Official Budget Document Published by Govt of India

The Union Budget 2025-26, presented by Finance Minister Nirmala Sitharaman on February 1, 2025, serves as the annual financial statement of the Government of India, outlining estimated receipts and expenditures for the fiscal year April 1, 2025, to March 31, 2026. This budget emphasizes inclusive development under the theme “Viksit Bharat,” prioritizing growth engines such as agriculture, micro, small, and medium enterprises (MSMEs), investment, and exports. It aims to accelerate economic growth, enhance private sector investments, and uplift key demographic groups including the poor, youth, farmers, and women. The budget continues efforts from previous years to foster job creation, skill development, and infrastructure while maintaining fiscal discipline.

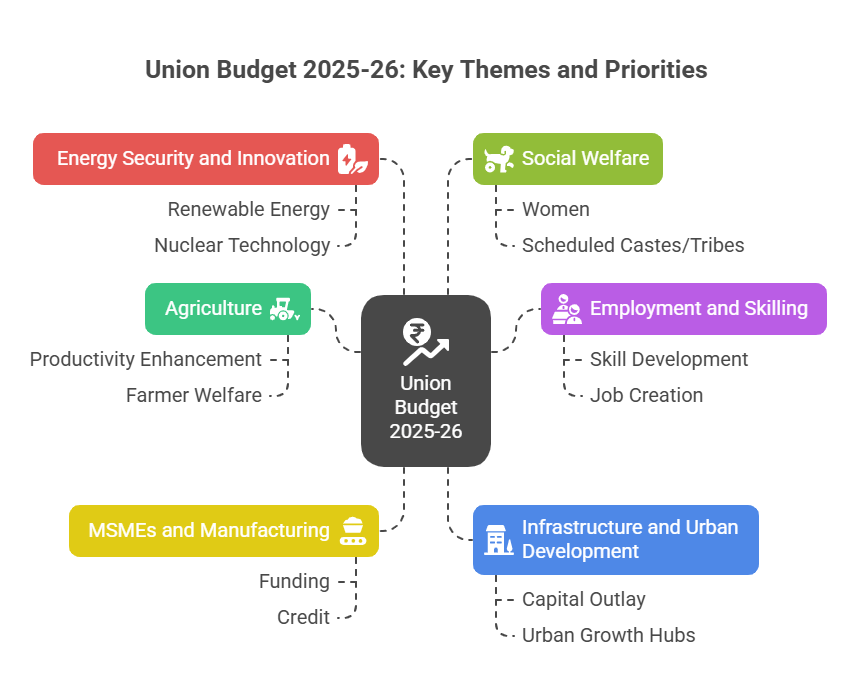

Key Themes and Priorities

The budget identifies several priority areas to drive sustainable and inclusive growth:

- Agriculture as the Primary Engine: Initiatives focus on productivity enhancement, self-reliance in key crops, and farmer welfare.

- Employment and Skilling: Targeted schemes aim to skill 4.1 crore youth and create jobs in manufacturing and other sectors.

- MSMEs and Manufacturing: Support for “Make in India” through funding, credit, and missions to boost entrepreneurship.

- Infrastructure and Urban Development: Significant capital outlay to build resilient infrastructure and promote urban growth hubs.

- Energy Security and Innovation: Emphasis on renewable energy, nuclear technology, and research for long-term sustainability.

- Social Welfare: Enhanced focus on women, scheduled castes/tribes, and urban workers through loans, healthcare, and housing.

These themes align with the vision of achieving a developed India by 2047, with inclusivity as a core principle.

