Inflation

Introduction to Inflation

Inflation refers to a sustained increase in the general price level of goods and services in an economy over time, which erodes the purchasing power of money. It is typically measured as an annual percentage increase using indices like the Consumer Price Index (CPI). Moderate inflation (around 2-3%) is often seen as a sign of a healthy economy, but high or hyperinflation can lead to economic instability. Understanding inflation is crucial for economic policy, investment decisions, and competitive exams.

Key Terms Related to Inflation

Here are essential terms explained concisely:

| Term | Definition |

|---|---|

| Inflation Rate | The percentage increase in the general price level over a specific period, often annually. |

| Deflation | A sustained decrease in the general price level, opposite of inflation, which can lead to reduced economic activity. |

| Disinflation | A slowdown in the rate of inflation, where prices rise but at a decreasing pace. |

| Hyperinflation | Extremely high and accelerating inflation, often exceeding 50% per month, leading to currency devaluation. |

| Stagflation | A situation where high inflation coincides with economic stagnation and high unemployment. |

| Consumer Price Index (CPI) | A measure of the average change in prices paid by consumers for a basket of goods and services. |

| Producer Price Index (PPI) | Tracks changes in prices received by domestic producers for their output. |

| Core Inflation | Inflation excluding volatile items like food and energy prices. |

| Wage-Price Spiral | A cycle where rising wages lead to higher prices, which in turn prompt further wage demands. |

| Shrinkflation | When product sizes shrink but prices remain the same, effectively increasing the price per unit. |

These terms form the foundation for discussing inflation dynamics.

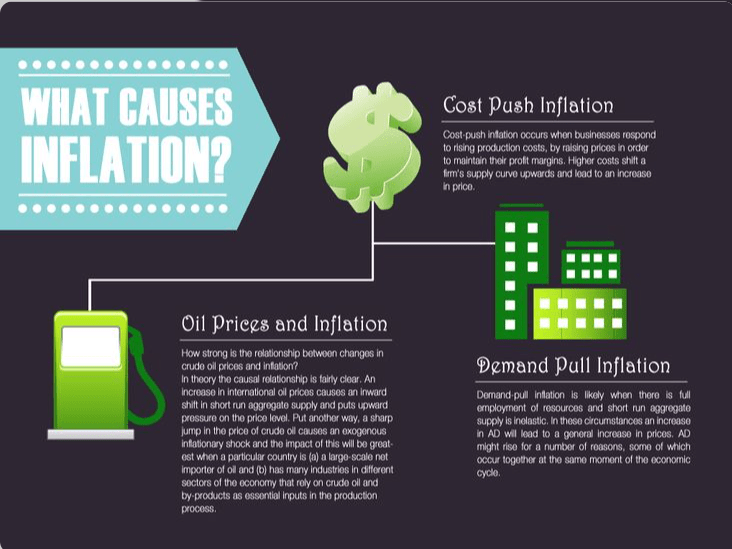

Causes of Inflation

Inflation arises from imbalances in supply and demand, monetary factors, or external shocks. The primary types are:

- Demand-Pull Inflation: Occurs when aggregate demand exceeds aggregate supply, often due to increased consumer spending, government expenditure, or low interest rates. For example, post-pandemic stimulus boosted demand, leading to higher prices.

- Cost-Push Inflation: Triggered by rising production costs, such as higher wages, raw material prices, or supply chain disruptions. Energy price shocks, like oil price hikes, are common culprits.

- Built-In Inflation: Results from adaptive expectations, where workers demand higher wages to keep up with past inflation, creating a self-perpetuating cycle.

- Monetary Factors: Excessive growth in money supply relative to economic output, often from loose monetary policy or printing money.

- Supply Shocks: Sudden disruptions like natural disasters, geopolitical events, or pandemics that reduce supply.

Examples: The 2021-2022 U.S. inflation spike was largely due to supply chain issues and energy volatility.

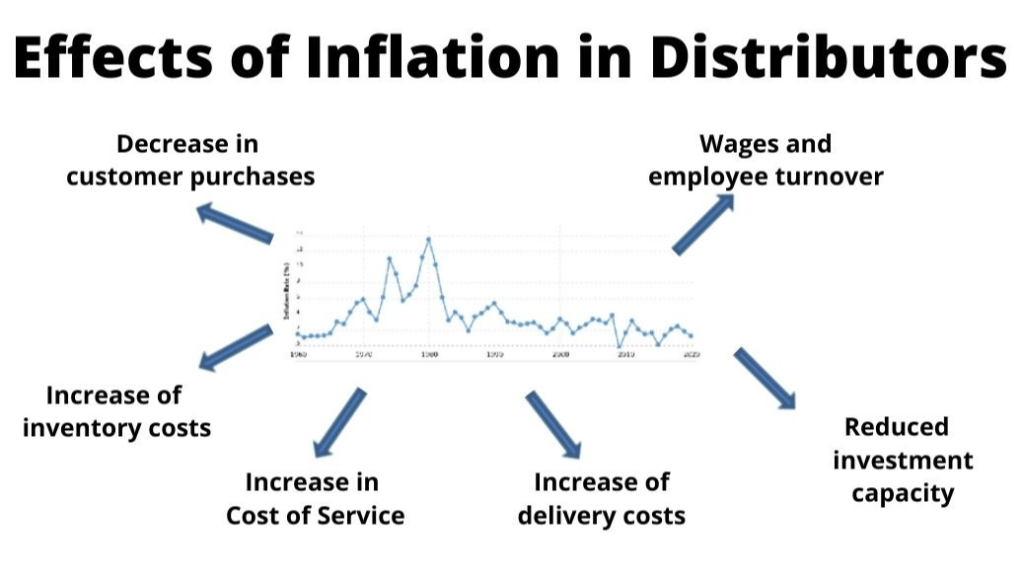

Effects of Inflation

Inflation impacts various economic agents differently. While moderate levels can stimulate growth, high inflation often has negative consequences:

- Erosion of Purchasing Power: Reduces the real value of money, making goods and services more expensive for consumers.

