1. Capital and Revenue Profit

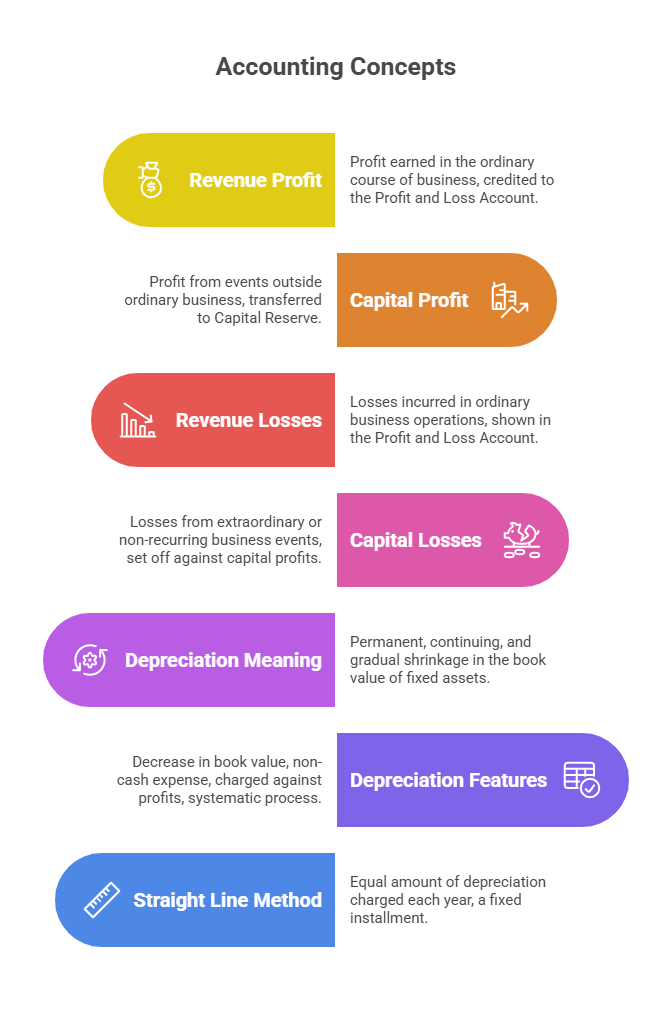

Revenue Profit

- Definition: Profit earned in the ordinary course of business.

- Sources:

- Sale of goods or services.

- Regular income from investment or operations.

- Treatment: Credited to the Profit and Loss Account.

Capital Profit

- Definition: Profit not earned through regular business activities; arises from events outside ordinary business.

- Sources:

- Sale of fixed assets at a profit (e.g. land, machinery).

- Shares issued at a premium.

- Treatment: Transferred to Capital Reserve (shown in balance sheet).

2. Capital and Revenue Losses

Revenue Losses

- Definition: Losses incurred in ordinary business operations (e.g. damages, bad debts).

- Treatment: Shown in the Profit and Loss Account.

Capital Losses

- Definition: Losses from extraordinary or non-recurring business events.

- Example: Sale of fixed assets at a loss, issue of shares at a discount.

- Treatment:

- Not shown in P&L account.

- Set off against capital profits.

- If large and not covered by capital profits, written off in installments over years.

3. Depreciation: Meaning and Features

Meaning of Depreciation

- Definition: Permanent, continuing, and gradual shrinkage in the book value of fixed assets due to use, passage of time, or obsolescence.

- Standard Definition: According to ICAI (AS-6), it’s the measure of wearing-out, consumption, or loss of value of depreciable assets.

Features of Depreciation

- Decrease in book value of fixed assets.

- Non-cash expense.

- Charged against profits, offering tax benefits.

- It is a continuing and systematic process.

4. Methods of Calculating Depreciation

As per Accounting Standard-6, the selected method should be used consistently; a change is allowed only in specific circumstances.

1. Straight Line Method

- Description: Equal amount of depreciation charged each year (Fixed Installment).

- Formula:

- Advantages:

- Simple and easy to apply.

- Asset can be fully depreciated to its scrap value.

- Suitable where usage and useful life are predictable (e.g. leasehold).

- Limitations:

- Assumes equal utility each year (not realistic).

- Does not account for increased maintenance costs as asset ages.

2. Written Down Value (WDV) Method

- Description: Fixed percentage charged on the reducing (written down) value every year.

- Also known as: Diminishing Balance Method.

- Advantages:

- Better matches asset usage/loss of efficiency over time.

- Accepted by tax authorities.

- Suitable for assets with increasing repairs and obsolescence risks.

