Recruitment of Officers in Grade ‘A’ and Grade ‘B’–

General and Specialist Stream: 2025

SMALL INDUSTRIES DEVELOPMENT BANK OF INDIA

HEAD OFFICE: SIDBI TOWER, 15 ASHOK MARG, LUCKNOW – 226001

Advertisement No. 03 /Grade ‘A’ and ‘B’ / 2025-26

Recruitment of Officers in Grade ‘A’ and Grade ‘B’–

General and Specialist Stream: 2025

Online Application Window: July 14, 2025 – August 11, 2025

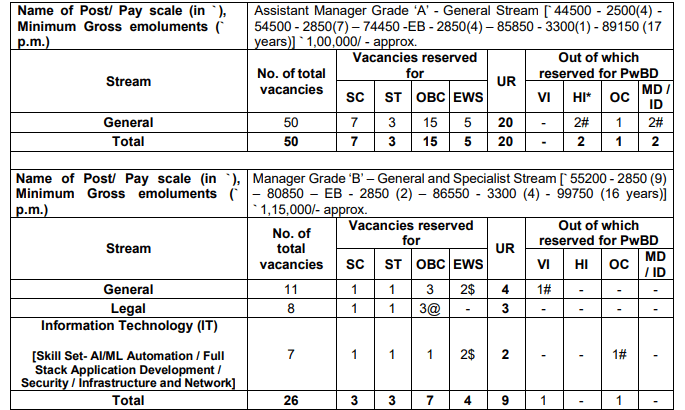

The Small Industries Development Bank of India (SIDBI), established under the Small Industries Development Bank of India Act, 1989, invites applications for 50 Assistant Manager (Grade A) vacancies in the General Stream.

This prestigious opportunity offers aspirants a chance to contribute to India’s MSME sector, ensuring financial support and development for millions of enterprises.

days

hours minutes seconds

until

Prelims Exam

The SEBI exam is a three-stage process: Phase I (Prelims), Phase II (Mains), and Interview.

Below is the detailed syllabus and exam pattern:

Syllabus and Exam Pattern

Phase I: Online Screening

English Language:

Grammar,

vocabulary,

reading comprehension,

passage making,

error spotting,

jumble words,

sentence framing,

fill in the blanks.

Reasoning:

Puzzles,

seating arrangement (circular, square & linear),

data sufficiency,

directions and distance,

coding-decoding,

blood relations,

inequality,

syllogism,

machine input and output,

verbal reasoning,

ordering and ranking,

arrangement and pattern,

scheduling,

distance and direction,

ranking.

Quantitative Aptitude:

Simplification and approximation,

number series,

quadratic equation,

number system / HCF & LCM,

ratio and proportion,

average,

partnership,

ages,

percentage,

profit & loss,

time, speed & distance,

problems on trains,

boat and stream,

time & work / pipes and cisterns,

simple and compound interest,

mixture & allegations,

permutation and combination,

probability,

data interpretation (DI),

caselet DI,

data sufficiency.

Computer Knowledge:

Computer fundamentals,

introduction to software,

data structure,

file structure,

programming basics,

systems analysis and design,

data communication and networks,

computer architecture,

operating systems,

database management systems.

General Awareness (With special reference to Banking and Financial Sector and Economic and Social Issues):

Monetary policies,

banking and financial awareness,

economic terms,

current affairs,

static GK,

financial and economic news,

government schemes,

agreement & deals,

banking terms- rates & processes,

national institutions.

MSMEs: Policy, Regulatory and Legal Framework; Finance and Management (with focus on MSME):

MSME financing (Due Diligence/ KYC, Financial ratios, Assessment of Term Loan / Working Capital, Documentary credit etc.),

NPA and recovery including IRAC norms,

NBFC Financing,

Credit risk assessment.

Stream Specific Test (For General Stream):

MSME financing (Due Diligence/KYC, Financial ratios, Assessment of Term Loan/Working Capital, Documentary credit, etc.),

NPA and recovery including IRAC norms,

NBFC Financing,

Credit risk assessment,

questions related to Investment Banking,

Merchant Banking,

Equity,

Alternative Investment Funds (AIFs),

Asset Reconstruction Companies (ARCs),

Promotion and development of MSMEs in India.

Phase I Exam Pattern: 200 marks, 120 minutes, MCQs, Common for All Streams (with stream-specific section). Negative marking of 1/4 for wrong answers.

Phase II: Online Examination

Paper 1 (75 marks, 75 minutes, Descriptive, English Language):

Essay,

précis writing,

comprehension,

business/office correspondence.

Paper 2 (125 marks total: 75 marks objective 50 questions 60 minutes + 50 marks descriptive attempt 4 out of 10 questions 75 minutes):]

MSMEs: Policy, Regulatory and Legal Framework,

Finance and Management (with focus on MSME),

MSME financing (Due Diligence/ KYC, Financial ratios, Assessment of Term Loan / Working Capital, Documentary credit etc.),

NPA and recovery including IRAC norms,

NBFC Financing,

Credit risk assessment,

questions related to Investment Banking,

Merchant Banking,

Equity,

Alternative Investment Funds (AIFs),

Asset Reconstruction Companies (ARCs),

Promotion and development of MSMEs in India.

Negative marking of 1/4 for wrong answers in objective part.

Phase III: Interview (100 marks). Final selection based on Phase II and Interview performance

Crack Target Mentorship Programme for SIDBI

Get exclusive study material free for first 100 Students

Read our PDFs

500 Top Economics Questions for PFRDA

500 MCQs for

financial/pension sector

FAQs

Start Your Journey with PFRDA

- Apply Now: Visit www.pfrda.org.in to submit your application by August 6, 2025.tay Connected: Follow PFRDA’s official website and social media for updates.

Prepare Smart: Enroll in cracktarget free PFRDA Grade A Online Course for exclusive pdf and mock tests, and expert guidance.- Stay Connected: Follow PFRDA’s official website and social media for updates.