India’s Economic Survey 2024-25, tabled by Union Finance Minister Smt. Nirmala Sitharaman on January 31, 2025, paints a robust picture of India’s economic resilience and growth potential.

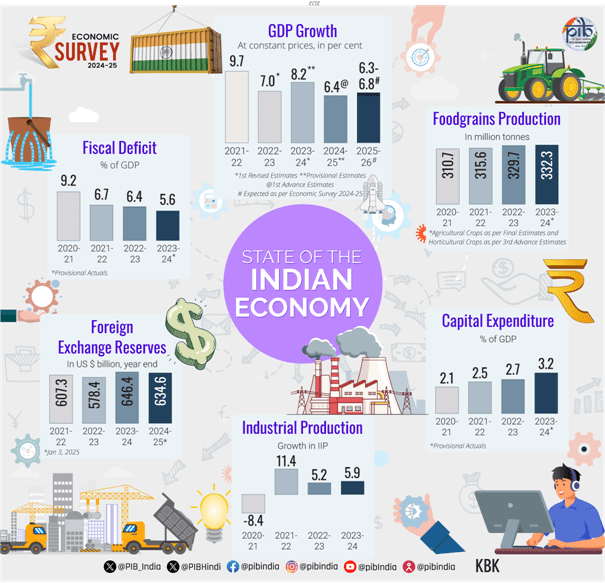

With real GDP growth projected at 6.4% in FY25 and expected to range between 6.3% and 6.8% in FY26, India continues to outperform global averages despite global uncertainties.

Key Economic Indicators for FY25

| Indicator | Value | Remarks |

|---|---|---|

| Real GDP Growth | 6.4% | Close to decadal average, driven by robust domestic demand. |

| Real GVA Growth | 6.4% | Supported by agriculture, industry, and services sectors. |

| Agriculture Growth | 3.8% | Rebound driven by horticulture, livestock, and fisheries. |

| Industrial Growth | 6.2% | Strong construction and utility services growth. |

| Services Growth | 7.2% | Robust performance in financial, real estate, and professional services. |

| Retail Inflation | 4.9% (Apr-Dec 2024) | Softened from 5.4% in FY24, with CPI expected to align to 4% in FY26. |

| Capital Expenditure Growth | 8.2% (Jul-Nov 2024) | Expected to gain further momentum. |

| Overall Exports Growth | 6.0% (Apr-Dec 2024) | Services exports surged to 12.8% (Apr-Nov FY25). |

| Gross FDI Inflows | USD 55.6 billion (Apr-Nov FY25) | 17.9% YoY growth from USD 47.2 billion in FY24. |

| Forex Reserves | USD 640.3 billion (Dec 2024) | Covers 10.9 months of imports and 90% of external debt. |

| Unemployment Rate | 3.2% (2023-24) | Declined from 6.0% in 2017-18. |

Economic Performance and Outlook

1. Steady Growth Amid Global Challenges

- Global Context: The global economy grew by 3.3% in 2023, with the IMF projecting modest growth of 3.2% over the next five years. Global manufacturing slowed due to supply chain disruptions and weak demand, but services performed strongly.

- India’s Resilience: India’s real GDP growth of 6.4% in FY25 remains close to its decadal average, supported by strong domestic demand and a rebound in rural consumption (private consumption expenditure up 7.3%).

2. Sectoral Performance

- Agriculture: Expected to grow at 3.8% in FY25, driven by:

- Record Kharif foodgrain production of 1647.05 LMT (+5.7% YoY).

- Key growth drivers: horticulture, livestock, and fisheries.

- Industry: Estimated growth of 6.2%, with strong performance in construction and utilities despite a Q2 slowdown due to monsoon effects and weak export demand.

- Services: Robust growth of 7.2%, with services exports surging to 12.8% (Apr-Nov FY25) from 5.7% in FY24.

3. Inflation and Fiscal Stability

- Inflation: Retail headline inflation softened to 4.9% (Apr-Dec 2024) from 5.4% in FY24. Food inflation rose to 8.4%, driven by vegetable and pulse prices. CPI is expected to align with the 4% target in FY26.

- Fiscal Health:

- Gross tax revenue (GTR) grew by 10.7% YoY (Apr-Nov 2024).

- Union capex increased by 8.2% (Jul-Nov 2024), with fiscal deficit indicators comfortably placed.

- State revenue expenditure grew by 12%, with subsidies up 25.7%.

4. External Sector Strength

- Exports: Overall exports grew by 6.0% YoY (Apr-Dec 2024), with services exports leading the charge.

- FDI: Gross FDI inflows rose to USD 55.6 billion (+17.9% YoY).

- Forex Reserves: Stood at USD 640.3 billion, covering 10.9 months of imports and 90% of external debt.