- Limitations:

- Complex to ascertain correct rate.

- Asset is never fully depreciated (value never reaches zero).

Formula for Rate of Depreciation (WDV):

Where:

= Rate of Depreciation,

= Scrap value,

= Cost of Asset,

= Useful life (years)

3. Annuity Method

- Description: Considers depreciation on cost of asset plus notional interest on capital outlay.

- Purpose: Spreads capital cost and interest (lost earning capacity) over asset’s life.

- Depreciation amount is constant; interest element decreases yearly.

4. Sum-of-the-Years-Digits Method

- Description: Accelerated depreciation; higher in early years, lower in later years.

- Calculation:

- Sum all digits of asset’s useful life.

- Each year’s depreciation: Multiply depreciable amount by the fraction of remaining life’s digit over total sum of the years’ digits.

- Formula for Sum of Digits:

, where

= useful years.

5. Sinking Fund Method (Depreciation Fund)

- Description: Sets aside depreciation to a separate ‘Sinking Fund’ invested in secure securities.

- Process:

- Annual depreciation credited to fund, invested externally.

- Fund and earned interest used to replace the asset at life-end.

6. Production Unit Method

- Production Unit Method

For assets whose life is measured in physical units produced.

Formula: - Machine Hour Method

For assets whose life is measured in operational hours.

Formula: - Depletion Method

Used for natural resources (mines, quarries, oil wells).

Formula:

Here are short explanations for each depreciation method, including the formulas:

6. Production Unit Method

- Used for: Assets whose useful life is measured by the total number of units they can produce (e.g., machines, vehicles).

- Explanation: Depreciation expense is based on actual usage or output, not time.

- Formula:

7. Machine Hour Method

- Used for: Assets measured by operating hours (e.g., machinery).

- Explanation: Depreciation is calculated according to the actual hours a machine operates.

- Formula:

8. Depletion Method

- Used for: Natural resources like mines, oil wells, and quarries.

- Explanation: The cost is spread over the quantity extracted during each period.

5. Summary Table: Major Depreciation Methods

| Method | Main Concept | Key Feature | Suitable For |

| Straight Line | Equal yearly charge | Simplicity | Leaseholds, buildings |

| Written Down Value | Fixed % on reducing balance | Realistic for tech/plant | Machines, vehicles, tech assets |

| Annuity | Charge includes cost + lost interest | Equal yearly depreciation | Expensive, long-term investments |

| Sum-of-the-Years-Digits | Higher charge early, lower later | Accelerated depreciation | Assets losing value quickly |

| Sinking Fund | Annual reserve investment | Replacement funding | Large, infrequently replaced assets |

| Production/Unit Method | Based on units produced | Matches asset output | Machines with usage-based lifespan |

| Machine Hour | Based on hours operated | Usage-based allocation | Industrial equipment |

| Depletion | Based on extraction | Resource-based allocation | Mines, quarries, oil wells |

9. Important Formulas

- Rate of Depreciation:

- Written Down Value Formula:

- Sum of Year’s Digits:

Key Takeaways

- Revenue profit/loss: Normal business, goes to P&L.

- Capital profit/loss: Not routine, shown in reserves/capital accounts.

- Depreciation: Systematic allocation for asset value decrease; many calculation methods suit different asset types.

Multiple Choice Questions (UPSC Style)

Question 1

Which of the following statements accurately distinguishes between capital profit and revenue profit?

(A) Capital profit arises from the sale of goods in the ordinary course of business, while revenue profit is derived from the sale of fixed assets.

(B) Revenue profit is credited to the Profit and Loss Account, whereas capital profit is transferred to the Capital Reserve and shown in the balance sheet.

(C) Capital profit includes regular income from investments, while revenue profit results from shares issued at a premium.

(D) Revenue profit is not earned through regular business activities, whereas capital profit is incurred in ordinary operations.

Correct Answer: (B)

Detailed Solution:

Option (B) is correct because, as per the study material, revenue profit is earned in the ordinary course of business (e.g., from sale of goods or services) and is credited to the Profit and Loss Account. In contrast, capital profit arises from events outside ordinary business (e.g., sale of fixed assets at a profit or shares issued at a premium) and is transferred to the Capital Reserve, appearing in the balance sheet.

Option (A) is incorrect as it reverses the definitions: capital profit, not revenue profit, comes from the sale of fixed assets.

Option (C) is wrong because it misattributes sources: regular income from investments is revenue profit, while shares at a premium are capital profit.

Option (D) is erroneous as it inverts the core distinction: revenue profit is from routine operations, and capital profit is non-routine.

