Introduction to Economic Reforms

Economic reforms in India refer to a series of policy changes initiated to transform the country’s economy from a predominantly closed, state-controlled system to a more open, market-oriented one. These reforms aimed to enhance efficiency, promote growth, and integrate India into the global economy. The most significant wave began in 1991, often termed the “Liberalization, Privatization, and Globalization” (LPG) model, under the leadership of Prime Minister P.V. Narasimha Rao and Finance Minister Dr. Manmohan Singh. Subsequent phases have built upon this foundation, addressing structural issues and adapting to evolving global dynamics.

The reforms encompassed deregulation, fiscal consolidation, trade liberalization, and financial sector modernization. They marked a departure from the post-independence socialist-inspired model, which emphasized self-reliance through import substitution and public sector dominance.

Pre-Reform Economic Landscape (1947–1991)

Post-independence, India’s economy was shaped by the Nehruvian model, influenced by socialist principles and the Soviet Union’s planned economy. Key features included:

- Five-Year Plans: Initiated in 1951 under the Planning Commission, these focused on heavy industries, agriculture, and infrastructure. The first plan (1951–1956) prioritized agriculture, while the second (1956–1961) emphasized industrialization via the Mahalanobis model.

- Industrial Policy: The Industrial Policy Resolution of 1956 reserved key sectors (e.g., steel, mining, railways) for the public sector, with private enterprises requiring licenses under the “License Raj” system. This led to bureaucratic inefficiencies and corruption.

- Trade and Foreign Exchange Regime: High tariffs, quantitative restrictions on imports, and a fixed exchange rate system protected domestic industries but resulted in inefficiencies, low exports, and balance of payments issues.

- Agricultural Policies: The Green Revolution (1960s–1970s) introduced high-yielding varieties, fertilizers, and irrigation, boosting food production. However, land reforms were uneven, and subsidies distorted markets.

- Economic Performance: Growth averaged around 3.5% annually (the “Hindu Rate of Growth”), with high poverty rates (over 50% in the 1970s) and dependence on foreign aid. Inflation, unemployment, and fiscal deficits were persistent challenges.

By the late 1980s, structural rigidities, coupled with external shocks like oil price hikes and the Gulf War, exacerbated economic vulnerabilities.

3. The 1991 Economic Crisis: Catalyst for Reforms

The immediate trigger for reforms was a severe balance of payments crisis in 1991. Key factors included:

- Fiscal Imbalances: High government spending on subsidies and defense led to fiscal deficits exceeding 8% of GDP.

- External Debt: Foreign exchange reserves dwindled to less than two weeks’ worth of imports (about USD 1 billion), forcing India to pledge gold to secure IMF loans.

- Inflation and Industrial Stagnation: Inflation peaked at 13–14%, while industrial growth stagnated due to restrictive policies.

- Global Context: The collapse of the Soviet Union (India’s major trading partner) and rising oil prices intensified the crisis.

In response, India approached the International Monetary Fund (IMF) and World Bank for assistance, committing to structural adjustments as conditions for loans.

4. Key Pillars of Economic Reforms: Liberalization, Privatization, and Globalization (LPG)

The 1991 reforms dismantled the License Raj and opened the economy. The LPG framework structured the changes:

- Liberalization: Removal of restrictions on private sector participation.

- Industrial delicensing: Most industries no longer required government approval.

- Deregulation of prices and interest rates.

- Privatization: Shift from public to private ownership.

- Disinvestment in public sector undertakings (PSUs) through share sales.

- Encouragement of private investment in infrastructure.

- Globalization: Integration with the world economy.

- Reduction in tariffs and non-tariff barriers.

- Promotion of foreign direct investment (FDI) and exports.

