Introduction and Overview

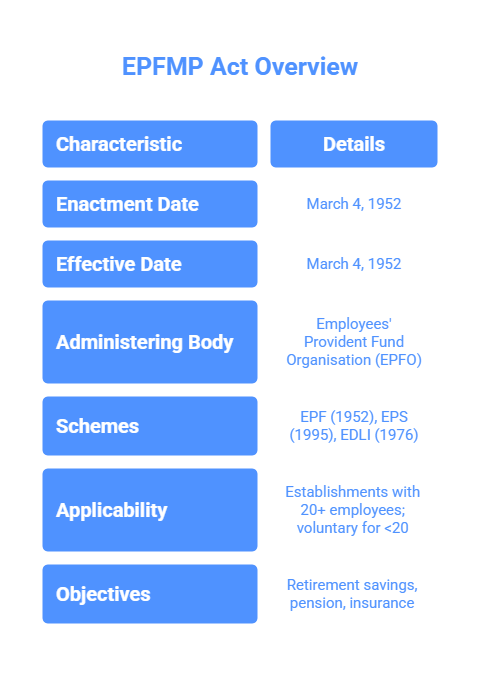

The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 (EPFMP Act), is a pivotal social security legislation in India, designed to provide financial stability to employees in the organized sector by ensuring retirement benefits, pension, and insurance. Enacted on March 4, 1952, and effective from the same year, the Act establishes three key schemes:

The Employees’ Provident Fund (EPF) Scheme, 1952;

The Employees’ Pension Scheme (EPS), 1995;

and

The Employees’ Deposit-Linked Insurance (EDLI) Scheme, 1976.

Administered by the Employees’ Provident Fund Organisation (EPFO),

a statutory body under the

Ministry of Labour and Employment,

the Act mandates contributions from both employers and employees to build a corpus for post-retirement, disability, or survivor benefits.

It applies to establishments with 20 or more employees in industries listed in Schedule I (e.g., cement, textiles, electronics), with provisions for voluntary coverage in smaller units.

The Act’s objectives include promoting savings, ensuring old-age security, and providing lump-sum or pension benefits, reflecting India’s commitment to labor welfare amid industrialization.

For UPSC EPFO and ALC exams, this Act is a core topic under “Industrial Relations & Labour Laws” and “Social Security,” with significant weightage due to its role in financial protection.

