🧾 ACCOUNTING & COST ACCOUNTING CONCEPTS

1. Break-even Point (BEP)

- The level of sales where Total Revenue = Total Cost.

- No profit, no loss.

- BEP (Units) = Fixed Costs ÷ (Selling Price per unit – Variable Cost per unit).

- Useful in marginal costing and decision-making.

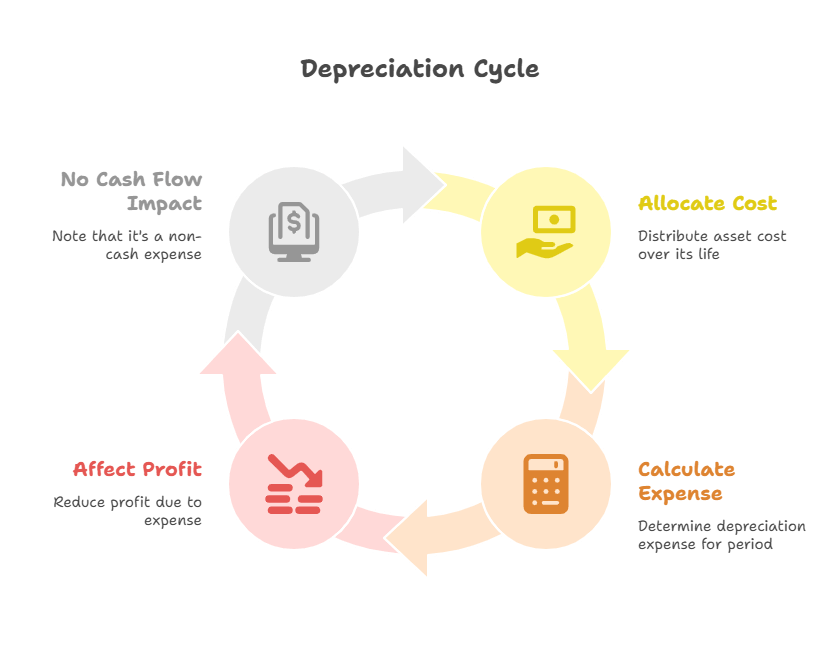

2. Depreciation

- Systematic allocation of cost of a tangible asset over its useful life.

- Non-cash expense – affects profit, not cash flow.

- Straight-Line Method (SLM): Equal depreciation every year = (Cost – Scrap Value) / Life.

- Written Down Value (WDV): Depreciation % applied on reducing balance.

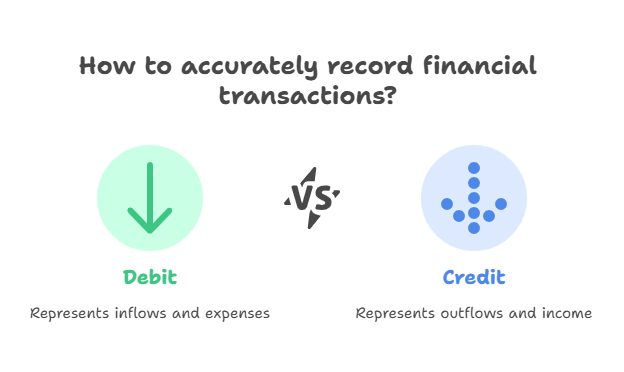

3. Double Entry System

- Every transaction has two aspects: Debit and Credit.

→ Debit what comes in / expenses

→ Credit what goes out / income

4. Ledger & Cash Book

- Journal → primary book of entries (chronological order).

- Ledger → principal book where transactions are classified account-wise.

- Cash Book → records only cash & bank transactions.

5. Final Accounts

Include:

- Trading Account → determines Gross Profit / Loss

- Profit & Loss Account → determines Net Profit / Loss

- Balance Sheet → shows financial position (assets, liabilities, capital)