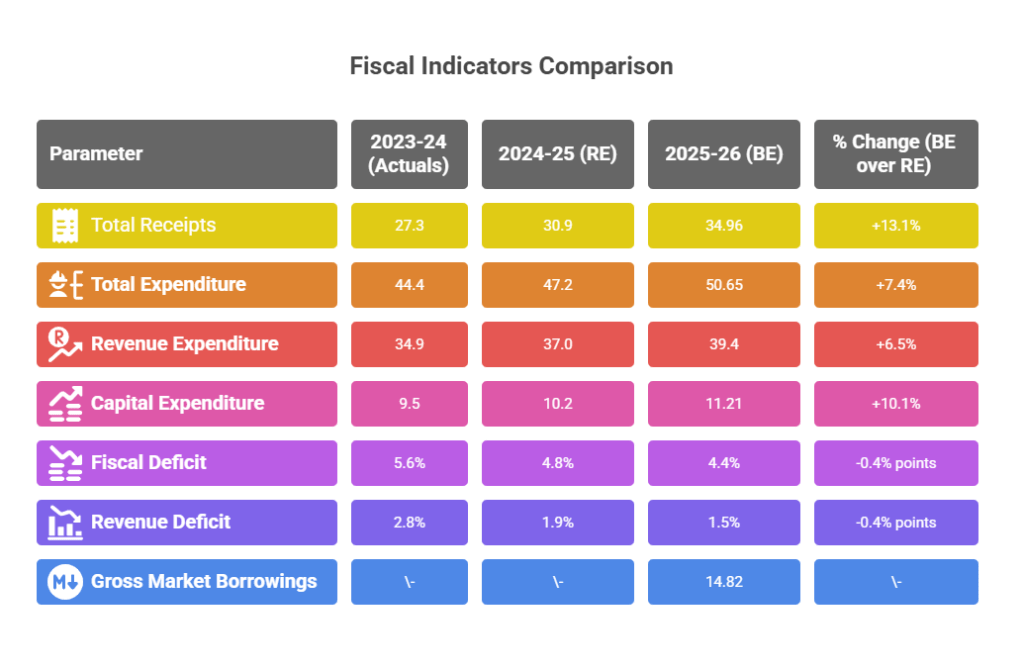

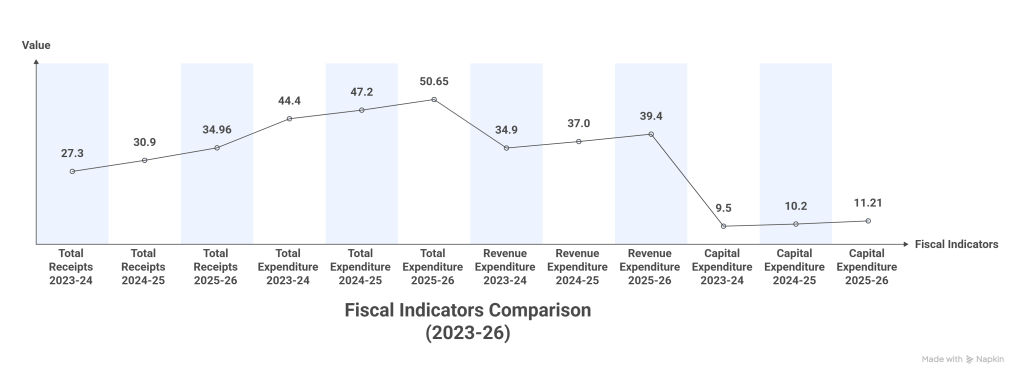

Fiscal Overview

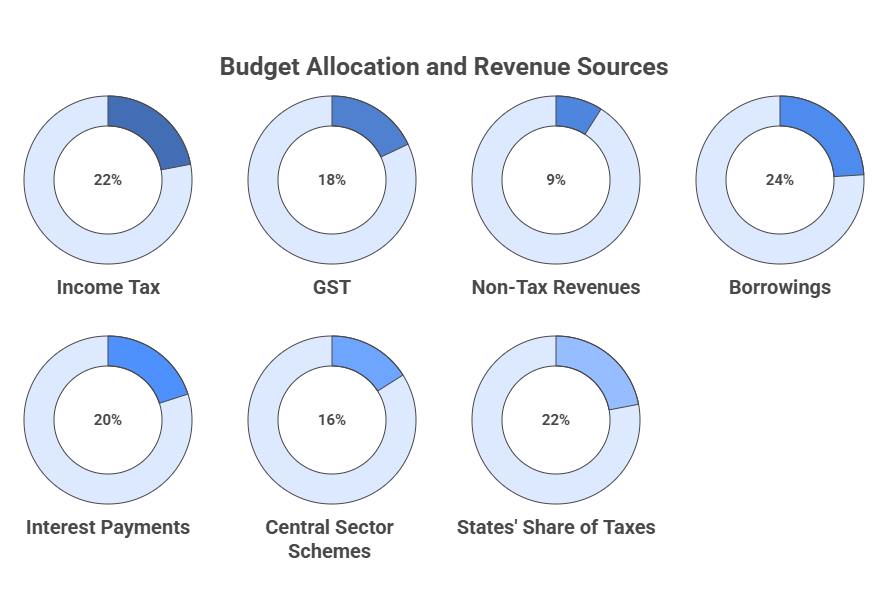

The budget projects a balanced approach to fiscal management, with a focus on reducing deficits while increasing capital expenditure. Key fiscal indicators are summarized in the table below, based on budget estimates (BE), revised estimates (RE), and actuals from previous years.