Table 1: Core Components of LPG Reforms

| Pillar | Key Measures | Objectives |

|---|---|---|

| Liberalization | Abolition of industrial licensing (except for 18 strategic sectors); deregulation of small-scale industries. | Reduce bureaucratic hurdles; enhance competition. |

| Privatization | Disinvestment in PSUs (e.g., initial sales in 1991–92 raised INR 3,038 crore); strategic sales in later phases (e.g., BALCO in 2001). | Improve efficiency; reduce fiscal burden. |

| Globalization | Devaluation of rupee by 18–19%; peak tariffs reduced from 350% to 35%; FDI limits raised (e.g., up to 51% in priority sectors). | Boost exports; attract foreign capital. |

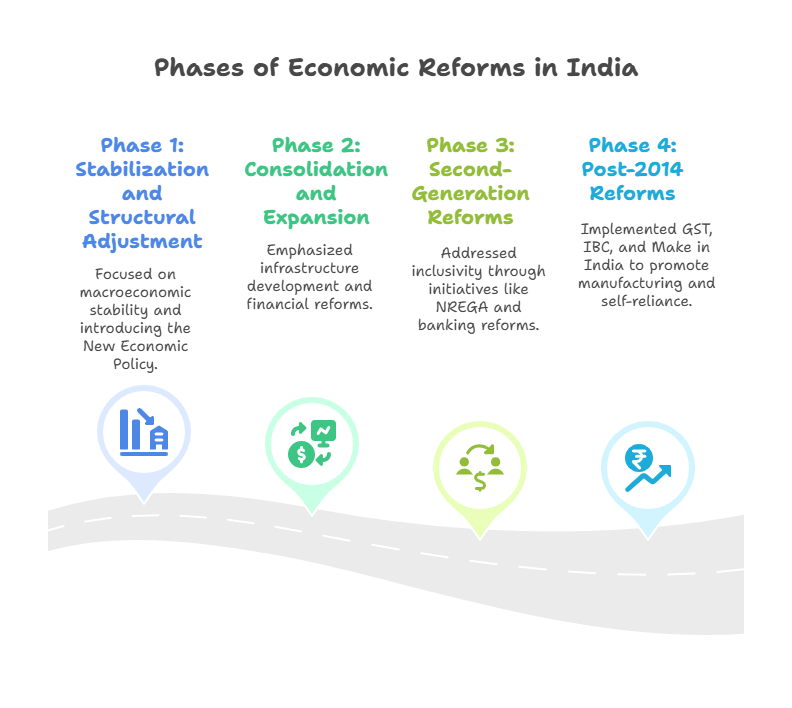

5. Phases of Economic Reforms

Reforms evolved in phases, responding to domestic needs and global trends.

- Phase 1: Stabilization and Structural Adjustment (1991–1996)

Focused on macroeconomic stability: Fiscal deficit reduced from 8.4% to 5.9% of GDP; inflation controlled below 10%. Introduction of the New Economic Policy (NEP) in 1991. - Phase 2: Consolidation and Expansion (1996–2004)

Emphasis on infrastructure (e.g., National Highways Development Project) and financial reforms. Establishment of the Securities and Exchange Board of India (SEBI) in 1992 for capital market regulation. - Phase 3: Second-Generation Reforms (2004–2014)

Addressed inclusivity: Initiatives like the National Rural Employment Guarantee Act (NREGA, 2005) for employment; banking sector reforms via Basel norms. FDI in retail (2012) and insurance sectors. - Phase 4: Post-2014 Reforms

Under the NDA government: Goods and Services Tax (GST, 2017) unified indirect taxes; Insolvency and Bankruptcy Code (IBC, 2016) for debt resolution; Make in India (2014) to promote manufacturing. COVID-19 response included Atmanirbhar Bharat (2020) for self-reliance with targeted stimulus.

Table 2: Timeline of Major Economic Reforms

| Year | Reform/Initiative | Description |

|---|---|---|

| 1991 | New Economic Policy | Devaluation, delicensing, FDI liberalization. |

| 1992 | Establishment of SEBI | Regulation of securities markets. |

| 1997 | New Telecom Policy | Liberalized telecom sector, leading to mobile revolution. |

| 2002 | Fiscal Responsibility and Budget Management Act | Mandated fiscal discipline. |

| 2016 | Demonetization | Withdrawal of high-denomination notes to curb black money. |

| 2017 | GST Implementation | Single tax regime replacing multiple indirect taxes. |

| 2020 | Farm Laws (later repealed in 2021) | Aimed at agricultural market reforms. |

| 2023–2024 | Digital Economy Push | Expansion of UPI, digital payments; semiconductor incentives. |

6. Sector-Wise Reforms

Reforms targeted specific sectors for holistic development.