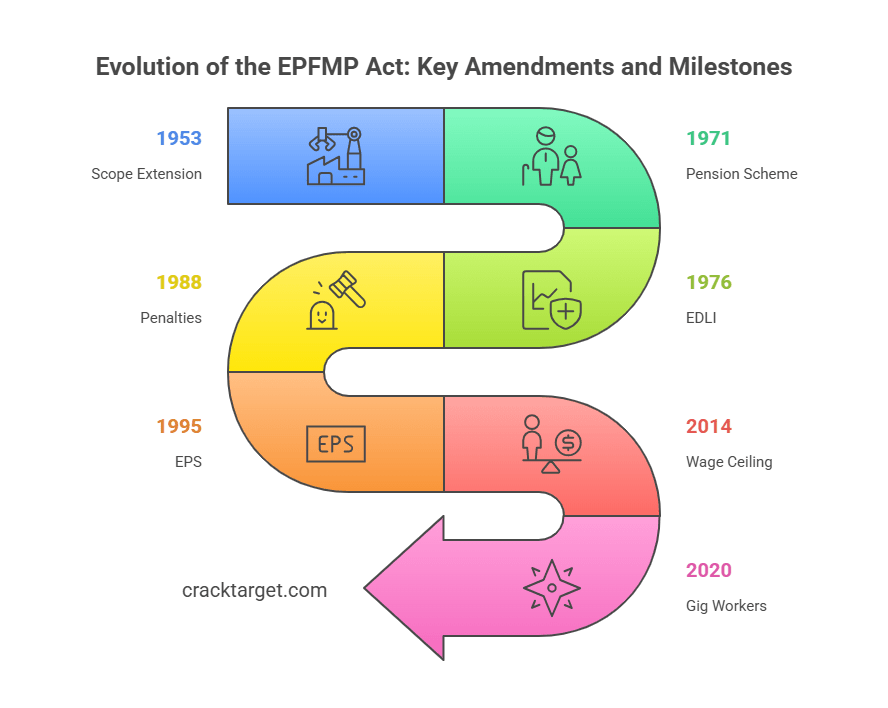

Historical Background

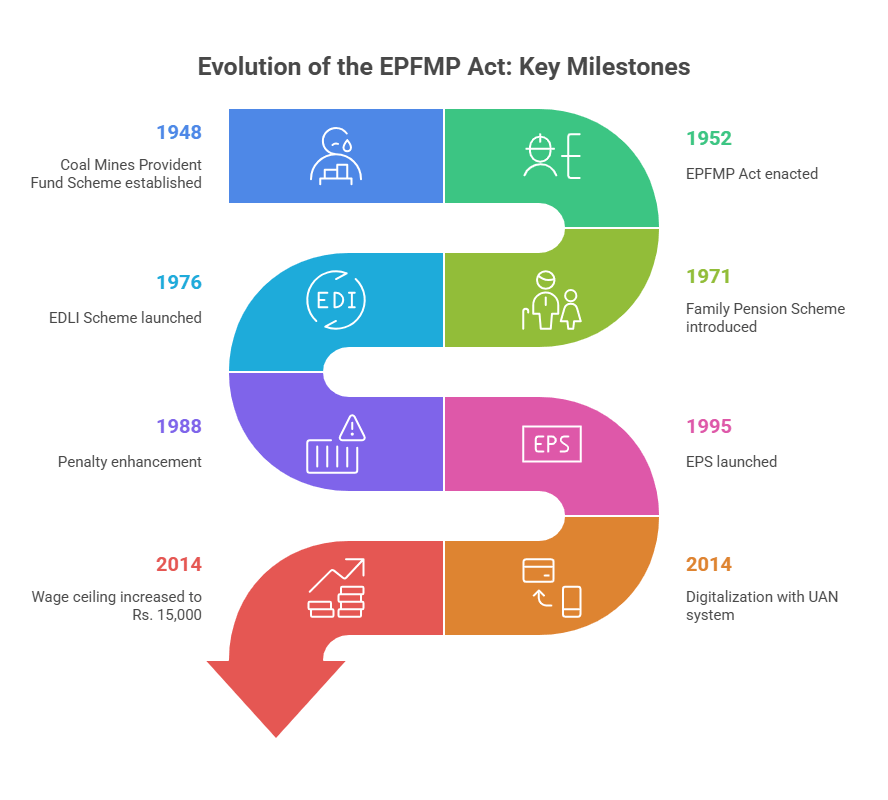

The EPFMP Act emerged from the need to provide social security to industrial workers during India’s early industrialization. Pre-independence, the Coal Mines Provident Fund Scheme, 1948, set a precedent for sector-specific savings. Post-independence, the Constitution’s Directive Principles (Articles 39, 41, 43) emphasized social security, leading to the Act’s enactment under Jawaharlal Nehru’s government. Influenced by ILO conventions, it addressed vulnerabilities of workers in factories, railways, and mines during the First Five-Year Plan (1951-56), which prioritized industrial growth. The EPFO was established in 1952 to implement the Act, starting with regional offices and expanding to over 120 by 2025. Key amendments include the 1971 Family Pension Scheme (replaced by EPS in 1995), EDLI in 1976, and 1988 penalty enhancements. The Act has been amended 15 times by 2016, adapting to globalization (e.g., 1990s economic reforms), digitalization (UAN system, 2014), and pandemics (COVID-19 advances, 2020). By 2025, it covers over 6 crore active members with a corpus exceeding Rs. 20 lakh crore.

