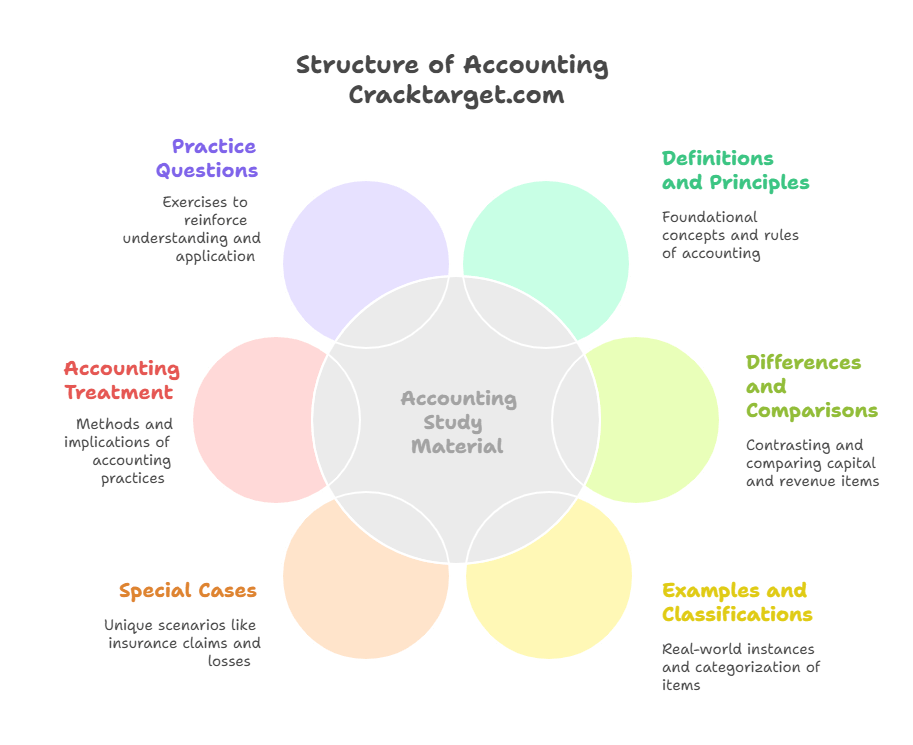

- Definitions and Key Principles

- Differences and Comparisons

- Examples and Classifications

- Special Cases: Insurance Claims and Losses

- Accounting Treatment and Implications

- Practice Questions with Explanations

1. Definitions and Key Principles

In accounting, transactions are classified as capital or revenue based on their nature, recurrence, and impact on the entity’s financial structure. This classification adheres to principles outlined in accounting standards such as Indian Accounting Standards (Ind AS) or Generally Accepted Accounting Principles (GAAP), which emphasize substance over form.

- Capital Receipt: A non-recurring inflow of funds that does not arise from the normal course of business operations. It typically increases the entity’s liabilities or reduces its assets without affecting the profit or loss for the period. Capital receipts are credited to the balance sheet and are not taxable as income.

- Revenue Receipt: A recurring inflow of funds from the entity’s core business activities or incidental operations. It increases the profit or loss for the period and is recorded in the income statement. Revenue receipts are generally taxable as income.

- Capital Expenditure: An outflow of funds for acquiring, improving, or extending the life of fixed assets (e.g., property, plant, equipment) that provide benefits over multiple accounting periods. It is capitalized on the balance sheet and depreciated over time, not charged entirely to the profit and loss account in the year incurred.

- Revenue Expenditure: An outflow of funds for maintaining the entity’s operational efficiency or generating revenue in the current accounting period. It provides short-term benefits (usually within one year) and is fully charged to the income statement as an expense, reducing the profit for the period.

Key Principles for Classification:

- Recurrence Test: Capital items are non-recurring; revenue items are recurring.

- Benefit Period Test: Capital items yield long-term benefits; revenue items yield immediate or short-term benefits.

- Purpose Test: Capital items relate to asset creation or enhancement; revenue items relate to operations or maintenance.

- Impact on Financial Statements: Capital items affect the balance sheet; revenue items affect the income statement.