- Current Account Deficit: Contained at 1.2% of GDP in Q2 FY25, supported by services trade surplus and record remittances.

5. Employment and Social Welfare

- Unemployment: Declined to 3.2% in 2023-24 from 6.0% in 2017-18, with rising labor force participation and worker-to-population ratios.

- Social Services: Government expenditure on social services grew at a 15% CAGR (FY21-FY25).

- Health Expenditure: Government share in total health expenditure rose from 29% to 48% (FY15-FY22), while out-of-pocket expenditure dropped from 62.6% to 39.4%.

- Inequality: Gini coefficient declined, reflecting reduced consumption inequality (rural: 0.237; urban: 0.284 in 2023-24).

Key Policy Recommendations

- Deregulation for Growth: The survey advocates Ease of Doing Business 2.0, a state-led initiative to reduce regulatory burdens, liberalize standards, and apply risk-based regulations to boost MSME growth and create a viable Mittelstand (SME sector).

- Infrastructure Investment: Continued focus on infrastructure over the next two decades to sustain high growth.

- AI and Workforce: Collaborative efforts between government, private sector, and academia to minimize adverse societal effects of AI and enhance skill development.

- MSME Support: Launch of the ₹50,000 crore Self-Reliant India Fund to provide equity funding to MSMEs.

- Renewable Energy: 15.8% YoY increase in solar and wind power capacity, supported by schemes like PM-Surya Ghar and National Green Hydrogen Mission.

Medium-Term Outlook

- Growth Projection for FY26: 6.3% to 6.8%, balancing global headwinds (geopolitical tensions, trade uncertainties) and domestic strengths (rural demand, stable macroeconomy).

- Global Challenges: Geo-economic fragmentation, China’s manufacturing dominance, and global dependency on China for energy transition.

- Domestic Levers: Sustained capex, private investment, consumer confidence, and structural reforms to enhance global competitiveness.

Sectoral Highlights

| Sector | Key Achievements | Challenges |

|---|---|---|

| Agriculture | Record Kharif production, 3.8% growth | Monsoon variability |

| Industry | 6.2% growth, strong PMI | Weak export demand, monsoon disruptions |

| Services | 7.2% growth, 12.8% export surge | Persistent services inflation |

| Infrastructure | 2031 km railway network, improved port efficiency | Need for sustained investment |

| Renewable Energy | 15.8% YoY capacity addition | Scaling green investments |

| MSMEs | ₹50,000 crore fund launched | Regulatory burdens |

Economic Survey 2024-25: Key Highlights and India’s Growth OutlookIndia’s Economic Survey 2024-25, tabled by Union Finance Minister Smt. Nirmala Sitharaman on January 31, 2025, underscores India’s economic resilience amid global uncertainties. With a projected real GDP growth of 6.4% in FY25 and 6.3%–6.8% in FY26, India continues to outpace global growth averages. This post provides a concise summary of key findings, designed for aspirants preparing for UPSC, RBI, and State PSC exams, with a dedicated section on Points to Remember and Mains Questions and Answers for exam preparation.

Key Economic Indicators for FY25

| Indicator | Value | Remarks |

|---|---|---|

| Real GDP Growth | 6.4% | Close to decadal average, driven by robust domestic demand. |

| Real GVA Growth | 6.4% | Supported by agriculture, industry, and services sectors. |

| Agriculture Growth | 3.8% | Rebound driven by horticulture, livestock, and fisheries. |

| Industrial Growth | 6.2% | Strong construction and utility services growth. |

| Services Growth | 7.2% | Robust performance in financial, real estate, and professional services. |

| Retail Inflation | 4.9% (Apr-Dec 2024) | Softened from 5.4% in FY24, with CPI expected to align to 4% in FY26. |

| Capital Expenditure Growth | 8.2% (Jul-Nov 2024) | Expected to gain further momentum. |

| Overall Exports Growth | 6.0% (Apr-Dec 2024) | Services exports surged to 12.8% (Apr-Nov FY25). |

| Gross FDI Inflows | USD 55.6 billion (Apr-Nov FY25) | 17.9% YoY growth from USD 47.2 billion in FY24. |

| Forex Reserves | USD 640.3 billion (Dec 2024) | Covers 10.9 months of imports and 90% of external debt. |

| Unemployment Rate | 3.2% (2023-24) | Declined from 6.0% in 2017-18. |

Economic Performance and Outlook1. Steady Growth Amid Global Challenges

- Global Context: Global growth was 3.3% in 2023, with the IMF projecting 3.2% over the next five years. Manufacturing slowed due to supply chain issues, but services remained robust.

- India’s Resilience: India’s 6.4% GDP growth in FY25 is driven by a 7.3% rise in private consumption, particularly rural demand.

2. Sectoral Performance

- Agriculture: Expected to grow at 3.8%, with Kharif foodgrain production at a record 1647.05 LMT (+5.7% YoY).