Definitions and Scope

Section 2 – Key Definitions under the EPFMP Act

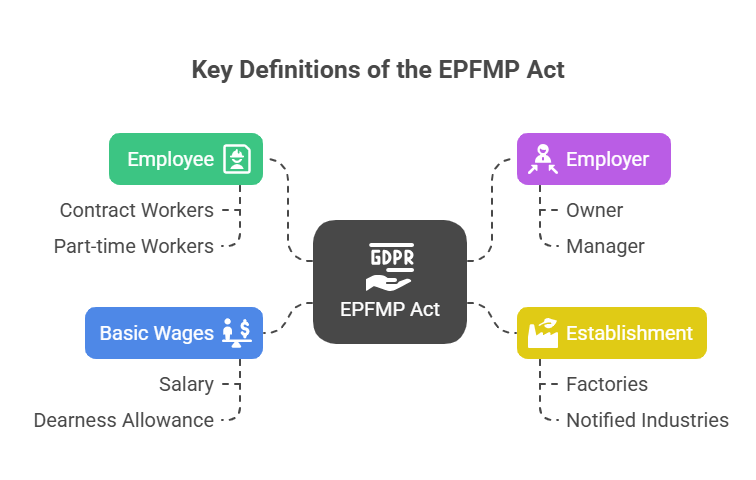

1. Employee

- Definition: Any person employed for wages in:

- Manual work

- Clerical work

- Supervisory work

- Technical work

- Inclusions:

- Employees of contractors

- Part-time workers

- Apprentices (except those under the Apprentices Act, 1961)

- Exclusions:

- Casual workers not connected with the work of the establishment

2. Employer

- The person who has ultimate control over the establishment’s affairs, including:

- Owner

- Occupier

- Manager

- Managing Agent

- Any person acting on behalf of the employer

3. Establishment

- Covers:

- All factories

- Any industry listed in Schedule I

- All branches and departments treated as a single unit

4. Exempted Establishment

- Establishments running their own Provident Fund schemes offering:

- Equal or better benefits than the EPF Scheme

- Must be approved by the Central Government under Section 17

5. Basic Wages

- Includes:

- Basic salary

- Dearness allowance (DA)

- Retaining allowance

- Excludes:

- Bonuses

- Overtime payments

- Food or meal allowances

Applicability of the Act

General Applicability

- Applies to all establishments with 20 or more employees

- Voluntary Coverage: Available for establishments with less than 20 employees through mutual agreement

- Once covered, remains applicable even if employee count drops below 20

Exemptions

- Cooperative societies with less than 50 members and no power usage

- New establishments may be granted relief for 3–5 years

Powers of the Central Government

- Can amend Schedule I by adding new industries for coverage under the Act

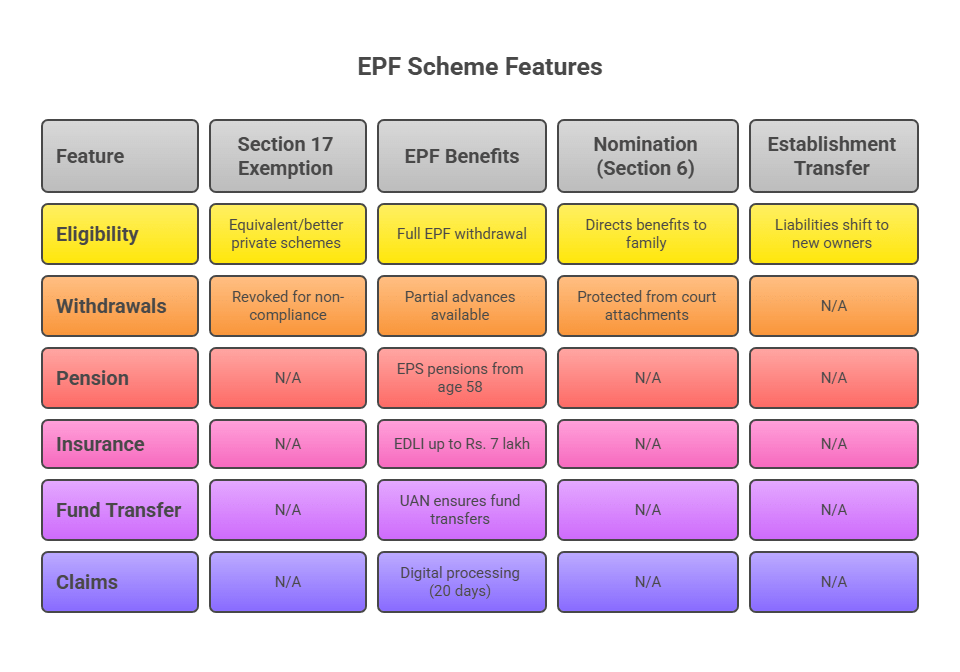

Employees’ Provident Fund Scheme

1. Legal Basis

- Framed Under: Section 5 of the Employees’ Provident Funds and Miscellaneous Provisions (EPFMP) Act, 1952