- Industrial Sector: Delicensing and FDI inflows spurred growth. Manufacturing’s GDP share rose, though it remains below 20%.

- Agricultural Sector: Shift from subsidies to market-oriented policies. Introduction of Minimum Support Prices (MSP) reforms and e-NAM (2016) for online trading. Challenges persist in irrigation and storage.

- Financial Sector: Banking reforms included privatization (e.g., merger of public banks in 2019–2020), non-performing assets (NPA) resolution via IBC. Capital markets deepened with dematerialization.

- Trade and External Sector: Export promotion through Special Economic Zones (SEZs, 2005). Trade as % of GDP increased from 15% in 1991 to over 40% by 2020.

- Infrastructure and Services: Public-Private Partnerships (PPPs) in roads, ports, and airports. Services sector (IT, BPO) boomed, contributing over 50% to GDP.

Table 3: Sector-Wise Growth Pre- and Post-Reforms (Approximate Averages)

| Sector | Pre-1991 Growth Rate (%) | Post-1991 Growth Rate (%) | Key Reforms Impact |

|---|---|---|---|

| Agriculture | 2.5 | 3.0 | Green Revolution extension; market access. |

| Industry | 5.0 | 6.5 | Delicensing; FDI inflows. |

| Services | 4.5 | 8.0 | IT liberalization; globalization. |

| Overall GDP | 3.5 | 6.5–7.0 | Sustained higher growth trajectory. |

7. Impacts and Outcomes

- Positive Impacts:

- GDP growth accelerated to 7–8% annually in the 2000s–2010s.

- Poverty reduction: From 45% in 1993 to about 20% by 2019 (Multidimensional Poverty Index).

- Forex reserves surged to over USD 600 billion by 2024.

- Emergence as a global IT hub and increased FDI (e.g., USD 81 billion in 2020–21).

- Negative Impacts and Challenges:

- Inequality widened (Gini coefficient rose from 0.32 to 0.38).

- Jobless growth: Formal employment stagnated despite GDP expansion.

- Environmental degradation from rapid industrialization.

- Persistent issues like farmer distress and MSME credit access.

8. Criticisms and Ongoing Challenges

Critics argue reforms favored urban elites and corporations, neglecting rural and informal sectors. The Washington Consensus-inspired model has been questioned for increasing vulnerability to global shocks (e.g., 2008 financial crisis, COVID-19). Recent challenges include supply chain disruptions, inflation, and geopolitical tensions affecting trade.

9. Recent Developments and Future Outlook (Up to 2025)

As of 2025, reforms emphasize digital transformation (e.g., India Stack for fintech) and sustainability (e.g., green energy targets under Paris Agreement). Initiatives like Production-Linked Incentives (PLI, 2020) aim to boost manufacturing. Future focus areas include labor code reforms (2020), skill development, and climate-resilient growth to achieve a USD 5 trillion economy by 2027–28.

Multiple Choice Questions on Economic Reforms in India

What is India’s targeted economy size by 2027–28, supported by ongoing reforms?

A) USD 1 trillion

B) USD 3 trillion

C) USD 5 trillion

D) USD 10 trillion

Answer: C

Explanation: Reforms emphasize sustainable growth to achieve a USD 5 trillion economy, focusing on manufacturing and digital transformation.

What does the acronym LPG stand for in the context of India’s 1991 economic reforms?

A) Liberalization, Protectionism, Globalization

B) Liberalization, Privatization, Globalization

C) Licensing, Privatization, Growth

D) Liberalization, Public Sector, Globalization

Answer: B

Explanation: The LPG model refers to Liberalization, Privatization, and Globalization, which formed the core framework of the 1991 reforms aimed at opening the economy.

Which Prime Minister and Finance Minister are primarily associated with initiating the 1991 economic reforms in India?