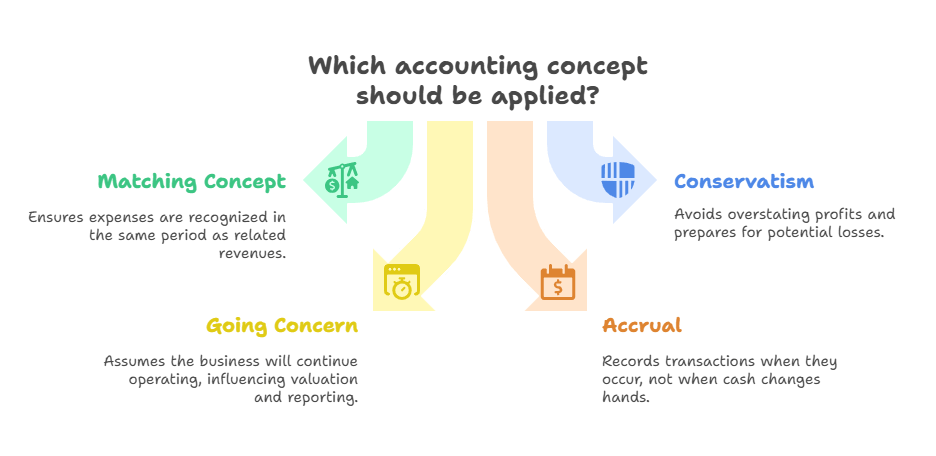

6. Accounting Concepts & Principles

- Matching Concept: Match expenses with related revenues.

- Conservatism (Prudence): Anticipate no profits, but provide for all losses.

- Going Concern: Business will continue.

- Accrual: Record income/expenses when earned/incurred, not when cash received/paid.

7. Reserves & Suspense Account

- Securities Premium Reserve: Premium on issue of shares is transferred here.

- Suspense Account: Temporary holding account for unclassified or unbalanced entries.

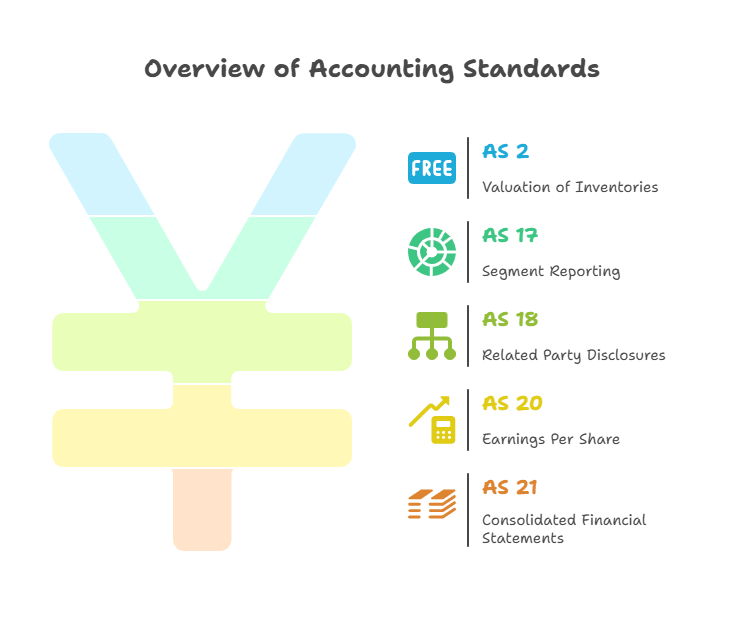

8. Valuation & Standards

- AS 2 – Valuation of Inventories (Lower of Cost or NRV).

- AS 17 – Segment Reporting.

- AS 18 – Related Party Disclosures.

- AS 20 – Earnings Per Share.

- AS 21 – Consolidated Financial Statements.

💰 FINANCIAL MANAGEMENT CONCEPTS

9. Financial Management

- Concerned with procurement, allocation, and control of financial resources.

- Key decisions:

- Investment (Capital Budgeting)

- Financing (Capital Structure)

- Dividend Policy

10. Working Capital

- Working Capital = Current Assets – Current Liabilities

- Indicates liquidity and short-term solvency.

- Types:

- Gross Working Capital: Total Current Assets

- Net Working Capital: CA – CL

11. Capital Budgeting

- Long-term investment decisions (projects, machinery, etc.).

- Key techniques:

- NPV (Net Present Value): PV of inflows – PV of outflows (considers time value).

- IRR: Discount rate where NPV = 0.

- Payback Period: Time to recover investment (ignores time value).

- Profitability Index: PV inflows ÷ PV outflows.

12. Leverage

- Use of fixed-cost capital (like debt) to magnify returns.

- Financial Leverage: Impact of debt on EPS.

- Operating Leverage: Impact of fixed operating costs on EBIT.

- Combined Leverage: Operating × Financial leverage.

- DuPont Analysis: ROE = (Net Profit Margin × Asset Turnover × Equity Multiplier).

13. Dividend Policy

- Balances shareholder returns and business growth needs.

- Affects market value and wealth of shareholders.

14. Working Capital Financing

- Can be aggressive (short-term borrowings) or conservative (long-term funds).

15. Factoring

- Selling trade receivables to a factor (financial intermediary) for cash.

- Helps in receivables management and liquidity.

16. Treasury & Hedging

- Treasury Management: Managing liquidity, investments, and risk.