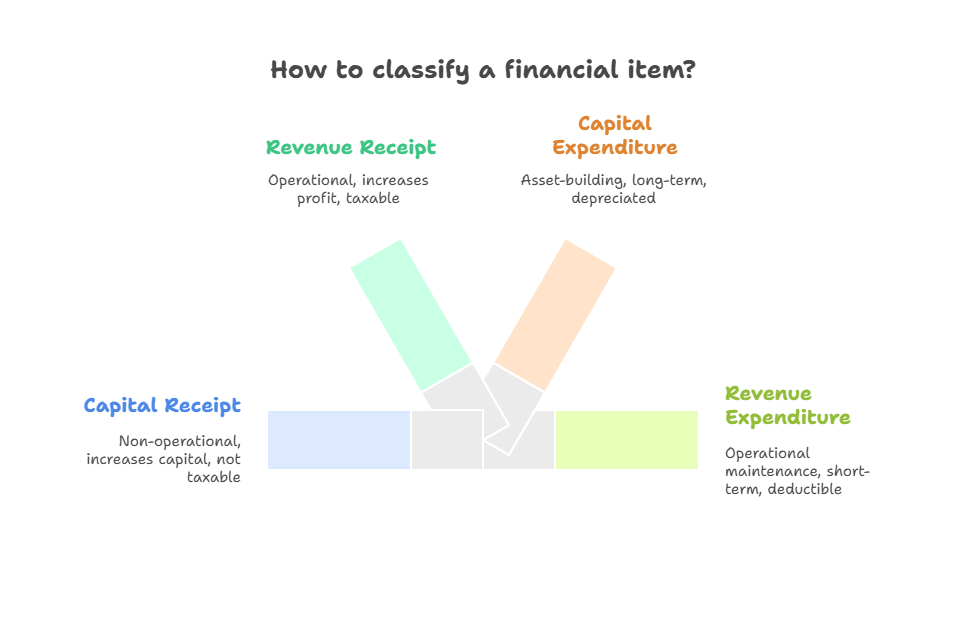

2. Differences and Comparisons

The following table provides a structured comparison to highlight distinctions:

| Aspect | Capital Receipt | Revenue Receipt | Capital Expenditure | Revenue Expenditure |

|---|---|---|---|---|

| Nature | Non-operational, one-time | Operational, recurring | Asset-building, long-term | Operational maintenance, short-term |

| Examples | Loan proceeds, sale of fixed assets | Sales revenue, interest income | Purchase of machinery, building construction | Salaries, rent, repairs |

| Financial Impact | Increases capital or reduces assets; no P&L effect | Increases profit; taxable | Capitalized on balance sheet; depreciated | Expensed in P&L; reduces profit |

| Tax Treatment | Generally not taxable as income | Taxable as business income | Not deductible immediately; depreciation allowed | Fully deductible in the year incurred |

| Recurrence | Irregular | Regular | One-time or infrequent | Frequent |

| Benefit Duration | Long-term structural change | Short-term income generation | Benefits over years | Benefits in current period |

| Accounting Entry | Credited to balance sheet (e.g., capital account) | Credited to income statement | Debited to asset account | Debited to expense account |

This table can be used as a quick reference for classification. Note that misclassification can lead to distorted financial statements, affecting ratios like return on capital employed or profitability metrics.

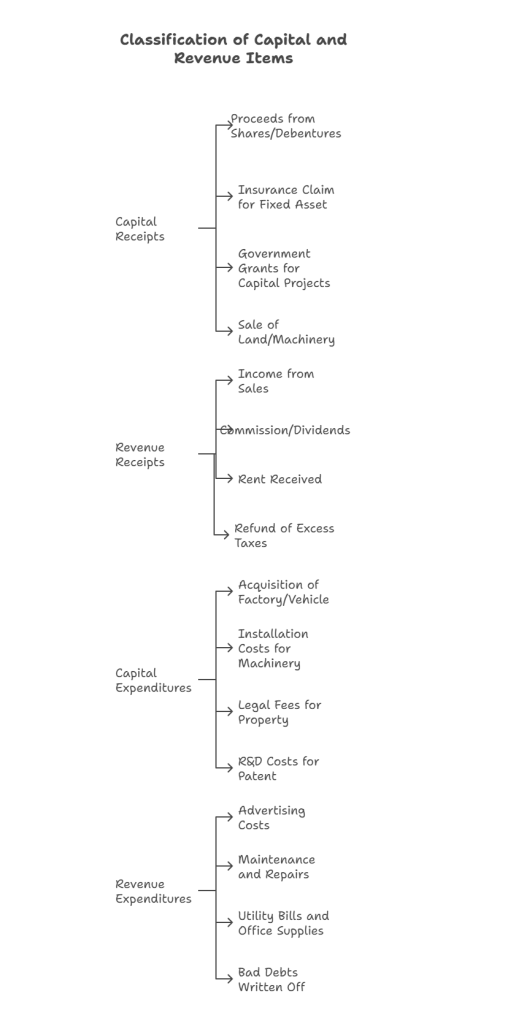

3. Examples and Classifications

To apply the concepts, consider the following examples:

- Capital Receipts:

- Proceeds from issuing shares or debentures.

- Insurance claim for loss of a fixed asset (e.g., building destroyed by fire).

- Government grants for capital projects.

- Sale of land or machinery.

- Revenue Receipts:

- Income from sales of goods or services.

- Commission earned, dividends received (if from regular investments).