Question 2

In the context of capital losses, which of the following treatments is most appropriate when such losses are large and not covered by capital profits?

(A) They are directly shown in the Profit and Loss Account to reflect operational impact.

(B) They are set off against revenue profits in the current year.

(C) They are written off in installments over several years.

(D) They are ignored and not recorded in the financial statements.

Correct Answer: (C)

Detailed Solution:

Option (C) is correct, as the material specifies that capital losses (e.g., from sale of fixed assets at a loss or shares issued at a discount) are not shown in the Profit and Loss Account; instead, if large and not covered by capital profits, they are written off in installments over years.

Option (A) is incorrect because capital losses are distinguished from revenue losses and are not debited to the Profit and Loss Account.

Option (B) is wrong as capital losses are first set off against capital profits, not revenue profits.

Option (D) is invalid, as all losses must be accounted for in financial statements to ensure accurate reporting.

Question 3

According to the features of depreciation outlined in the study material, which of the following is NOT a characteristic of depreciation?

(A) It represents a permanent, continuing, and gradual shrinkage in the book value of fixed assets.

(B) It is a non-cash expense that provides tax benefits by being charged against profits.

(C) It is a one-time allocation for asset obsolescence, not a systematic process.

(D) It measures the wearing-out or loss of value of depreciable assets as per ICAI (AS-6).

Correct Answer: (C)

Detailed Solution:

Option (C) is correct (i.e., it is NOT a characteristic) because the material emphasizes that depreciation is a continuing and systematic process, not a one-time allocation. It involves gradual shrinkage due to use, time, or obsolescence.

Option (A) is a characteristic, directly matching the definition of depreciation as permanent, continuing, and gradual.

Option (B) aligns with the features: depreciation is a non-cash expense charged against profits, offering tax benefits.

Option (D) reflects the standard ICAI (AS-6) definition, confirming it as a measure of asset value loss.

Question 4

An asset is purchased for ₹1,00,000 with an estimated residual value of ₹10,000 and a useful life of 5 years. Under the Straight Line Method, what is the annual depreciation amount?

(A) ₹18,000

(B) ₹20,000

(C) ₹22,000

(D) ₹25,000

Correct Answer: (A)

Detailed Solution:

To arrive at the solution, apply the Straight Line Method formula from the material:

Annual Depreciation = (Cost of Asset – Estimated Residual Value) / Useful Life

= (₹1,00,000 – ₹10,000) / 5

= ₹90,000 / 5

= ₹18,000

Thus, option (A) is correct.

Option (B) would result if the residual value were ignored: ₹1,00,000 / 5 = ₹20,000, which violates the formula.

Option (C) is incorrect, possibly from miscalculating (₹1,00,000 – ₹0) / 4.5 or similar error.

Option (D) errs by dividing without subtracting residual value and using a shorter life: ₹1,00,000 / 4 = ₹25,000.

Question 5

Which depreciation method is most suitable for assets like mines or oil wells, where the asset’s life is measured by extractable quantity, and why?

(A) Straight Line Method, as it ensures equal yearly charges regardless of output.

(B) Written Down Value Method, because it applies a fixed percentage on reducing balance for technological assets.

(C) Depletion Method, as it bases depreciation on the units extracted relative to total extractable quantity.

(D) Sinking Fund Method, since it invests annual reserves for asset replacement in secure securities.

Correct Answer: (C)

Detailed Solution:

Option (C) is correct, as the material specifies the Depletion Method for natural resources like mines, quarries, or oil wells. The formula is Depreciation per Unit = Depreciable Amount / Total Quantity Extractable, aligning with usage-based allocation for exhaustible resources.

Option (A) is unsuitable, as Straight Line assumes predictable usage over time, not output; it is better for leaseholds or buildings.

Option (B) fits machines or vehicles with obsolescence risks, not resource extraction.

Option (D) is for large assets needing replacement funding, not specifically for depletion based on extraction.

Multiple Choice Questions (UPSC Style)

Question 6

Under the Written Down Value (WDV) Method of depreciation, which of the following statements is accurate regarding its limitations?

(A) It is simple to apply and ensures the asset is fully depreciated to zero value.

(B) It assumes equal utility each year, which may not reflect increasing maintenance costs.

(C) It is complex to determine the correct rate, and the asset’s book value never reaches zero.

(D) It is unsuitable for assets with obsolescence risks, as it does not accelerate depreciation in early years.

Correct Answer: (C)

Detailed Solution:

Option (C) is correct, as the study material highlights that the WDV Method’s limitations include the complexity in ascertaining the correct depreciation rate and the fact that the asset is never fully depreciated, with its book value approaching but not reaching zero.