Sector-wise Allocations and Initiatives

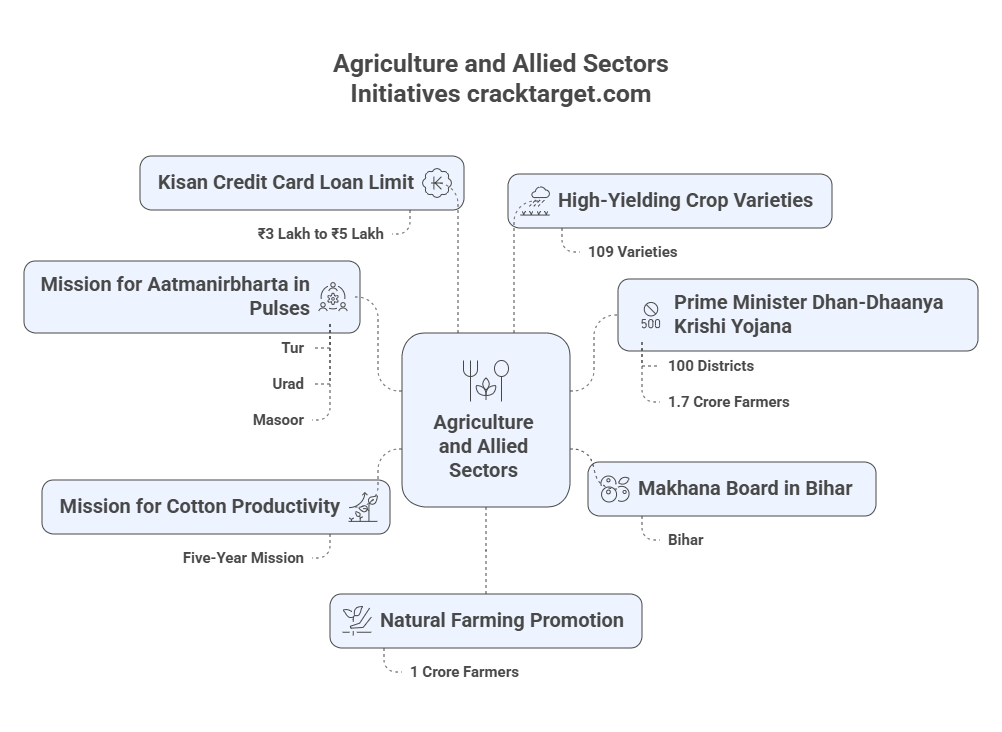

Agriculture and Allied Sectors

Allocation: ₹95,298 crore.

- Launch of Prime Minister Dhan-Dhaanya Krishi Yojana in 100 districts to benefit 1.7 crore farmers by addressing low productivity.

- Six-year Mission for Aatmanirbharta in Pulses (Tur, Urad, Masoor), with procurement by NAFED and NCCF.

- Establishment of Makhana Board in Bihar and a five-year Mission for Cotton Productivity.

- Increase in Kisan Credit Card (KCC) loan limit from ₹3 lakh to ₹5 lakh under the Modified Interest Subvention Scheme.

- Release of 109 high-yielding, climate-resilient crop varieties and promotion of natural farming for 1 crore farmers.