A) Indira Gandhi and Pranab Mukherjee

B) Rajiv Gandhi and V.P. Singh

C) P.V. Narasimha Rao and Dr. Manmohan Singh

D) Atal Bihari Vajpayee and Yashwant Sinha

Answer: C

Explanation: P.V. Narasimha Rao as Prime Minister and Dr. Manmohan Singh as Finance Minister led the introduction of the New Economic Policy in 1991.

What was the average annual GDP growth rate in India prior to the 1991 reforms, often termed the “Hindu Rate of Growth”?

A) 7–8%

B) 3.5%

C) 5.5%

D) 2%

Answer: B

Explanation: The pre-reform era (1947–1991) saw an average growth rate of approximately 3.5%, reflecting structural inefficiencies under the planned economy model.

Which policy resolution in 1956 reserved key sectors like steel and mining for the public sector in India?

A) Industrial Policy Resolution

B) Agricultural Policy Resolution

C) Trade Policy Resolution

D) Fiscal Policy Resolution

Answer: A

Explanation: The Industrial Policy Resolution of 1956 emphasized public sector dominance in strategic industries, contributing to the License Raj system.

What was the primary focus of India’s first Five-Year Plan (1951–1956)?

A) Heavy industrialization

B) Agriculture and irrigation

C) Export promotion

D) Financial sector reforms

Answer: B

Explanation: The first plan prioritized agriculture to address food shortages, while subsequent plans shifted toward industrialization.

What external event exacerbated India’s balance of payments crisis in 1991?

A) Asian Financial Crisis

B) Gulf War and oil price hikes

C) Global Recession of 2008

D) COVID-19 Pandemic

Answer: B

Explanation: The Gulf War led to rising oil prices and disrupted remittances, compounding India’s foreign exchange reserves depletion.

By how much was the Indian rupee devalued as part of the 1991 reforms?

A) 5–10%

B) 18–19%

C) 25–30%

D) 40%

Answer: B

Explanation: The rupee was devalued by approximately 18–19% to boost exports and correct the balance of payments imbalance.

What was reduced from around 350% to 35% under the globalization pillar of the 1991 reforms?

A) Corporate tax rates

B) Peak import tariffs

C) Interest rates

D) Fiscal deficits

Answer: B

Explanation: Peak tariffs on imports were significantly lowered to promote trade liberalization and global integration.

Which international organization provided loans to India in 1991 conditional on structural adjustments?

A) World Trade Organization

B) International Monetary Fund

C) Asian Development Bank

D) United Nations

Answer: B

Explanation: India approached the IMF for assistance, agreeing to reforms as part of the loan conditions.

What system was largely dismantled through the liberalization measures in 1991?

A) Green Revolution

B) License Raj

C) Public Distribution System

D) Five-Year Planning

Answer: B

Explanation: The License Raj, involving bureaucratic approvals for industries, was abolished for most sectors to reduce inefficiencies.

In which phase of reforms was the Goods and Services Tax (GST) implemented?

A) 1991–1996

B) 1996–2004

C) 2004–2014

D) Post-2014

Answer: D

Explanation: GST was introduced in 2017 under the post-2014 phase to unify indirect taxes across the country.

What act was enacted in 2002 to mandate fiscal discipline in India?

A) Insolvency and Bankruptcy Code

B) Fiscal Responsibility and Budget Management Act

C) National Rural Employment Guarantee Act

D) New Telecom Policy

Answer: B

Explanation: This act aimed to reduce fiscal deficits and promote responsible budgeting.

Which initiative was launched in 2014 to promote manufacturing in India?

A) Atmanirbhar Bharat

B) Make in India

C) Digital India

D) Green Revolution

Answer: B

Explanation: Make in India focused on attracting investments and enhancing the manufacturing sector’s contribution to GDP.

What was the primary goal of the second-generation reforms (2004–2014)?

A) Macroeconomic stabilization

B) Infrastructure development

C) Inclusivity and social programs

D) Agricultural subsidies

Answer: C

Explanation: This phase emphasized inclusive growth through programs like NREGA for rural employment.

In which year was demonetization implemented to curb black money?