Option (A) is incorrect, as simplicity applies to the Straight Line Method, and WDV does not fully depreciate the asset to zero.

Option (B) misattributes a limitation of the Straight Line Method, which assumes equal utility without accounting for rising maintenance.

Option (D) is erroneous, as WDV is suitable for assets with obsolescence risks, precisely because it charges higher depreciation in early years to match efficiency loss.

Question 7

An asset costs ₹2,00,000 with a scrap value of ₹20,000 and a useful life of 4 years. Using the Sum-of-the-Years-Digits Method, what is the depreciation for the first year?

(A) ₹60,000

(B) ₹72,000

(C) ₹80,000

(D) ₹90,000

Correct Answer: (B)

Detailed Solution:

To arrive at the solution, first calculate the depreciable amount: ₹2,00,000 – ₹20,000 = ₹1,80,000.

Next, compute the sum of the years’ digits for a 4-year life: (n(n+1))/2 = (4×5)/2 = 10.

For the first year, the fraction is the remaining life (4) over the sum (10): (4/10) × ₹1,80,000 = ₹72,000.

Thus, option (B) is correct.

Option (A) results from an incorrect fraction, such as (3/10) × ₹1,80,000 = ₹54,000, or miscalculation.

Option (C) ignores the scrap value: (4/10) × ₹2,00,000 = ₹80,000.

Option (D) errs by using a different sum or fraction, such as (5/10) × ₹1,80,000 = ₹90,000.

Question 8

Which of the following methods of depreciation is most appropriate for industrial equipment where the asset’s life is determined by operational hours, and what is its key formula?

(A) Production Unit Method; Depreciation per Unit = Depreciable Amount / Total Life in Units.

(B) Machine Hour Method; Depreciation per Hour = Depreciable Amount / Total Life in Hours.

(C) Depletion Method; Depreciation per Unit = Depreciable Amount / Total Quantity Extractable.

(D) Annuity Method; Depreciation includes cost plus notional interest, spread equally.

Correct Answer: (B)

Detailed Solution:

Option (B) is correct, as the study material specifies the Machine Hour Method for assets with life measured in operational hours, such as industrial equipment. The formula is Depreciation per Hour = Depreciable Amount / Total Life in Hours, ensuring allocation based on actual usage.

Option (A) applies to assets with life in physical units produced, not hours.

Option (C) is for natural resources like mines, based on extractable quantity.

Option (D) considers cost plus lost interest for long-term investments, with constant annual depreciation, not usage-based.

Question 9

In the Annuity Method of depreciation, what is the primary purpose, and how does it differ from the Straight Line Method?

(A) To allocate equal depreciation annually without interest; it matches Straight Line in spreading cost evenly.

(B) To include notional interest on capital outlay along with cost recovery; it results in constant depreciation while interest decreases yearly.

(C) To charge a fixed percentage on reducing balance; it accelerates depreciation unlike the equal charges in Straight Line.

(D) To set aside funds for asset replacement via investments; it differs by focusing on external fund accumulation rather than book value reduction.

Correct Answer: (B)

Detailed Solution:

Option (B) is correct, as per the material: the Annuity Method spreads the capital cost plus notional interest (for lost earning capacity) over the asset’s life, maintaining constant depreciation amounts while the interest element decreases annually. This differs from the Straight Line Method, which charges equal depreciation without considering interest.

Option (A) confuses it with Straight Line, ignoring the interest component.

Option (C) describes the Written Down Value Method, which uses reducing balance.

Option (D) outlines the Sinking Fund Method, emphasizing fund investment for replacement.

Question 10

According to Accounting Standard-6 (AS-6), under what circumstances is a change in the method of depreciation permitted?

(A) It is allowed annually to optimize tax benefits, without specific justification.

(B) It is permitted only in specific circumstances, and the selected method must otherwise be used consistently.

(C) It is mandatory every few years to reflect changing asset utility, regardless of consistency.

(D) It is prohibited entirely to ensure comparability of financial statements over time.

Correct Answer: (B)

Detailed Solution:

Option (B) is correct, as the study material states that per AS-6, the selected depreciation method should be applied consistently, with changes allowed only in specific circumstances (e.g., for better representation or statutory requirements).

Option (A) is incorrect, as changes are not arbitrary for tax optimization but require justification.

Option (C) misstates the policy, as consistency is prioritized unless specific conditions warrant change.

Option (D) is overly restrictive, as changes are permitted under defined conditions to maintain relevance.

Question 11

Which of the following best describes the process involved in the Sinking Fund Method of depreciation?