- Redistribution of Income: Hurts fixed-income groups (e.g., pensioners) and low-income households disproportionately, as their wages may not keep pace. Benefits debtors by reducing real debt value.

- Higher Interest Rates: Central banks raise rates to curb inflation, increasing borrowing costs and potentially slowing growth.

- Impact on Savings and Investments: Discourages savings if returns don’t outpace inflation; shifts investments toward assets like real estate.

- Economic Uncertainty: Leads to mal-investments, reduced exports (due to higher domestic prices), and potential unemployment if it triggers a recession.

- Long-Term Effects: Persistent high inflation can anchor higher expectations, making it harder to control.

Positive effects include encouraging spending and reducing real debt burdens, but these are outweighed in high-inflation scenarios.

Control Measures for Inflation

Governments and central banks use a mix of policies to manage inflation:

- Monetary Policy: Central banks raise interest rates to reduce money supply and demand. They can also use open market operations to sell bonds.

- Fiscal Policy: Increase taxes or cut government spending to lower aggregate demand.

- Supply-Side Measures: Improve productivity through deregulation, infrastructure investment, or subsidies to reduce costs.

- Price Controls: Temporary caps on prices, though often ineffective long-term as they can cause shortages.

- Other Strategies: Enhance debt transparency, avoid fiscal dominance, or shift to renewable energy to mitigate supply shocks.

| Policy Type | Tools | Pros | Cons |

|---|---|---|---|

| Monetary | Raise rates, reduce money supply | Quick to implement | Can slow growth |

| Fiscal | Higher taxes, lower spending | Targets demand directly | Politically challenging |

| Supply-Side | Deregulation, investments | Long-term benefits | Slow to take effect |

Effective control requires coordination, as seen in the Federal Reserve’s response to post-2020 inflation.

Inflation Targeting

Inflation targeting is a monetary policy framework where central banks publicly announce a specific inflation rate (e.g., 2%) and adjust policies to achieve it over the medium term. It promotes transparency and anchors expectations.

- Process: Estimate target, monitor indicators, and use tools like interest rates to steer inflation.

- Benefits: Stabilizes economy, reduces volatility; successful in countries like New Zealand and Canada.

- Challenges: Inflexible during shocks; U.S. targets 2% but has faced above-target periods in 2025.

- Global Adoption: Over 40 countries use it, focusing on 1-3% ranges for stability.

This strategy has proven effective in maintaining low inflation historically.

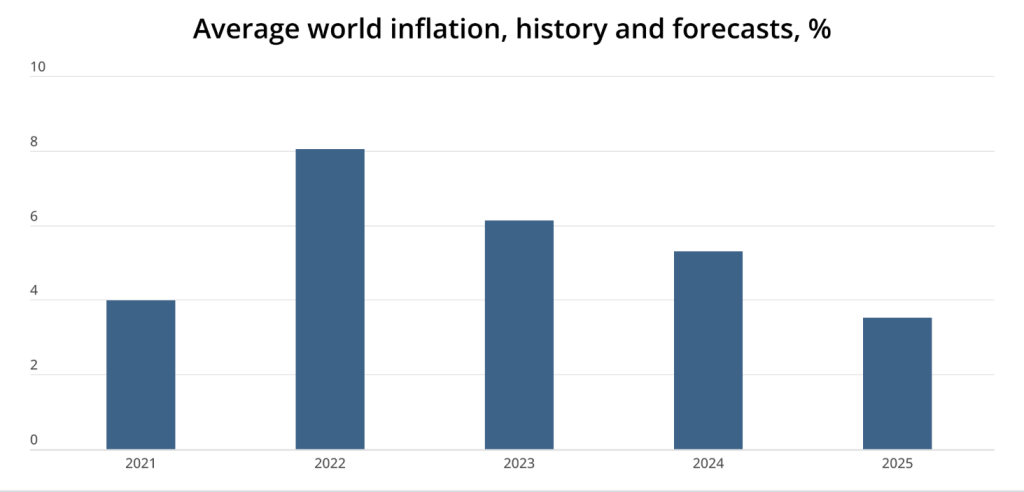

Trends in Inflation

Global inflation peaked post-2020 due to pandemics and geopolitical events but is declining. As of November 2025:

- Global Outlook: Headline inflation expected at 4.4% in 2025, down from 5.8% in 2024. Core inflation may rise to 3.4% in H2 2025 due to tariffs.

- Regional Variations: Developed economies like the U.S. (above 2% target) and Germany (cumulative 22% rise 2020-2025) face persistent pressures; Asia (e.g., Japan at 8% cumulative) is lower. OECD headline stable at 4.2% in September 2025.

- Forecasts: Experts predict 4.0% global average for 2025, with risks from energy and trade tensions. U.S. expectations at 3.2% short-term.

Trends show a cooling but uneven path, with emerging markets facing higher rates. For exams, focus on recent data and policy responses.

Leave a comment