- Industry: Estimated at 6.2% growth, supported by construction and utilities, though Q2 saw moderation due to monsoon and weak exports.

- Services: Strong at 7.2%, with services exports up 12.8% (Apr-Nov FY25).

3. Inflation and Fiscal Stability

- Inflation: Retail inflation softened to 4.9% (Apr-Dec 2024), with food inflation at 8.4%. CPI is expected to align with the 4% target in FY26.

- Fiscal Health:

- Gross tax revenue (GTR) grew by 10.7% YoY (Apr-Nov 2024).

- Union capex rose by 8.2% (Jul-Nov 2024).

- State revenue expenditure up by 12%, with subsidies growing 25.7%.

4. External Sector Strength

- Exports: Overall exports grew 6.0% YoY, with services exports leading at 12.8%.

- FDI: Gross FDI inflows rose to USD 55.6 billion (+17.9% YoY).

- Forex Reserves: At USD 640.3 billion, covering 10.9 months of imports and 90% of external debt.

- Current Account Deficit: Contained at 1.2% of GDP in Q2 FY25.

5. Employment and Social Welfare

- Unemployment: Dropped to 3.2% in 2023-24 from 6.0% in 2017-18.

- Social Services: Expenditure grew at a 15% CAGR (FY21-FY25).

- Health Expenditure: Government share rose from 29% to 48% (FY15-FY22), with out-of-pocket expenditure down from 62.6% to 39.4%.

- Inequality: Gini coefficient declined (rural: 0.237; urban: 0.284 in 2023-24).

Points to Remember for UPSC, RBI, and State PSC Exams

- GDP and GVA Growth: Real GDP and GVA growth at 6.4% in FY25, with FY26 projections of 6.3%–6.8%, reflecting India’s resilience amid global slowdown.

- Inflation Trends: Retail inflation at 4.9% (Apr-Dec 2024), with CPI expected to stabilize at 4% in FY26, aligning with RBI’s target.

- Sectoral Contributions:

- Agriculture: 3.8% growth, driven by record Kharif production (1647.05 LMT).

- Industry: 6.2% growth, with manufacturing PMIyors: Ease of Doing Business 2.0, a state-led initiative for deregulation to boost MSME growth.

- Infrastructure Investment: Critical for sustaining high growth over the next two decades, with 2031 km of railway network commissioned and improved port efficiency.

- AI and Workforce: Emphasis on skill development to leverage AI for economic growth while minimizing societal risks.

- Self-Reliant India Fund: ₹50,000 crore fund to provide equity funding for MSMEs.

- Renewable Energy: 15.8% YoY increase in solar and wind capacity, driven by schemes like PM-Surya Ghar and National Green Hydrogen Mission.

5 Mains Questions and Answers for UPSC, RBI, and State PSC

Question 1: Discuss the significance of the Economic Survey 2024-25’s emphasis on deregulation under Ease of Doing Business 2.0 for achieving India’s medium-term growth objectives.

Answer: The Economic Survey 2024-25 highlights Ease of Doing Business (EoDB) 2.0 as a state-led initiative to accelerate India’s economic growth by reducing regulatory burdens and fostering a vibrant MSME sector, envisioned as India’s Mittelstand. Deregulation aims to enhance business efficiency, lower operational costs, and unlock growth opportunities, aligning with the goal of Viksit Bharat by 2047. The survey proposes a three-step process for states: identifying deregulation areas, benchmarking regulations against other states/countries, and assessing their cost to enterprises. This approach addresses root causes of business challenges, such as excessive compliance, high tariffs, and restrictive standards, which hinder MSME scalability.By liberalizing standards, enforcing legal safeguards, reducing tariffs, and adopting risk-based regulations, EoDB 2.0 seeks to create an enabling environment for businesses. The launch of the ₹50,000 crore Self-Reliant India Fund complements this by providing equity funding to MSMEs, fostering innovation and growth. These measures are critical to counter global challenges like geo-economic fragmentation and trade uncertainties, ensuring India’s competitiveness. For sustainable growth, states must lead reforms to simplify processes and reduce compliance costs, enabling MSMEs to contribute significantly to the projected 6.3%–6.8% GDP growth in FY26. Effective deregulation will strengthen domestic growth levers, positioning India as a global economic leader.

Question 2: Analyze the factors contributing to India’s robust services sector growth as highlighted in the Economic Survey 2024-25, and its impact on the external sector.