- Nature: Core social security scheme mandating retirement/emergency savings

2. Membership & Eligibility

- Mandatory from Day One for:

- Employees earning up to ₹15,000/month in wages (basic + DA + retaining allowance)

- Universal Account Number (UAN):

- Enables portability of EPF accounts across jobs/employers

3. Contributions

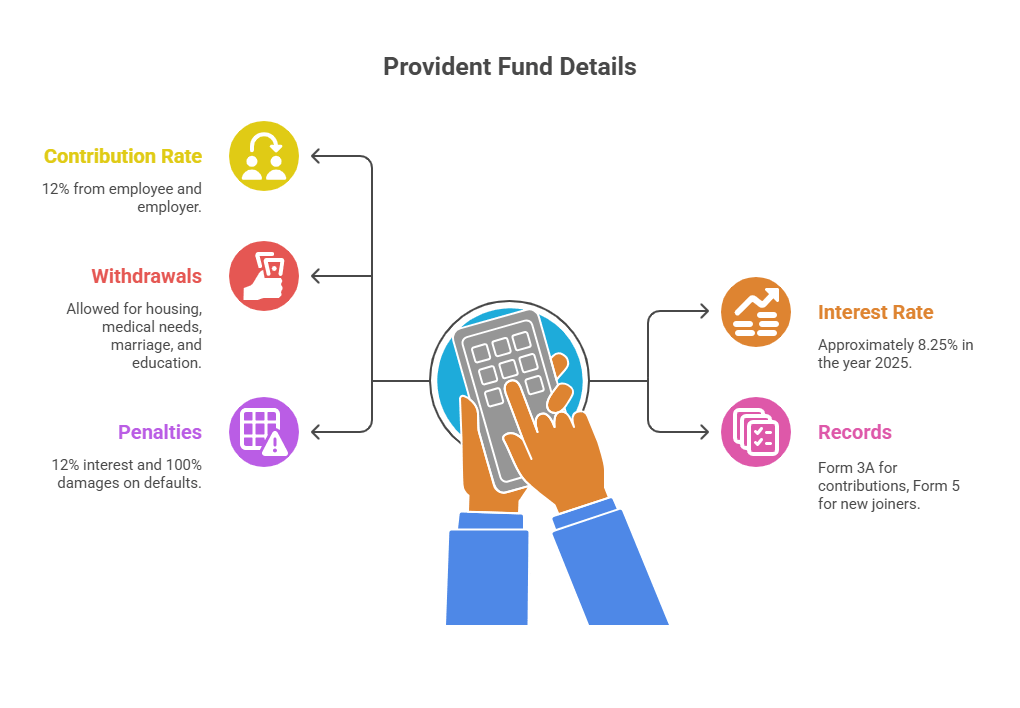

- Employee Share: 12% of basic wages + DA + retaining allowance

- Employer Share: 12% (with 3.67% to EPF and 8.33% to EPS, where applicable)

- Deposit Deadline: 15th of the following month

- Interest:

- Set annually by EPFO; e.g., 8.25% for 2025

- Credited to the member’s account annually

4. Scheme Details (As per Schedule II)

- Covers:

- Joining formalities

- Contribution timelines

- Nominations

- Withdrawal/Advance rules

- Interest crediting

- Record-keeping responsibilities

5. Withdrawals & Advances

- Permitted for:

- Housing

- Medical treatment

- Marriage or higher education of self/family

- Eligibility:

- Generally after 5–10 years of service

- Tax Status:

- Falls under Section 80C

- EEE status: Exempt at Contribution, Growth (Interest), and Withdrawal

6. Record-Keeping & Forms

- Form 3A: Annual statement of contributions

- Form 5: Details of new joiners

- Digital Services:

- Online claim filing

- Passbook access via EPFO portal/UMANG app

7. Penalties for Non-Compliance

- Interest on Delay: 12% per annum

- Damages/Penalty: Up to 100% of arrears

- Actionable by: EPFO under relevant provisions

8. Coverage & Reach

- Total Subscribers: Over 6 crore workers covered

- Managed by: Employees’ Provident Fund Organisation (EPFO)