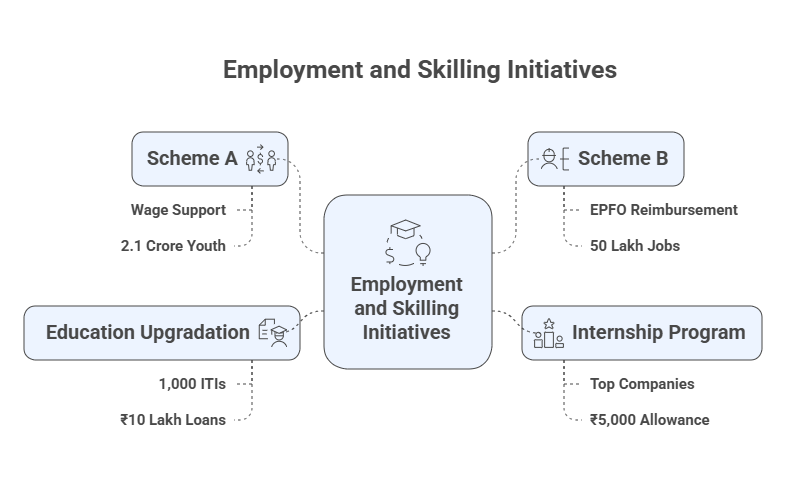

Employment and Skilling

- Five schemes worth over ₹2 lakh crore to skill 4.1 crore youth and create jobs.

- Scheme A: Wage support up to ₹15,000 for first-time formal sector entrants, benefiting 2.1 crore youth.

- Scheme B: EPFO contribution reimbursement for new manufacturing hires, generating 50 lakh jobs.

- Internship program for 1 crore youth in top companies, with ₹5,000 monthly allowance.

- Upgradation of 1,000 Industrial Training Institutes and loans up to ₹10 lakh for higher education.

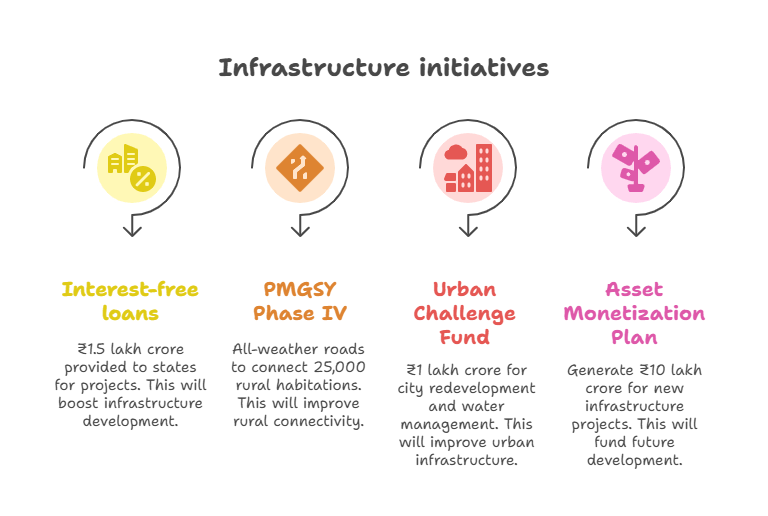

Infrastructure

Allocation: ₹11.21 lakh crore (3.1% of GDP).

- ₹1.5 lakh crore in interest-free loans to states for capital projects.

- Phase IV of Pradhan Mantri Gram Sadak Yojana (PMGSY) for all-weather roads to 25,000 rural habitations.

- Urban Challenge Fund of ₹1 lakh crore for city redevelopment and water management in 100 cities.

- Asset Monetization Plan 2025-30 to generate ₹10 lakh crore for new projects.

