Tag: finance

-

120 UPSC-Level MCQs on Accountancy and Audit

23,924 views

(as per UPSC EPFO Syllabus) Below is a set of 120 multiple-choice questions (MCQs) at UPSC level, based on the UPSC EPFO syllabus for Accountancy and Audit. The questions cover key topics such as accounting principles, financial statements, depreciation, cost accounting, management accounting, auditing principles, types of audits, vouching, verification, and related areas. Each question…

-

Capital and Revenue Profit and Losses, and Depreciation: UPSC EPFO APFC

23,924 views

1. Capital and Revenue Profit Revenue Profit Capital Profit 2. Capital and Revenue Losses Revenue Losses Capital Losses 3. Depreciation: Meaning and Features Meaning of Depreciation Features of Depreciation 4. Methods of Calculating Depreciation As per Accounting Standard-6, the selected method should be used consistently; a change is allowed only in specific circumstances. 1. Straight…

-

Partnership: Accounting for UPSC EPFO APFC

23,924 views

What is a Partnership? Key Features of Partnership Partnership Deed Contents Include: Rules if There is No Partnership Deed If there’s no written deed, default rules are: Interest on Capital Goodwill Methods of Valuing Goodwill Types of Capital Accounts Admission of a Partner Main Points on Admission Retirement and Death of Partner Dissolution of Partnership…

-

-

Study Material on Union Budget 2025-26 of India

23,924 views

Official Budget Document Published by Govt of India The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, serves as the annual financial statement of the Government of India, outlining estimated receipts and expenditures for the fiscal year April 1, 2025, to March 31, 2026. This budget emphasizes inclusive development under…

-

Study Material: Classification of Capital and Revenue Items in Accounting

23,924 views

1. Definitions and Key Principles In accounting, transactions are classified as capital or revenue based on their nature, recurrence, and impact on the entity’s financial structure. This classification adheres to principles outlined in accounting standards such as Indian Accounting Standards (Ind AS) or Generally Accepted Accounting Principles (GAAP), which emphasize substance over form. Key Principles…

-

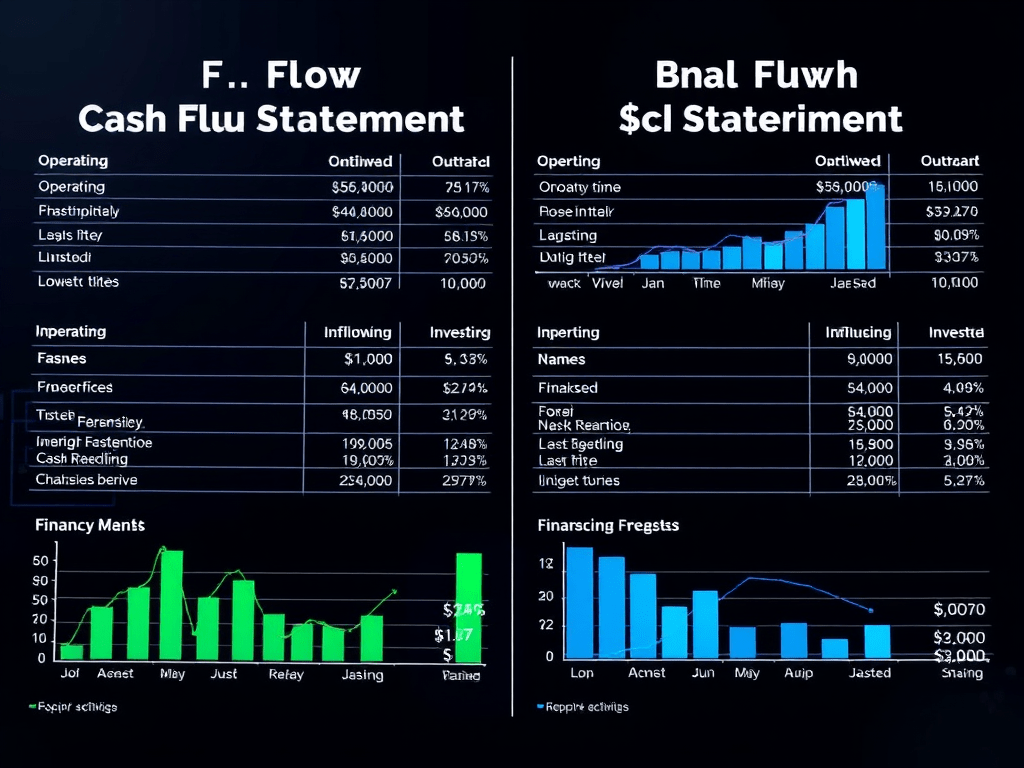

Cash Flow Statement and Fund Flow Statement

23,924 views

Introduction to Cash Flow and Fund Flow Statements Cash Flow Statement and Fund Flow Statement are essential tools in financial analysis, providing insights into an entity’s liquidity, solvency, and resource management. While both statements track changes in financial position, they differ in focus: Cash Flow emphasizes actual cash movements, whereas Fund Flow highlights changes in…

-

Accounting as a Financial Information System

23,924 views

Introduction to Accounting as a Financial Information System Accounting is fundamentally a system designed to collect, process, and communicate financial information about an entity (such as a business, government, or non-profit organization) to various stakeholders. It serves as a financial information system by transforming raw economic data into meaningful, structured reports that aid in decision-making.…