Employees’ Pension and Deposit-Linked Insurance Schemes

Employees’ Pension Scheme (EPS), 1995

1. Legal Basis

- Under: Section 6A of the EPF & MP Act, 1952

- Objective: Provide pension for retirement, disability, or death

2. Funding & Contributions

- From Employer’s EPF Share:

- 8.33% of wages (up to ₹15,000/month wage ceiling) diverted to EPS

- Central Government:

- Adds 1.16% of wages (up to ₹15,000)

3. Eligibility & Benefits (as per Schedule III)

- Minimum Service for Full Pension: 10 years

- Pensionable Age: 58 years

- Early Pension: From 50 years (with reduced amount)

- Disablement Pension: Available without service requirement

- Family Pension:

- To widow, children, or orphans in case of death

4. Pension Calculation

- Formula: Pension=Pensionable Salary×Pensionable Service*0.7

- Pensionable Salary: Average of last 60 months’ salary

- Minimum Pension: ₹1,000/month

- Commutation: Up to 1/3rd of pension allowed as lump sum

Employees’ Deposit-Linked Insurance (EDLI) Scheme, 1976

1. Legal Basis

- Under: Section 6C of the EPF & MP Act

- Objective: Life insurance linked to EPF membership

2. Contributions

- Employer: 0.5% of basic wages (up to ₹15,000/month)

- Employee: No contribution required

- EDLI Admin Charges: Additional 0.01% by employer

3. Insurance Benefit

- Payable on Death of employee during service

- Amount (as per 2021 update): (Average EPF balance of last 12 months×30)+Bonus (₹1.5 lakh max)

- Maximum Benefit: Up to ₹7 lakh

4. Disbursement & Records

- Nominees receive insurance amount

- Schedule IV: Covers eligibility, calculation scale, and exclusions

Common Features of EPS & EDLI

| Feature | EPS, 1995 | EDLI, 1976 |

|---|---|---|

| Based On | Section 6A | Section 6C |

| Employee Contribution | None (Only via EPF) | None |

| Employer Contribution | 8.33% to EPS | 0.5% to EDLI |

| Government Contribution | 1.16% | None |

| Coverage | Pension benefits (retirement/disability/survivors) | Life insurance (on death) |

| Maximum Benefit | Pension as per formula (min ₹1,000) | ₹7 lakh (as per 2021 update) |

| Administered By | EPFO | EPFO |

| Digital Access | Claim filing and tracking via EPFO Portal/UMANG App |

| Scheme | Contribution | Benefits | Key Feature |

|---|---|---|---|

| EPS | 8.33% employer, 1.16% government | Pension at 58, survivor benefits | Min Rs. 1,000/month |

| EDLI | 0.5% employer | Insurance up to Rs. 7 lakh | Linked to EPF balance |

Contributions and Funds

Contributions under Section 6 of the EPF & MP Act

1. Mandatory Contributions

- Rate: 12% of:

- Basic Wages

- Dearness Allowance (DA)

- Retaining Allowance

- Shared Equally:

- Employer: 12%

- Employee: 12%

- Wage Ceiling for EPS & EDLI: ₹15,000/month

2. Fund-Wise Allocation (From Employer’s 12%)

| Fund | Share | Remarks |

|---|---|---|

| Provident Fund (EPF) | 3.67% | Accumulates savings + interest |

| Pension Fund (EPS) | 8.33% | Subject to wage ceiling of ₹15,000/month |

| Insurance Fund (EDLI) | 0.50% | For life insurance benefits |

| Admin Charges | 0.50% (EPF) + 0.01% (EDLI) | Paid only by employer |

3. Voluntary Provident Fund (VPF)

- Employees can contribute up to 100% of wages voluntarily

- No matching contribution from employer

- Same interest rate and tax benefits as EPF

4. Deposit Timeline & Procedure

- Due Date: By the 15th of the following month

- Payment Method: Through Electronic Challan-cum-Return (ECR)

5. Investment of Funds

- Managed by EPFO

- Invested in:

- Government Securities

- Corporate Bonds

- Equities (up to 15%)

- Goal: Ensure optimal and safe returns for subscribers

6. Defaults & Penalties

- Interest on Delayed Payment: 12% p.a.