Answer: The Economic Survey 2024-25 reports a robust 7.2% growth in India’s services sector in FY25, driven by strong performance in financial services, real estate, professional services, and public administration. Key factors include post-pandemic recovery, increased digitalization, and rising global demand for India’s IT and business process outsourcing services. Services exports surged by 12.8% (Apr-Nov FY25), up from 5.7% in FY24, securing India the seventh-largest share in global services exports. This growth is supported by a skilled workforce, technological advancements, and favorable government policies promoting digital infrastructure.The services sector’s performance significantly strengthens India’s external sector. Robust services exports, combined with record remittances, have contained the current account deficit at 1.2% of GDP in Q2 FY25. Services trade surplus and remittances from OECD economies have bolstered foreign exchange reserves, reaching USD 640.3 billion by December 2024, covering 10.9 months of imports and 90% of external debt. This external sector stability enhances India’s resilience against global shocks. However, persistent services inflation poses a challenge. Continued investment in digital infrastructure and skill development, as emphasized in the survey, will be crucial to sustain this growth and enhance India’s global competitiveness.

Question 3: Evaluate the role of infrastructure investment in sustaining India’s high economic growth, as outlined in the Economic Survey 2024-25. (250 words)Answer: The Economic Survey 2024-25 underscores the critical role of infrastructure investment in sustaining India’s high economic growth (6.4% in FY25, projected 6.3%–6.8% in FY26) over the next two decades. Infrastructure development enhances connectivity, reduces logistical costs, and boosts productivity, forming the backbone of economic expansion. Key achievements include 2031 km of railway network commissioned (Apr-Nov 2024), the introduction of 17 Vande Bharat train pairs, and a reduction in port container turnaround time from 48.1 hours in FY24 to 30.4 hours in FY25. These improvements enhance operational efficiency and trade competitiveness.The survey highlights a 15.8% YoY increase in solar and wind power capacity, driven by schemes like PM-Surya Ghar and National Green Hydrogen Mission, supporting sustainable infrastructure growth. Union capital expenditure (capex) grew by 8.2% (Jul-Nov 2024), with fiscal indicators allowing room for further investment. However, challenges include sustaining funding, addressing monsoon-related disruptions, and ensuring private sector participation. The survey advocates for continued capex to meet Viksit Bharat 2047 goals, emphasizing public-private partnerships and innovative financing. Robust infrastructure investment will strengthen domestic growth levers, ensuring India’s competitiveness amid global uncertainties like geo-economic fragmentation.

Question 4: How does the Economic Survey 2024-25 address the role of agriculture in India’s economic growth, and what are the key challenges in sustaining agricultural productivity? (250 words)Answer: The Economic Survey 2024-25 projects a 3.8% growth in agriculture for FY25, driven by a record Kharif foodgrain production of 1647.05 LMT (+5.7% YoY), supported by above-normal monsoons and adequate reservoir levels. Horticulture, livestock, and fisheries are key growth drivers, with Q2 FY25 recording a 3.5% growth, an improvement over prior quarters. The survey emphasizes agriculture’s role in supporting rural demand, contributing to the 7.3% rise in private consumption expenditure, a key driver of India’s 6.4% GDP growth in FY25.Challenges include monsoon variability, which impacts sectors like mining and construction, and high food inflation (8.4% in Apr-Dec 2024) driven by vegetable and pulse prices. To sustain productivity, the survey advocates technological interventions, irrigation improvements, and policy support for crop diversification. Government initiatives like the ₹50,000 crore Self-Reliant India Fund aim to bolster rural MSMEs, indirectly supporting agricultural growth. Addressing these challenges requires investment in climate-resilient farming, enhanced storage infrastructure, and market reforms to stabilize prices. By strengthening these areas, agriculture can continue to underpin rural economic growth and contribute to India’s medium-term growth objectives.

Question 5: Discuss the Economic Survey 2024-25’s perspective on the role of AI in India’s economic growth and the measures suggested to mitigate its societal risks.

Answer: The Economic Survey 2024-25 recognizes AI’s potential to drive economic growth in India, a services-driven economy with a youthful workforce. AI can enhance productivity, improve labor market outcomes, and support sectors like IT and manufacturing, contributing to the projected 6.3%–6.8% GDP growth in FY26. The survey highlights the need for skill development to equip workers for an AI-augmented landscape, given India’s competitive services sector, which grew by 7.2% in FY25 and saw 12.8% export growth.However, AI adoption poses societal risks, including job displacement and inequality. The survey notes existing barriers to large-scale AI adoption, providing a window for proactive policymaking. It calls for collaboration between government, private sector, and academia to minimize adverse effects through:

Education and Skilling: Prioritizing AI-related competencies in education systems.

- Policy Frameworks: Developing regulations to balance innovation and job security.

- Public-Private Partnerships: Encouraging innovation while addressing workforce transitions.

These measures aim to leverage AI for inclusive growth while mitigating risks. By aligning AI adoption with Ease of Doing Business 2.0 and infrastructure investments, India can enhance global competitiveness and achieve Viksit Bharat by 2047.

Leave a comment