- Rent received from letting out property used in business.

- Refund of excess taxes paid (if related to operational income).

- Capital Expenditures:

- Acquisition of a new factory or vehicle.

- Installation costs for machinery.

- Legal fees for acquiring property.

- Research and development costs leading to a patent (if capitalized under Ind AS 38).

- Revenue Expenditures:

- Advertising costs to promote products.

- Routine maintenance and repairs of equipment.

- Utility bills and office supplies.

- Bad debts written off from trade receivables.

Classification Guidelines:

- If a transaction enhances earning capacity (e.g., adding a new wing to a building), it is capital expenditure.

- If it merely maintains existing capacity (e.g., painting a building), it is revenue expenditure.

- Receipts from abnormal events (e.g., asset disposal) are capital; from normal trading are revenue.

4. Special Cases: Insurance Claims and Losses

Insurance claims often appear in examination questions due to their dual nature. The classification depends on the underlying asset or event:

- Insurance Claim for Fixed Assets (Capital Items):

- If machinery or building is completely damaged by fire, flood, or accident, the claim compensates for the loss of a capital asset. Thus, it is a capital receipt. The amount is not treated as income but used to replace the asset or reduce the loss on disposal.

- Example: A machine costing ₹5,00,000 is destroyed by fire, and insurance pays ₹4,00,000. The ₹4,00,000 is a capital receipt; any shortfall (₹1,00,000) is a capital loss.

- Insurance Claim for Stock or Goods (Revenue Items):

- If inventory is damaged, the claim relates to trading stock and is a revenue receipt, as it compensates for operational loss.

- Example: Stock worth ₹2,00,000 damaged by fire; insurance claim of ₹1,80,000 is revenue receipt, credited to the trading account.

- Partial Damage:

- For repairs to fixed assets covered by insurance, the claim may be revenue receipt if it covers maintenance costs. However, if it funds significant improvements, it could be capital.

- Losses Without Insurance:

- Loss of fixed asset: Capital loss (debited to capital account or asset disposal).

- Loss of stock: Revenue loss (debited to profit and loss).

Rationale: The key is to trace the claim to the nature of the insured item. Capital assets lead to capital classifications; revenue items lead to revenue classifications.

5. Accounting Treatment and Implications

- Journal Entries:

- Capital Receipt (e.g., insurance claim for machinery): Bank A/c Dr. To Insurance Claim (Capital) A/c.

- Revenue Receipt (e.g., sales): Bank A/c Dr. To Sales A/c.

- Capital Expenditure (e.g., machinery purchase): Machinery A/c Dr. To Bank A/c.

- Revenue Expenditure (e.g., repairs): Repairs A/c Dr. To Bank A/c.

- Implications:

- In taxation: Capital receipts are exempt (except under specific heads like capital gains); revenue receipts are included in taxable income.

- In budgeting: Governments classify borrowings as capital receipts and taxes as revenue receipts.

- Errors in classification can lead to under/overstatement of profits, affecting stakeholder decisions.

6. Practice Questions with Explanations

To ensure coverage of similar questions, practice the following:

- Question: The insurance claim received on account of machinery damaged completely by fire is:

(a) Capital receipt (b) Revenue receipt

(c) Capital expenditure (d) Revenue expenditure

Answer: (a) Capital receipt.

Explanation: The claim compensates for the loss of a capital asset (machinery), making it a non-recurring capital inflow, not arising from operations. - Question: Expenditure on legal fees for defending a title to property is: (a) Capital receipt (b) Revenue receipt

(c) Capital expenditure (d) Revenue expenditure

Answer: (c) Capital expenditure.

Explanation: It protects or enhances the value of a fixed asset (property), providing long-term benefits. - Question: Proceeds from the sale of old furniture used in business are: (a) Capital receipt (b) Revenue receipt

(c) Capital expenditure (d) Revenue expenditure

Answer: (a) Capital receipt.

Explanation: Sale of a fixed asset is non-operational and reduces the asset base. - Question: Cost of advertising a new product launch is: (a) Capital receipt (b) Revenue receipt

(c) Capital expenditure (d) Revenue expenditure

Answer: (d) Revenue expenditure.

Explanation: It is an operational cost for generating immediate sales revenue. - Question: Government subsidy received for purchasing solar panels is: (a) Capital receipt (b) Revenue receipt

(c) Capital expenditure (d) Revenue expenditure

Answer: (a) Capital receipt.

Explanation: It supports capital asset acquisition, treated as a reduction in asset cost or a capital inflow. - Question: Insurance claim for theft of trading stock is:

(a) Capital receipt (b) Revenue receipt

(c) Capital expenditure (d) Revenue expenditure

Answer: (b) Revenue receipt.

Explanation: Stock is a revenue item; the claim compensates for operational loss.

Leave a comment