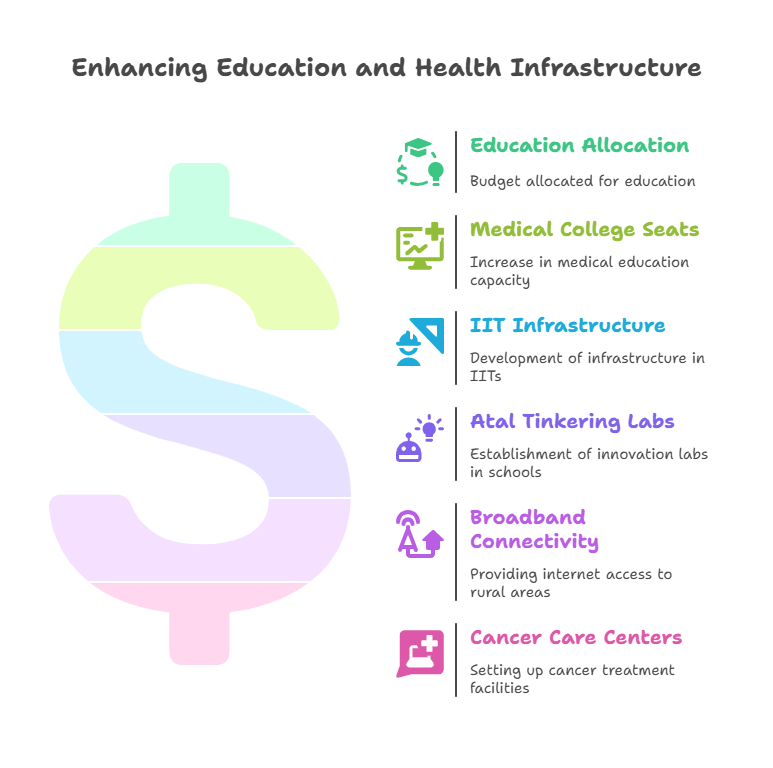

Education and Health

Education Allocation: ₹2,66,817 crore; Health: ₹1,71,437 crore.

- Addition of 10,000 medical college seats and infrastructure in five IITs for 6,500 students.

- 50,000 Atal Tinkering Labs in government schools and broadband for rural schools/health centers.

- Day Care Cancer Centres in all district hospitals, starting with 200 in 2025-26.

MSMEs and Energy

- Enhanced MSME classification limits and ₹10,000 crore Fund of Funds for startups.

- Nuclear Energy Mission with ₹20,000 crore for Small Modular Reactors.

- Pumped Storage Policy and Maritime Development Fund of ₹25,000 crore.

Tax Reforms

Direct Taxes

- Revised slabs under new regime: Nil up to ₹4 lakh; 5% for ₹4-8 lakh; up to 30% above ₹24 lakh. Standard deduction increased to ₹75,000.

- TDS limit on rent raised to ₹6 lakh; senior citizens’ interest TDS to ₹1 lakh.

- Extension of updated return filing to four years; new Income Tax Bill for simplification.

Indirect Taxes and Customs

- Capital gains: Short-term 20%, long-term 12.5%; exemption limit ₹1.25 lakh.

- Customs duty reductions: Mobile phones/chargers to 15%; gold/silver to 6%; critical minerals exempted.

- Abolition of angel tax; corporate tax for foreign companies reduced to 35%.

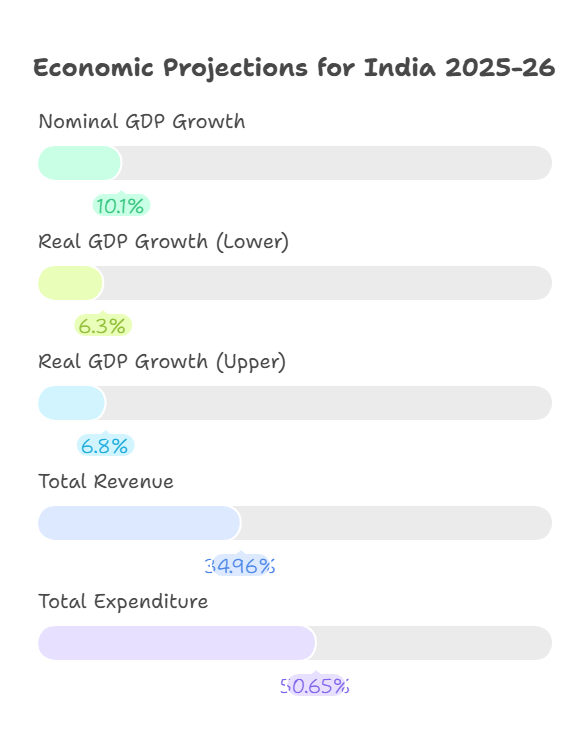

Economic Projections

Nominal GDP growth is estimated at 10.1% for 2025-26, with real GDP projected between 6.3% and 6.8%. The budget anticipates total revenue of ₹34.96 trillion and expenditures of ₹50.65 trillion, supporting inclusive growth amid global uncertainties.

Conclusion

The Union Budget 2025-26 represents a strategic framework for achieving economic resilience and social equity, with targeted investments in key sectors and prudent fiscal management. It builds on prior reforms to propel India toward self-reliance and prosperity, while addressing challenges in employment, agriculture, and infrastructure.

Students are encouraged to refer to official documents for in-depth analysis and monitor implementation for real-world impacts.