A) 1991

B) 2002

C) 2016

D) 2020

Answer: C

Explanation: Demonetization in 2016 withdrew high-denomination notes to formalize the economy and reduce undeclared wealth.

Which sector saw the introduction of high-yielding varieties during the Green Revolution in the 1960s–1970s?

A) Services

B) Industry

C) Agriculture

D) Finance

Answer: C

Explanation: The Green Revolution boosted agricultural productivity through improved seeds, fertilizers, and irrigation.

What was established in 1992 to regulate India’s capital markets?

A) Reserve Bank of India

B) Securities and Exchange Board of India (SEBI)

C) Planning Commission

D) National Bank for Agriculture and Rural Development

Answer: B

Explanation: SEBI was created to oversee and regulate securities markets, enhancing investor confidence.

Which policy in 1997 liberalized the telecom sector, leading to a mobile revolution?

A) New Industrial Policy

B) New Telecom Policy

C) Foreign Exchange Management Act

D) Export Promotion Policy

Answer: B

Explanation: This policy encouraged private participation, resulting in rapid growth in telecommunications.

What was introduced in 2005 to promote exports through designated zones?

A) Public-Private Partnerships

B) Special Economic Zones (SEZs)

C) Minimum Support Prices

D) Basel Norms

Answer: B

Explanation: SEZs provided incentives for export-oriented units, boosting trade and foreign investment.

Which sector contributes over 50% to India’s GDP post-reforms, driven by IT and BPO?

A) Agriculture

B) Industry

C) Services

D) Mining

Answer: C

Explanation: The services sector expanded significantly due to liberalization, becoming the dominant contributor to economic output.

What was the approximate reduction in India’s poverty rate from 1993 to 2019?

A) From 10% to 5%

B) From 45% to 20%

C) From 70% to 50%

D) From 30% to 15%

Answer: B

Explanation: Reforms led to substantial poverty alleviation, as measured by the Multidimensional Poverty Index.

How did India’s foreign exchange reserves change post-1991 reforms?

A) Remained below USD 1 billion

B) Surged to over USD 600 billion by 2024

C) Declined further

D) Stabilized at USD 50 billion

Answer: B

Explanation: Increased FDI and exports strengthened reserves, providing a buffer against external shocks.

What increased from 15% in 1991 to over 40% by 2020 as a percentage of GDP?

A) Agricultural output

B) Industrial investment

C) Trade

D) Fiscal deficit

Answer: C

Explanation: Trade liberalization enhanced India’s integration into global markets.

Which of the following is a positive impact of economic reforms on India’s economy?

A) Widening inequality

B) Emergence as a global IT hub

C) Environmental degradation

D) Jobless growth

Answer: B

Explanation: Reforms fostered the IT sector’s growth, positioning India as a leader in software services.

What was the annual GDP growth rate in India during the 2000s–2010s post-reforms?

A) 3–4%

B) 7–8%

C) 1–2%

D) 10–12%

Answer: B

Explanation: Accelerated growth reflected the success of liberalization in enhancing economic efficiency.

What measure of inequality rose from 0.32 to 0.38 post-reforms?

A) Human Development Index

B) Gini coefficient

C) Literacy rate

D) Life expectancy

Answer: B

Explanation: The Gini coefficient indicates increased income inequality, a criticism of the reform process.

Which challenge persists despite reforms, characterized by formal employment stagnation?

A) High inflation

B) Jobless growth

C) Low FDI

D) Declining exports

Answer: B

Explanation: Economic expansion did not proportionally create jobs, leading to underemployment issues.

What recent initiative (2020) focused on self-reliance with targeted stimulus amid COVID-19?

A) Make in India

B) Atmanirbhar Bharat

C) Digital Economy Push

D) Production-Linked Incentives

Answer: B

Explanation: Atmanirbhar Bharat aimed to promote domestic production and reduce import dependence.

Which code was introduced in 2016 for efficient debt resolution?

A) Goods and Services Tax

B) Insolvency and Bankruptcy Code

C) Fiscal Responsibility Act

D) Labor Code Reforms

Answer: B

Explanation: The IBC streamlined bankruptcy processes, improving the financial sector’s health.

Leave a comment