 25% for non-convertible ones per SEBI. Exemptions for banks, etc. (Option D wrong). Not for shares/dividends (Options A, C).

Question 15:

Redemption of debentures by conversion means:

A) Repaying in cash at maturity.

B) Exchanging debentures for shares, no cash outflow.

C) Purchasing in open market at discount.

D) Installment payments by lots.

Correct Answer: B

Detailed Explanation:

Conversion is like trading a loan note for ownership—debentures become shares, no money paid out. Optional after 18-36 months. Other options are cash-based methods.

Question 16:

When debentures are issued at discount and redeemed at premium:

A) No loss is recorded.

B) Loss on issue is debited, premium on redemption credited.

C) Only premium is considered.

D) Discount is ignored.

Correct Answer: B

Detailed Explanation:

Discount (sold below face) is a loss; premium redemption (repaid above face) is extra cost. Both accounted: debit loss, credit premium liability. Like buying cheap but paying extra later.

Question 17:

Buy-back of shares is limited to:

A) Unlimited amount any year.

B) 25% of paid-up capital and free reserves in a financial year.

C) Only from profits, no reserves.

D) Without special resolution.

Correct Answer: B

Detailed Explanation:

Buy-back is company repurchasing shares, capped at 25% to protect finances. Requires special resolution, solvency declaration. Sources include reserves (Option C wrong).

Question 18:

Perpetual debentures are redeemed:

A) At fixed intervals.

B) Only on company liquidation.

C) Annually in installments.

D) By conversion mandatorily.

Correct Answer: B

Detailed Explanation:

Perpetual (irredeemable) debentures last “forever”—repaid only if company winds up. Like a permanent loan. Others have timelines.

Question 19:

Subscribed capital equals issued capital when:

A) There is under-subscription.

B) All issued shares are fully applied for by the public.

C) Calls are in arrears.

D) Shares are forfeited.

Correct Answer: B

Detailed Explanation:

Subscribed is what public agrees to buy from issued (offered). Equal if fully taken. Under-subscription (Option A) makes subscribed less.

Question 20:

The common seal of a company serves as:

A) A decorative emblem.

B) Its official signature for documents.

C) Proof of unlimited liability.

D) A record of share capital.

Correct Answer: B

Detailed Explanation:

The seal is like a company’s “stamp of approval”—used to authenticate contracts, as the company can’t sign like a person. Essential for legal validity. Not decorative (Option A) or related to liability/capital (Options C, D).

Leave a comment