(A) Depreciation is charged as a fixed percentage on the reducing book value, with investments made in external securities for tax benefits.

(B) Annual depreciation is credited to a fund and invested in secure securities, accumulating with interest to replace the asset at the end of its life.

(C) Depreciation includes the cost of the asset plus notional interest, resulting in a constant annual charge spread over the useful life.

(D) Depreciation is allocated based on units produced, with the fund used solely for maintenance rather than replacement.

Correct Answer: (B)

Detailed Solution:

Option (B) is correct, as the study material outlines the Sinking Fund Method (also known as Depreciation Fund) where annual depreciation is credited to a separate fund, invested externally in secure securities, and the accumulated fund plus earned interest is utilized to replace the asset at the end of its useful life. This ensures systematic provision for asset renewal.

Option (A) confuses it with the Written Down Value Method, which uses a fixed percentage on reducing balance but does not involve external investments for replacement.

Option (C) describes the Annuity Method, which incorporates notional interest alongside cost recovery.

Option (D) misaligns with the Production Unit Method, which bases depreciation on output units, without a focus on fund accumulation for replacement.

Question 12

An asset is acquired for ₹5,00,000 with an estimated scrap value of ₹50,000 and a useful life of 10 years. Using the Production Unit Method, if the total estimated life in units is 1,00,000 and 12,000 units are produced in a year, what is the depreciation for that year?

(A) ₹45,000

(B) ₹50,000

(C) ₹54,000

(D) ₹60,000

Correct Answer: (C)

Detailed Solution:

To arrive at the solution, first determine the depreciable amount: ₹5,00,000 – ₹50,000 = ₹4,50,000.

Next, calculate depreciation per unit using the formula from the material: Depreciation per Unit = Depreciable Amount / Total Life in Units = ₹4,50,000 / 1,00,000 = ₹4.50 per unit.

For the year with 12,000 units produced: Depreciation = 12,000 × ₹4.50 = ₹54,000.

Thus, option (C) is correct.

Option (A) results from ignoring the scrap value: (₹5,00,000 / 1,00,000) × 12,000 = ₹60,000, then subtracting an arbitrary amount.

Option (B) errs by using time-based allocation instead: ₹5,00,000 / 10 = ₹50,000.

Option (D) omits the scrap value deduction: (₹5,00,000 / 1,00,000) × 12,000 = ₹60,000.

Question 13

In the context of revenue losses, which treatment aligns with standard accounting practices as per the provided material?

(A) They are transferred to Capital Reserve and offset against capital profits.

(B) They are shown in the Profit and Loss Account, as they arise from ordinary business operations such as bad debts or damages.

(C) They are written off in installments over years if not covered by revenue profits.

(D) They are ignored in financial statements unless they exceed a certain threshold.

Correct Answer: (B)

Detailed Solution:

Option (B) is correct, as the material defines revenue losses as those incurred in ordinary business operations (e.g., damages, bad debts) and specifies that they are debited to the Profit and Loss Account to reflect their impact on operational performance.

Option (A) applies to capital losses, which are offset against capital profits rather than shown in the Profit and Loss Account.

Option (C) describes the treatment for large capital losses not covered by capital profits.

Option (D) is incorrect, as all material losses must be recorded to ensure accurate and transparent financial reporting.

Question 14

Which key takeaway from the study material accurately summarizes the distinction between revenue and capital items in accounting?

(A) Revenue profits and losses are non-routine and shown in reserves, while capital items are from normal operations and go to the Profit and Loss Account.

(B) Capital profits and losses are routine and debited/credited to Profit and Loss, whereas revenue items are extraordinary and affect reserves.

(C) Revenue profits/losses arise from normal business and are recorded in the Profit and Loss Account, while capital profits/losses are non-routine and shown in reserves or capital accounts.

(D) Both revenue and capital profits are transferred to reserves, but losses are always written off immediately in the Profit and Loss Account.

Correct Answer: (C)

Detailed Solution:

Option (C) is correct, directly aligning with the key takeaways: revenue profits/losses are from normal business activities and go to the Profit and Loss Account, whereas capital profits/losses are not routine, arising from extraordinary events, and are shown in reserves or capital accounts (e.g., capital profits to Capital Reserve, capital losses offset against capital profits or written off gradually).

Option (A) reverses the distinctions, misattributing routine to capital and non-routine to revenue.

Option (B) inverts the treatments, assigning routine to capital and extraordinary to revenue.

Option (D) incorrectly generalizes that all profits go to reserves and all losses are immediately written off in Profit and Loss, ignoring the specific handling.

Leave a comment