- Hedging: Protecting against adverse financial risks (exchange, interest, commodity).

COST & MANAGEMENT ACCOUNTING CONCEPTS

17. Cost Accounting

- Determines cost of products/services for control and decision-making.

- Systems:

- Job Costing: For customized products (e.g. furniture, projects).

- Contract Costing: Long-term jobs like construction.

- Process Costing: Continuous production (cement, chemicals).

- Operating Costing: Service industries (transport, hospitals).

18. Marginal Costing

- Considers variable costs only for decision making.

- Contribution = Sales – Variable Cost

- Useful for BEP, Make or Buy, Pricing, etc.

19. Standard Costing & Variance Analysis

- Sets standard cost for materials, labour, overheads.

- Variance = Actual – Standard.

- Helps in performance evaluation and control.

20. Budgetary Control

- Comparing actual with budgeted performance.

- Budgets act as tools for planning and control.

21. Responsibility Accounting

- Assigns costs and revenues to responsibility centers:

- Cost Center – controls costs.

- Profit Center – controls profit.

- Investment Center – controls ROI.

22. Costing Innovations

- Target Costing: Cost = Target Price – Desired Profit.

- Life Cycle Costing: Considers all costs from design to disposal.

- Kaizen Costing: Continuous improvement and cost reduction.

- JIT (Just-in-Time): Minimizes inventory and carrying costs.

🧮 AUDITING CONCEPTS

23. Auditing Definition

- Systematic and independent examination of financial statements to express an opinion.

24. Types of Audit

- Statutory Audit: Mandated by law (Companies Act, 2013).

- Internal Audit: Conducted by employees to strengthen internal control.

- Tax Audit: As per Section 44AB of Income Tax Act.

- Cost Audit: As per Section 148 of Companies Act.

- Forensic Audit: Detects and prevents frauds.

- Management Audit: Evaluates managerial efficiency.

- Compliance Audit: Checks adherence to laws and regulations.

- Environmental/Social/Performance Audit: Non-financial evaluation (CSR, sustainability).

25. Audit Process & Terms

- Vouching: Checking authenticity of transactions with documentary evidence.

- Verification: Confirming existence and valuation of assets & liabilities.

- Test Checking: Sampling a few transactions instead of all.

- Audit Program: Detailed plan of audit procedures.

- Working Papers: Auditor’s records supporting conclusions (owned by auditor).

- Letter of Engagement: Defines scope, objective, and responsibility of audit.

- Audit Evidence: Should be sufficient and appropriate (SA 500).

- Risk Assessment: Identifying chances of material misstatement (SA 315).

- Sampling Risk: Sample may not represent population.

- Internal Check: Part of internal control to prevent errors.

26. Standards on Auditing (SAs)

- SA 200: Overall objectives of independent auditor.

- SA 500: Audit Evidence.

- SA 570: Going Concern.

27. CARO (Companies Auditor’s Report Order)

- Additional reporting requirements for certain companies (Companies Act).

28. CAG (Comptroller & Auditor General)

- Audits accounts of the Central & State Governments.

29. Peer Review

- Quality review of audit work by another independent auditor (ICAI initiative).

🌐 ACCOUNTING STANDARDS (IND AS / IFRS)

30. IFRS & Ind AS

- Ind AS = IFRS-converged standards (global alignment).

- IFRS 9 / Ind AS 109: Financial Instruments.

- Ind AS 115: Revenue from Contracts with Customers.

- Ind AS 116: Leases – requires right-of-use asset recognition.

- Ind AS 36: Impairment of Assets.

- Ind AS 19: Employee Benefits (including defined benefit plans).

- Ind AS 12: Income Taxes (current and deferred tax).

📈 FINANCIAL ANALYSIS CONCEPTS

31. Ratio Analysis

- Tool of Financial Statement Analysis to assess performance.

- Liquidity Ratios: Short-term solvency (Current Ratio, Quick Ratio).

- Leverage Ratios: Debt usage (Debt-Equity, Interest Coverage).

- Profitability Ratios: Profit margin, ROE, ROA, etc.

- Activity Ratios: Efficiency (Inventory, Receivables turnover).

32. Cash Flow Statement

- Classifies cash flows as:

- Operating Activities

- Investing Activities

- Financing Activities

33. Contingent Liabilities & Prior Period Items

- Contingent Liabilities: Possible obligations disclosed in Notes to Accounts.

- Prior Period Items: Errors or omissions from previous year shown separately.

34. Gross Profit Ratio

- = (Gross Profit ÷ Net Sales) × 100

- Measures efficiency of production and pricing.

Leave a comment