- Damages:

- Ranges from 5% to 25% p.a. depending on delay period

- Recovery Mode: Treated as arrears of land revenue

7. Exempted Establishments

- Can maintain private Provident/Pension/Insurance Funds

- Must provide equal or better benefits

- Approval required from EPFO under Section 17

8. Digital Facilities

Update KYC and personal details

ECR Portal: For filing returns and payments

UMANG App & EPFO Portal:

View passbook

Track claims

File grievances

| Fund | Contribution Source | Investment | Default Penalties |

|---|---|---|---|

| Provident Fund | 12% employee + employer | Securities, equities | 12% interest, 5-25% damages |

| Pension Fund | 8.33% employer, 1.16% govt | Bonds, safe assets | As above |

| Insurance Fund | 0.5% employer | Insurance pool | As above |

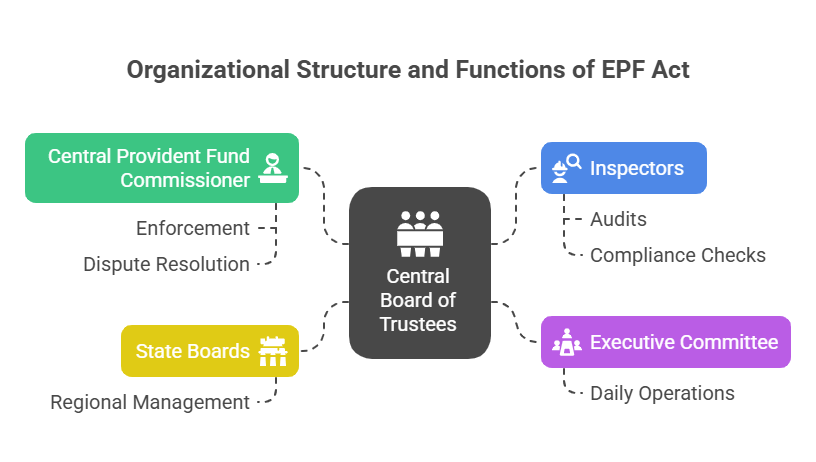

Authorities and Administration

| Authority | Role | Powers |

|---|---|---|

| CBT | Frames schemes, investments | Policy decisions, oversight |

| CPFC | Enforcement, disputes | Determines applicability, recovery |

| Inspectors | Audits, compliance | Entry, seizure, inquiries |

Exemptions, Benefits, and Transfers

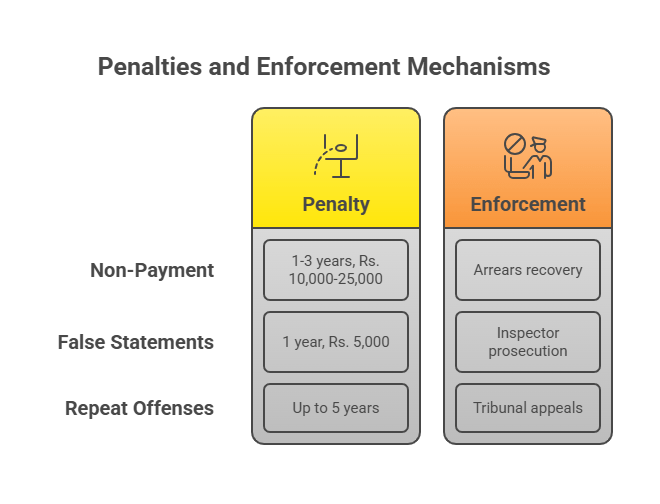

Page 9: Penalties and Enforcement

Section 14 prescribes penalties: imprisonment up to 1 year and fines up to Rs. 5,000 for evasion or false statements; up to 5 years for repeat offenses. Non-payment of contributions attracts fines of Rs. 10,000-25,000 and 1-3 years imprisonment (Section 14A). Companies face director liability (Section 14AB). Dues are recoverable as land revenue arrears, with property attachment possible. Inspectors enforce via inquiries, audits, and prosecutions, with appeals to tribunals under Section 7I. Cognizance requires government sanction (Section 14AC). Over 50,000 prosecutions annually recover Rs. 500 crore in dues (2024 data). The focus is on compliance, with damages up to 100% for delays.

Amendments, Conclusion, and Importance

The Social Security Code, 2020 aims to consolidate and streamline multiple labor laws.

EPFMP Act is partially subsumed, with full integration expected by 2026

Ensures coverage expansion to gig economy and informal sector

Leave a comment