Now Attempt 25 High Quality MCQs

Question: Who presented the Union Budget 2025-26, and on what date was it presented?

A) Amit Shah on January 31, 2025

B) Nirmala Sitharaman on February 1, 2025

C) Piyush Goyal on February 28, 2025

D) Rajnath Singh on March 1, 2025

Correct Answer: B) Nirmala Sitharaman on February 1, 2025

Explanation: The budget was presented by Finance Minister Nirmala Sitharaman on February 1, 2025, as the annual financial statement for the fiscal year April 1, 2025, to March 31, 2026.

Question: What is the central theme of the Union Budget 2025-26?

A) Atmanirbhar Bharat

B) Viksit Bharat

C) Digital India

D) Make in India

Correct Answer: B) Viksit Bharat

Explanation: The budget emphasizes inclusive development under the theme “Viksit Bharat,” focusing on growth engines like agriculture, MSMEs, investment, and exports.

Question: Which demographic groups are prioritized for upliftment in the Union Budget 2025-26?

A) The poor, youth, farmers, and women

B) Urban elites, entrepreneurs, and exporters

C) Senior citizens, students, and industrialists

D) Migrants, laborers, and tourists

Correct Answer: A) The poor, youth, farmers, and women

Explanation: The budget aims to enhance private sector investments and uplift key groups including the poor (Garib), youth (Youth), farmers (Annadata), and women (Nari).

Question: What is the projected fiscal deficit as a percentage of GDP for 2025-26?

A) 5.6%

B) 4.8%

C) 4.4%

D) 1.5%

Correct Answer: C) 4.4%

Explanation: The budget estimates a fiscal deficit of 4.4% of GDP, reflecting a reduction from the revised estimate of 4.8% for 2024-25.

Question: What is the total capital expenditure allocated in the Union Budget 2025-26?

A) ₹9.5 lakh crore

B) ₹10.2 lakh crore

C) ₹11.21 lakh crore

D) ₹39.4 lakh crore

Correct Answer: C) ₹11.21 lakh crore

Explanation: Capital expenditure is set at ₹11.21 lakh crore, marking a 10.1% increase over the revised estimate for 2024-25.

Question: In the agriculture sector, what is the allocation for 2025-26?

A) ₹95,298 crore

B) ₹2,66,817 crore

C) ₹1,71,437 crore

D) ₹11.21 lakh crore

Correct Answer: A) ₹95,298 crore

Explanation: The agriculture and allied sectors receive an allocation of ₹95,298 crore, supporting initiatives like productivity enhancement and self-reliance in key crops.

Question: Which new scheme is launched in 100 districts to benefit 1.7 crore farmers by addressing low productivity?

A) Prime Minister Dhan-Dhaanya Krishi Yojana

B) Mission for Aatmanirbharta in Pulses

C) Kisan Credit Card Scheme

D) Natural Farming Promotion

Correct Answer: A) Prime Minister Dhan-Dhaanya Krishi Yojana

Explanation: This scheme targets low productivity in 100 districts, aiming to benefit 1.7 crore farmers.

Question: How many high-yielding, climate-resilient crop varieties are planned for release under the agriculture initiatives?

A) 50

B) 109

C) 200

D) 1,000

Correct Answer: B) 109

Explanation: The budget includes the release of 109 such varieties, alongside promoting natural farming for 1 crore farmers.

Question: What is the total value of the five schemes aimed at skilling 4.1 crore youth and creating jobs?

A) Over ₹1 lakh crore

B) Over ₹2 lakh crore

C) ₹10,000 crore

D) ₹1.5 lakh crore

Correct Answer: B) Over ₹2 lakh crore

Explanation: These schemes focus on employment and skilling, targeting 4.1 crore youth in manufacturing and other sectors.

Question: Under Scheme A for employment, what is the maximum wage support provided to first-time formal sector entrants?

A) ₹5,000

B) ₹10,000

C) ₹15,000

D) ₹20,000

Correct Answer: C) ₹15,000

Explanation: Scheme A offers wage support up to ₹15,000, benefiting 2.1 crore youth.

Question: How many jobs are expected to be generated under Scheme B through EPFO contribution reimbursement for new manufacturing hires?

A) 10 lakh

B) 30 lakh

C) 50 lakh

D) 1 crore

Correct Answer: C) 50 lakh

Explanation: Scheme B aims to generate 50 lakh jobs by reimbursing EPFO contributions.

Question: What is the allocation for infrastructure in the Union Budget 2025-26 as a percentage of GDP?

A) 1.5%

B) 2.8%

C) 3.1%

D) 5.6%

Correct Answer: C) 3.1%

Explanation: Infrastructure receives ₹11.21 lakh crore, equivalent to 3.1% of GDP.

Question: How much interest-free loan is provided to states for capital projects?

A) ₹1 lakh crore

B) ₹1.5 lakh crore

C) ₹2 lakh crore

D) ₹10 lakh crore

Correct Answer: B) ₹1.5 lakh crore

Explanation: This allocation supports state-level capital projects.

Question: Under Phase IV of Pradhan Mantri Gram Sadak Yojana, how many rural habitations will receive all-weather roads?

A) 10,000

B) 25,000

C) 50,000

D) 100,000

Correct Answer: B) 25,000

Explanation: The scheme targets 25,000 rural habitations for improved connectivity.

Question: What is the allocation for education in the Union Budget 2025-26?

A) ₹95,298 crore

B) ₹1,71,437 crore

C) ₹2,66,817 crore

D) ₹11.21 lakh crore

Correct Answer: C) ₹2,66,817 crore

Explanation: Education receives ₹2,66,817 crore, including additions like 10,000 medical college seats.

Question: How many Atal Tinkering Labs are planned for government schools?

A) 1,000

B) 5,000

C) 10,000

D) 50,000

Correct Answer: D) 50,000

Explanation: This initiative aims to foster innovation in schools.

Question: What is the fund allocation for the Nuclear Energy Mission focused on Small Modular Reactors?

A) ₹10,000 crore

B) ₹20,000 crore

C) ₹25,000 crore

D) ₹1 lakh crore

Correct Answer: B) ₹20,000 crore

Explanation: The mission supports energy security through nuclear technology.

Question: Under the new tax regime, what is the income slab for nil tax?

A) Up to ₹3 lakh

B) Up to ₹4 lakh

C) Up to ₹8 lakh

D) Up to ₹24 lakh

Correct Answer: B) Up to ₹4 lakh

Explanation: The revised slabs start with nil tax up to ₹4 lakh.

Question: What is the increased standard deduction under the new tax regime?

A) ₹50,000

B) ₹75,000

C) ₹1 lakh

D) ₹1.25 lakh

Correct Answer: B) ₹75,000

Explanation: The standard deduction is raised to ₹75,000 for simplification.

Question: What is the new short-term capital gains tax rate announced in the budget?

A) 12.5%

B) 15%

C) 20%

D) 30%

Correct Answer: C) 20%

Explanation: Short-term capital gains are taxed at 20%, while long-term is 12.5%.

Question: What is the exemption limit for capital gains?

A) ₹75,000

B) ₹1 lakh

C) ₹1.25 lakh

D) ₹5 lakh

Correct Answer: C) ₹1.25 lakh

Explanation: The exemption limit is set at ₹1.25 lakh for capital gains.

Question: Which tax has been abolished in the Union Budget 2025-26?

A) GST

B) Angel tax

C) Corporate tax

D) Income tax

Correct Answer: B) Angel tax

Explanation: Angel tax is abolished to support startups, and corporate tax for foreign companies is reduced to 35%.

Question: What is the estimated nominal GDP growth for 2025-26?

A) 6.3%

B) 6.8%

C) 10.1%

D) 13.1%

Correct Answer: C) 10.1%

Explanation: Nominal GDP growth is projected at 10.1%, with real GDP between 6.3% and 6.8%.

Question: What is the target for reducing outstanding liabilities as a percentage of GDP by March 2031?

A) 50%

B) 56.1%

C) 60%

D) 70%

Correct Answer: A) 50%

Explanation: The government aims to reduce liabilities to 50% of GDP by March 2031, from an estimated 56.1% in 2025-26.

Question: What is the total projected revenue for 2025-26?

A) ₹34.96 trillion

B) ₹50.65 trillion

C) ₹11.21 lakh crore

D) ₹14.82 lakh crore

Correct Answer: A) ₹34.96 trillion

Explanation: Total revenue is anticipated at ₹34.96 trillion, supporting expenditures of ₹50.65 trillion amid global uncertainties.

Leave a comment